There is one question I struggle with more than any other. It’s impossible to answer.

On the surface it’s easy. Buying a house is a good long-term move.

There are tax benefits.

You get to deduct your mortgage interest on the first $750,000 of mortgage debt. There is a capital gains exclusion.

There are investment benefits.

Your mortgage allows you to use leverage. A small down payment buys a big house.

Your house might appreciate. The mortgage payoff is fixed so 100% of the appreciation is yours.

Your mortgage becomes a way to save. The house goes up. Your mortgage goes down. You get more money when you sell.

Just buy a house that’s valued at 3 to 4 times your annual income. Put 20% down on a 30 year fixed rate mortgage.

Now for the hard part.

Should I buy a house now or wait in San Francisco?

Let’s see.

Three times your annual income of $500,000. You should buy a house worth $1,500,000.

Have you considered a cardboard box? Maybe buy a parking spot and live out of your Prius?

The numbers don’t work.

It’s a problem.

Justin Fox wrote about What Makes Housing Too Expensive in Bloomberg.

The New York Times covered the Cries to Build, Baby Build in the Bay Area.

Kim-Mai Cutler shared her Slidedeck on Medium, The San Francisco Bay Area in the Second Gilded Age.

The problems are two-fold.

First, too many people competing to buy too few housing units. Second, the bay and the ocean. There is no new land.

We will get into dealing with the high cost of buying in San Francisco. First, let us review the basics of investing.

Should I Buy a House Now or Wait? Your House is Not Like Your 401(k)

Your 401(k) is where you gained your first experience investing.

A part of your pay check goes into your 401(k). You choose mutual funds to invest your savings in. The mutual funds buy stocks and bonds.

But, there are many ways buying a house is different from investing in stocks and bonds.

Your House is an Expense

Rent is a fixed expense. It may go up every year, but it stays the same month to month. Plus, if you have a problem, you call your landlord.

A house is a variable expense.

Your mortgage may be fixed. Property taxes are predictable. Everything else varies.

Got a problem? Who you gonna call?

It’s you!

Repairs, maintenance, improvements will all vary.

You buy a stock. Invest in a mutual fund. Your costs are limited to the price you pay to buy a share, the fund’s expense fee, and taxes owed in the future.

Imagine if I told you, “I have a great investment opportunity.”

It will cost a lot to start. You’ll have to put money in every month. There will be times where you will have to contribute more, but I can’t tell you how much or when.

Maybe, you can sell in a few years for a profit.

Would you buy now or wait? What I just described to you is buying a house.

What a Makes a House Worth $1.6 Million?

The all-time high median home value in San Francisco is $1.6 million.

The all-time high share price for Salesforce (CRM) is $310.

What determines the value of the average house in San Francisco? What sets the price of one share of a San Francisco based tech company?

What makes a stock or bond valuable?

A stock or bond is valuable because the company who issues the stock or bond makes money.

The stock of a company is valuable today. You expect it to increase in value over time.

Today and in the future the value of the stock is tied to the company’s current and expected future earnings.

You can even find formulas for calculating the fair price of a stock based on expected cash flows.

Bonds have value because you believe the company borrowing the money (issuing the bond) will pay the money back with interest.

Why?

Because the company makes money.

This is the fundamental difference between stocks, bonds, and your house.

Your house does not make money.

Supply and demand determines the value of your house.

If it is worth more in the future, it will be because more people are competing for fewer houses in your area.

San Francisco is just an example of supply and demand on a much larger scale. The demand for housing in San Francisco is so much greater than the supply.

One House, One City, One State, One Country

You only buy one.

You lack diversification when you buy a house.

The global stock market is huge. There are more than 10,000 plus stocks spread all over the world that you can invest in.

When I build an investment portfolio for you, you will be buying thousands of stocks and bonds. You will do so by buying a handful of mutual funds or exchange traded funds. Each fund will own hundreds or thousands of stocks and bonds.

Your house will be one house, in one city, in one state, in one country. There is no diversification to buying a house.

Whether your house goes up in value will be tied to the fortunes of your neighborhood and city.

Should I Buy a House Now or Wait? Housing Is an Inefficient Market

A house may only sell once or twice a decade.

There is a lack of available information. People buying houses vary in their skill and knowledge level.

