How to react to the announcement of an acquisition, liquidity event, and sudden windfall.

It Happened Today

Everyone gathered in the big conference room. They announced the deal.

Cheers and applause…

We all made mental notes of how much money we would receive as we walked back to our desk.

So Much Money

- One Million

- Two Million

- Four…

We didn’t share notes. But, we knew that a lot of us would deal with more money than ever before.

Just Last Week

My wife and I were frustrated. We do a great job of saving money, but our goals seemed distant.

Would we have to move to another city to make buying a house realistic?

Would achieving one goal mean giving up on another?

What do we do?

Dinner That Night

We were all so excited after the acquisition. Someone said, “Let’s grab a beer.”

We skipped our normal spot opting for a place that better fit the occasion (at three times the price).

Everyone usually goes for a hamburger and a beer. Now, we are ordering $120 steaks and champagne by the bottle.

Some people are talking about buying a Ferrari.

So Many Questions

- Is this who we are now?

- Am I rich?

- Is this really happening?

“Let’s Talk to an Advisor”

Said my wife after dinner. She has always been better at helping me think through this stuff.

We searched the internet and found a firm with a team approach. They specialize in working with people in tech, who have stock options.

We checked out their website. Lots of blog posts on the issues we are facing.

We filled out their contact form requesting to schedule an initial call.

Talking to an Expert

We made the call. It was short, but we learned a lot. Instead of talking about how great the firm is. The advisor asked a lot of questions about us.

We shared three things:

- Feeling conflicted about what to do and excited by the possibilities.

- Ok skipping the $120 steak and Ferrari if we know why we are skipping it.

- Are the goals that seemed distant now possible?

After listening to us, the advisor proposed a next step to continue working together.

We liked what we heard and decided to move forward.

Getting Started

Our first meeting started with a review of our current financial situation.

- Age – 35

- Salary – $225,000

- Monthly Living Expenses – $8,000

- Bank Accounts – $43,000

- 401(k) – $67,000

- Grad School – Wife will complete this fall. Making $150,000 after graduation, with $78,000 in student loans.

- Expected Windfall – $1.6 million cash, $850,000 in nonqualified stock options (vest quarterly over four years)

We went through each item in detail. We covered:

- All our accounts

- What banks and investment companies we use

- How we invest

There were so many details we had not thought of. For the first time, we could see our entire financial life as a whole instead of separate parts.

“What are your goals?”

Together we charted the course. First, “Where do you see yourself a year from now?” Second, “Five years from now, what’s your vision of the future?”

We shared three things:

- Buy a House

- Start a Family

- Travel

Try as we might. We could not be more specific. We could not say when, how much, how many, or where.

It feels like a lot of money. San Francisco’s really expensive. We don’t know what’s possible with the money we expect to receive.

The Confidence to Move Forward

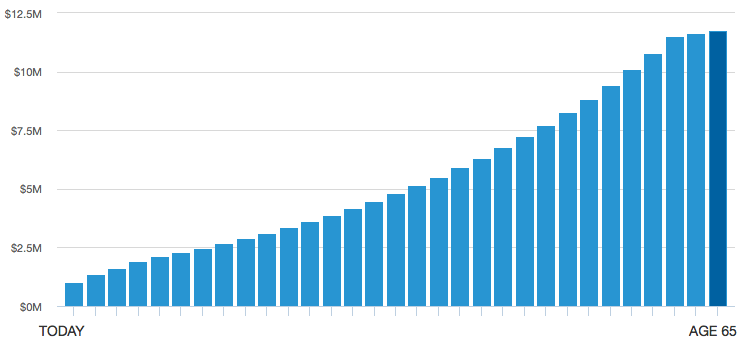

We first looked at how life will look if we do nothing with the money.

This represented just taking the cash and doing nothing with it. The cash just piles up and grows at the same rate as inflation. We continue to max out my 401(k) and live the same life.

