Knowing where to focus is key to the success of your financial plan.

Something specific will trigger your decision to hire a financial advisor.

- What do I do with my stock options?

- I’m scared I will owe a ton in taxes.

- I want to buy a house.

You must know where to start before you can address specific questions.

Think of this as your financial plan’s top ten.

1. Avoid Debt

Before you can promote health, you have to avoid illness.

The abuse of debt is like smoking a pack a day. When you use debt to buy things that do not grow in value, your financial plan goes up in smoke.

It will kill you. The only question is when.

Bad debt moves your financial plan in the wrong direction

You want to build wealth for yourself.

Credit card debt builds wealth for Visa and MasterCard. Not you.

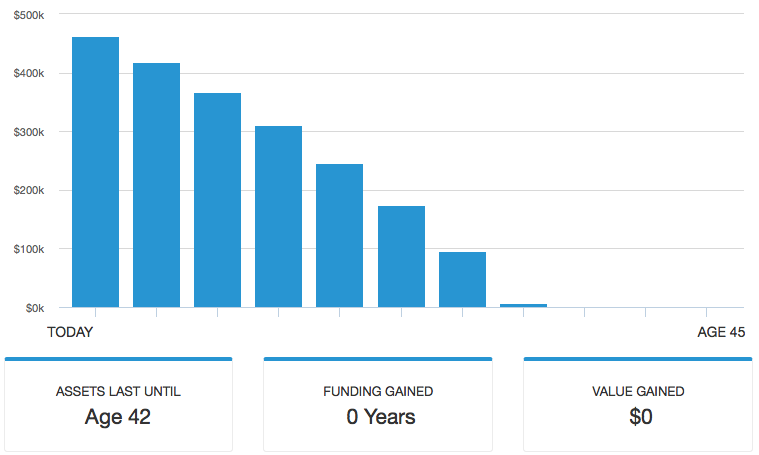

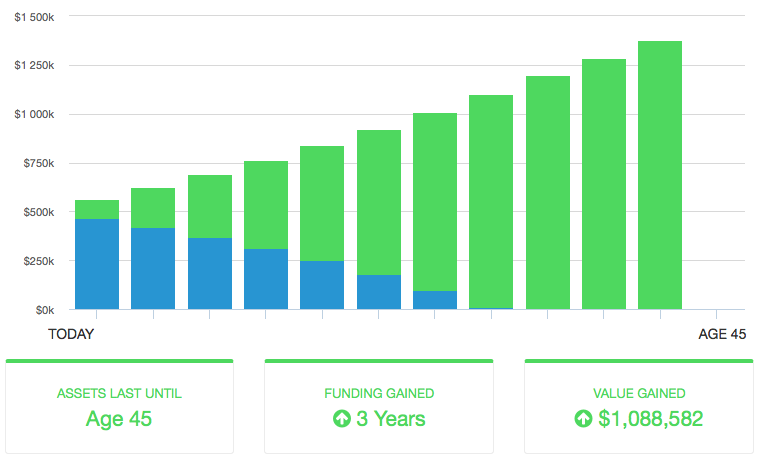

2. Save Money

The way to start building wealth for yourself is to save.

Not saving is like chasing your tail. Even without debt, you are stuck in place.

Start by saving ten percent of your income.

Avoiding debt and saving ten percent makes a huge difference.

Your 401(k) is the simplest way to do this. You can log-in to your 401(k) right now and raise your contribution to ten percent.

Done.

Using your 401(k) to save 10% works up to $180,000 in income. Past $180,000, ten percent exceeds the maximum 401(k) contribution.

Let’s say you go from $180,000 to $250,000 a year.

Ten percent of $250,000 is $25,000. The max 401(k) contribution is $18,000. You need to save $7,000 more.

You can do this by opening up a taxable, brokerage account.

Consistent saving is the key to promoting the health of your financial plan.

3. Make Money

Income: earn more, save more.

Even if you keep your saving fixed at ten percent, ten percent of a higher income accumulates faster.

Income is the fuel that drives your savings.

I ask every client, every year about their career.

- Tell me about your job a year from now.

- Where do you see your career five years from now?

- How much money would you like to some day make?