The range of individual outcomes is huge.

There were 5,700 homes sold in San Francisco during 2022.

On an average day 5,628,855 shares of Salesforce (CRM) trade hands.

A fair price is easier to determine with a stock than it is with a house. The price on a stock gets adjusted millions of times per day.

Buying one house in one city means the outcome is hard to predict.

There is an average return. But, individual results will vary.

Buying a house is a lot like investing in the stock of one company.

How Much Will My House Go Up in Value?

With thousands of stocks and bonds, there is a lot of historical data to help us know what we can expect. Some will go up, some will go down, but we know what to expect.

There is an average.

There is an average expected return in housing too. The average is for the nation as a whole, and it’s around 3 to 4% per year.

Even in the Bay Area, the winners and losers can be only 80 miles apart.

It’s impossible to predict with any certainty the future value of one house.

But, using the average rates of return for housing and the stock market, we can make some comparisons.

Should I Buy a House Now or Wait? Stock Market vs a House

Let’s assume your life is simple (Ha!).

You have $1.5 million cash. You can buy a house in San Francisco or invest in the stock market.

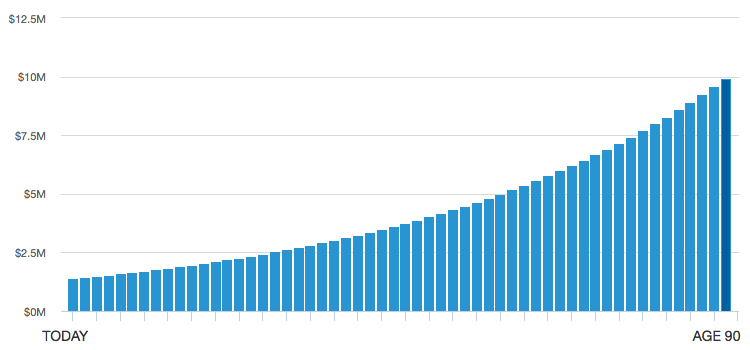

A house purchased today for $1.5 million growing in value at 3.69% per years adds up to $9,890,271 at the end of 55 years.

Not bad.

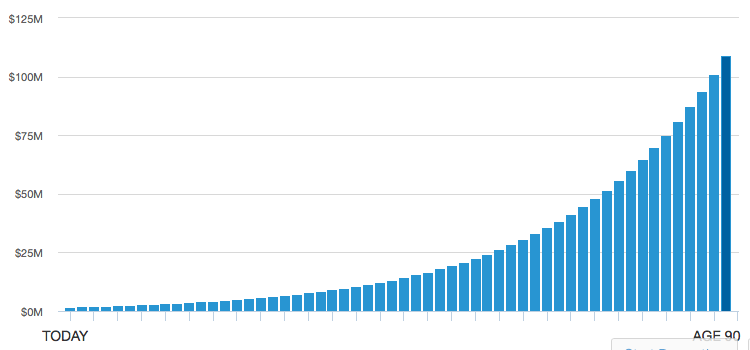

What if you invested the $1.5 million in the stock market instead?

We will use the Dimensional US Equity ETF (ticker DFUS) to represent an investment in the entire US stock market. Since 1926, the entire US Stock Market index has grown at 9.9% per year.

Your $1.5 million growing at 9.6% per year over 55 years adds up to $108,620,554.

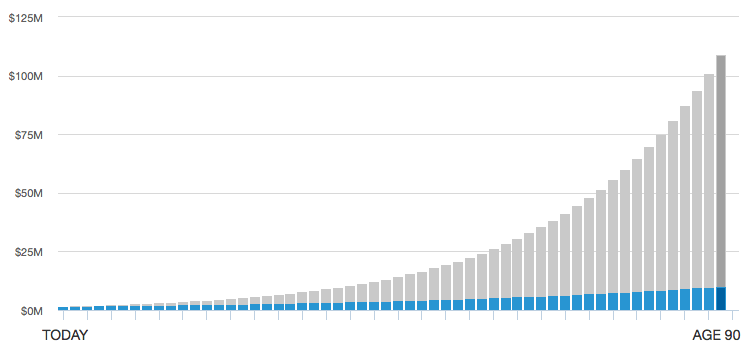

Here is another way of looking at it.