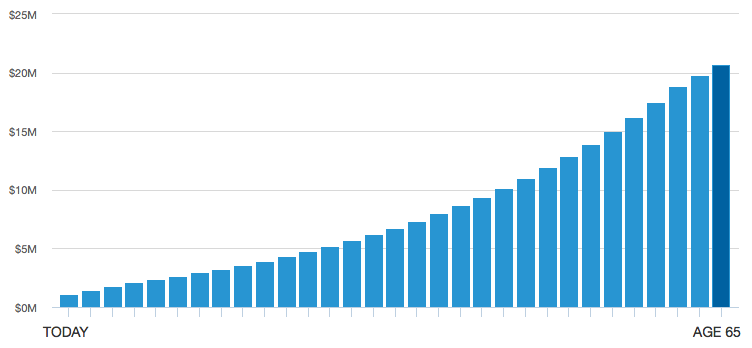

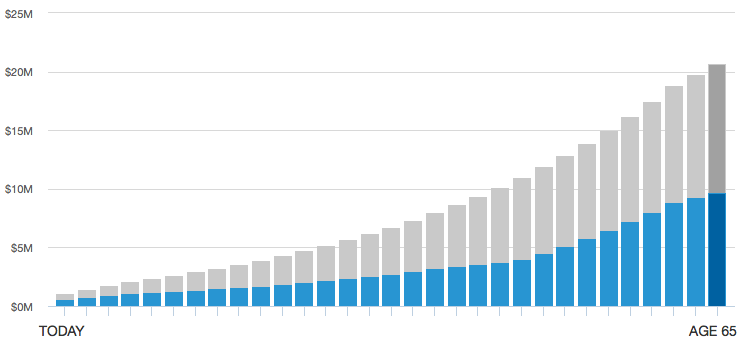

What if we invested the cash? Let’s assume it grows at 9%.

Our investment portfolio will grow to $20,675,867. We are so rich!

But, wait:

What does that number even mean? We haven’t talked about our goals. We still don’t know:

- How much to spend on a house

- Can we buy a house and travel

- How does starting a family change things

Getting Clear on Our Goals

We started with the house.

Our advisor recommended we look for a house valued at 4x our annual income. We expect to earn $375,000 next year.

A house valued at $1.5 million…

Buying a house at $1.5 million with a 30 year fixed rate mortgage and 20% down payment, we will put $300,000 down.

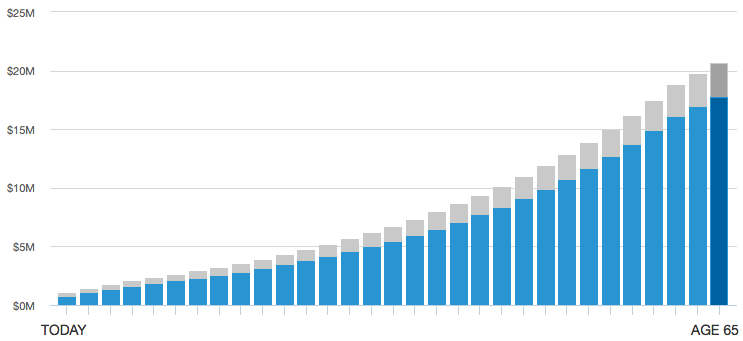

How does that change the projection:

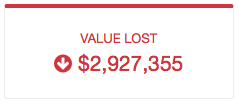

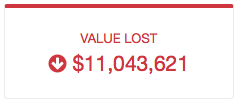

Using $300,000 of our investment portfolio for a down payment drops our projected portfolio at age 65 by:

We have less money in our investment portfolio, but we accomplished our goal. Our advisor also explained to us the difference between an investment portfolio and our net worth.

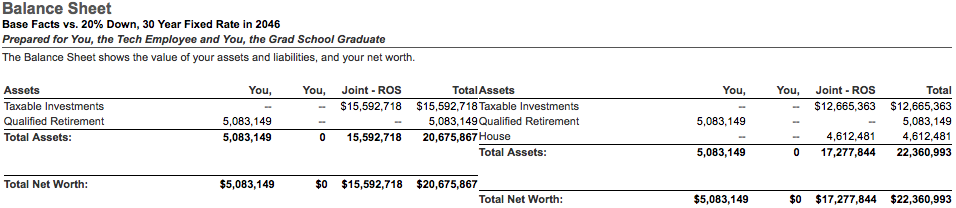

Investment Portfolio vs Net Worth

Our investment portfolio includes all our liquid assets. Money in the bank and investment accounts. Money we can access in a short amount of time.