Your career turns your personal wealth (knowledge and skills) into financial wealth (income).

Our focus early on is learn to save, manage your career, and make lots of money.

4. You Only Live Once (YOLO)

Instead of a victory cry for excusing poor judgement. YOLO is a reminder of the importance of lifestyle choices to your financial plan.

As a client’s father told her:

“Flexibility is the key.”

Lifestyle determines flexibility.

What we are talking about here is the freedom to do what you want.

You may not quit your job, take six months off, and travel the world. But, there is real power in having the freedom to do all those things and more.

One client told her boss she was quitting for another job. Her employer countered with a 50% raise, change in job title, and big signing bonus.

She said, “No, thank you.”

She believed the new job was better for her career and life. The financial plan we built together the flexibility to say no.

This is the real power behind your financial plan.

How to get the power

Money rarely sits idle. Left alone it gets spent.

Get the power by capturing your raises as saving. Spend only 50% of every raise.

I tell every client, “send me an email as soon as you receive a raise.”

I request their first pay stub post raise. I do the math. Together we automate the saving of 50%.

You save more without noticing and still have more to spend. It’s great.

Automate the saving of your raises up front. Don’t worry about the spending after. Build freedom and flexibility.

5. Pay Off Your Debts

Avoiding debt stops the bleeding. Paying off your debts allows you to heal.

Why is saving money number two if debt is so bad?

We want to change the way you relate to money first.

Who are you? Are you a saver? Do you avoid debt?

This cannot be true until you start saving.

The other reason we save first is to avoid the cause of future debt.

How did you get in debt to begin with?

It usually starts with student loans to pay for college. Then you need money to get started so you open a credit card. Life happens. There’s no money so more credit cards or new medical bills.

It’s a vicious cycle.

We save first to break the cycle so that you have cash for when life happens.

6. Invest Your Cash

Many clients think of investing first.

Investing is important, but other things matter more.

Goal of investing your cash is to not miss out on global progress.

Don’t sweat the specifics. Leave that to your financial advisor. Just avoid having lots of cash sitting around not invested.

Meb Faber shows that the difference between asset allocation models (specific ways to invest) is small. The real difference is between cash and diversified investments.

7. Use Your Stock Options

Stock options can help you make years of progress in one moment.

How to be ready for your one moment:

- Avoid and drop debt

- Keep cash to pay for exercise and taxes

- Plan for taxes over many years

Use your stock options to speed up your financial plan. Start by reading our Definitive Guide to Stock Options in San Francisco.

8. Be Tax Smart

Like investing this is a source of too much concern.

A lot of folks that I work with worry about taxes. The reason I say it’s an unjust concern is because there is no 100% tax. It is always to your advantage to make more money.

But, there is huge savings to be had by being tax smart.

Some specific things that we look at:

- Timing exercise and sell of stock options to convert ordinary income into capital gains

- Planning around the alternative minimum tax

- Using tax advantaged retirement savings such as 401(k), Roth conversions, and after-tax 401(k)

All three are examples of specific things we do to deal with taxes.

9. Watch the Fees

You would not run a marathon with a weighted vest.

Fees slow you down.

Look for mutual funds and ETFs with fees less than 0.50%.

Remember that money invested with high fees is still better than cash with no fees. That’s why fees are number nine on our top 10 list.

It matters but not as much as some of the other things we’ve looked at.

10. Get Lucky

How much of your success is luck? How much is hard work and smarts?

I don’t know.

We cannot control luck. It’s last on the list. We spend little time or effort on it.

But:

We still want to recognize the role that it plays

Some ways that we recognize luck are:

- Solid Foundation – See 1-9. Be ready to capitalize on good fortune.

- Gratitude – Acknowledge people, places, and things that have helped you.

- Insurance – Use insurance to protect you against times of misfortune.

Good luck is a part of your financial plan. It is a small part that we cannot control but we still want to be mindful of the role it plays.

Know Where to Focus

You can get overwhelmed by the number and complexity of your specific questions.

Taking a step back, you can see how your questions relate to this top ten list. You may find that things are a little more simple than they seem at first glance.

Build Your Own List

You can rearrange the items on this list based on your life.

Working with an advisor helps you know where to focus now.