The blue represents the increased value of your house. The grey what you would have gained with an investment in the stock market.

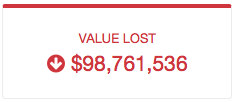

Your value lost is huge.

Now, our model is full of assumptions.

What will increase in value faster? Your house? The US stock market?

Who knows?

The key is to remember:

Your house is not an investment. Your house is a place to live.

Buying a house only because you believe it’s value will go up is a bad idea.

Bonus – How to Make the Impossible Achievable for You

A house is not an investment.

But buying a house can still be a good idea for you.

When You Absolutely, Positively Should Buy a House Now

When should you buy a house in San Francisco? When is it smart to pay more than $1 million for your house?

It’s the toughest question I help clients answer.

Here are four ways I help clients answer the question: Should I buy a house now or wait?

1. Life

Are you getting married? Planning to have a baby? Tired of renting?

Your life is the most important factor.

I usually tell clients,

“Look, I believe buying a house is a good idea. Buying a house in San Francisco is expensive. The rules I use to determine what house is right for you (2 to 2.5 times annual income) don’t apply. Your house is not an investment. Let your life determine when the time is right for you.”

Don’t get in a hurry.

Save money. Get ready for a down payment. Decide when the time is right for you

2. Down Payment

Do you have a down payment?

Our target down payment is twenty percent of your purchase price.

That’s $300,000 on an average, $1.5 million house in San Francisco.

You don’t want to be house poor.

Sitting in an empty house with an empty bank account is a very lonely feeling.

The down payment is more of a red light/green light.

Don’t buy if you don’t have it. Don’t buy if the down payment is all you have.

3. Plan to Stay

The longer you plan to stay in one place, the greater the chances that buying is better than renting.

Your house is not an investment. It’s a place to live.

By buying, you will replace rent with the expense of owning.

But, there is a tipping point, when owning starts to look better than renting.

The technical term for this tipping point is the breakeven horizon.

Zillow does some work on calculating the breakeven horizon.

Like our earlier example comparing buying a house to investing in the stock market, calculations of a breakeven horizon are based on assumptions that may or may not be true.

The one thing I believe is that the longer you will own a house the greater the chance that buying is the right move to make.

4. Need a Place to Put Money

I love Johnny Depp in the movie Blow.

There is a scene where the drug trade is going well for Johnny’s character.

They are running operations from a house. Cash is flowing in. There’s just one problem.

They have run out of places to put the cash. Johnny cries out, “We are going to need a bigger boat.”

There comes a time where buying a house is your next best move.

I start to recommend buying a house when the down payment would be a third of your investment portfolio.

The idea here is to balance your investments amongst stocks, bonds, and real estate.

“I thought a house is not an investment.”

You are right. It’s a place to live. But, buying a house should play a role in your financial plan.

Absent a strong desire to own a house. The point when buying a house is your next best move is when a 1/3 of your portfolio covers the down payment.

An average house in San Francisco is $1.5 million so we are talking an investment portfolio of $1,000,000.

A third of $1,000,000 is $300,000, which is twenty percent of the $1.5 million purchase price.

Wait. Did You See What Did Not Make the List?

There is one item that did not make the list.

Did you catch it?

Price

Price is the least important factor in determining whether you should buy or sell a house.

Price may determine whether you CAN afford to buy. It does not determine whether you SHOULD.

Housing prices are like a tide.

Price floats all ships.

You may be lucky. Maybe you find a deal. But, don’t get caught waiting for 2009 to happen again. It might be awhile.

Everyone who bought a house in 2014, 15, or 16 will be quick to tell you they just knew the time was right. You’ll check Zillow. See how much houses have went up since then, and think maybe I should wait.

The price goes up. The price goes down.

What Should I Do? Should I Buy a House Now or Wait?

Only you can decide, but don’t worry about missing out.

Some of my clients will continue to rent and others are looking to buy. Their “right move” has more to do with life than it does with dollars.

Understand what buying means to you.

Check the four ways to think about whether you should.

Decide what’s best for you.

Continue to explore this topic with the help of a financial advisor by scheduling a call today.

Continue reading: Three Ways to Buy a House in San Francisco