We cannot make withdrawals from a house. The house and mortgage don’t count as part of our investment portfolio. They count as part of our net worth.

Our $300,000 down payment just moved from the investment portfolio to our balance sheet (net worth).

Buying the house looks like a good idea:

The house increases our projected net worth at age 65 by $1,685,126.

What About Travel and Starting a Family?

I understand the house. Sure, we spend some money now on a down payment. But, the house goes up in value.

We are just buying memories with travel. The money doesn’t grow. It gets spent.

How much travel? How much will a family cost?

We had talked in general about the details. But, it was always someday.

Someday is now.

We decided to look at:

- $48,000 a year spent on travel

- $90,000 a year spent on a child born this year until age 22

- Planning to pay 100% of costs for four years at Stanford University

All in addition to buying the house.

Ugghhh! This doesn’t look. The difference between the two lines (grey and blue) is big.

Ouch! This doesn’t feel right. The blue line still goes up over time, but that’s a lot of money to give up.

We paused for a moment to talk about what’s important to us.

What do we value?

Our advisor told us there’s no right answer. We get to choose and together we will explore how to make it happen.

The travel is optional. $48,000 is a lot. You run out of places to go after awhile.

A baby is not. We want a family. But, who knows what college will look like. Does it have to be Stanford?

Our advisor pointed out that the further out we go. The more variables. The less accurate our projection.

We cannot predict the future, only explore the possibilities.

The goal of this exercise is to explore in broad terms what is possible.

How much confidence can we have?

Having more money is not the most important thing. This much money can do a lot. I understand that buying a house and starting a family are expensive.

But:

There is a point where you are spending too much. I wondered where that point might be for us.

We took a look at one last tool.

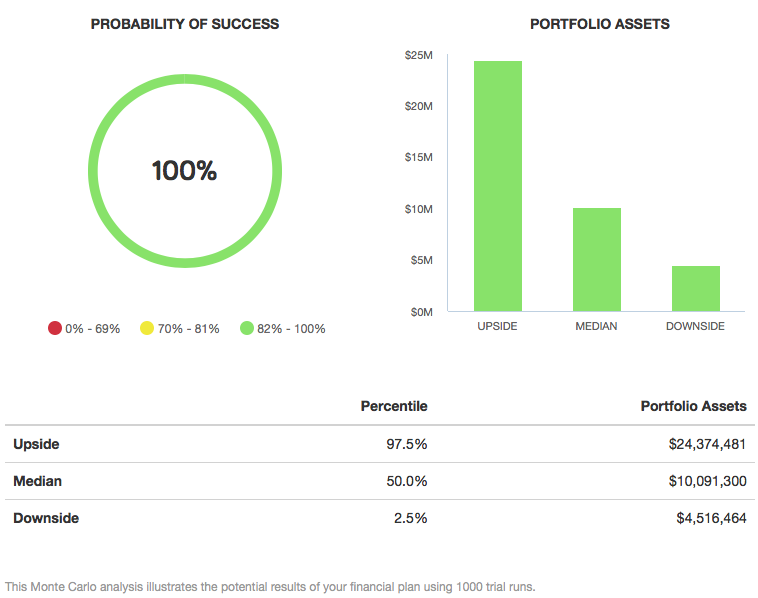

We ran 1,000 simulations to model the up and down nature of life and investment returns.

Even with:

- House

- Travel

- Family

We still had 100% probability of success. Each simulation resulted in success.

We were feeling more confident. The possibilities became more real.

What Do We Do Next?

Our advisor recommended two things.

First, we needed to get specific around taxes and timing. The tax questions are easy. The IRS defines the rules. Our goal is simple:

Pay as little in taxes as possible.

Second, breath. Give ourselves time to think. Explore the possibilities. Do not make any big decisions in the next year.

Do not:

- Buy a house

- Take a huge trip

Do not do anything in the next year we were not already planning to do before the acquisition.

Just breath.