One of the trends I’m seeing this year is new clients who think they need a 10(b)5-1 plan.

In discovery calls, they’ll tell me it’s something they want help with. Then, when they become a client and list out their top three questions, one of them is inevitably about setting up a 10(b)5-1 plan.

When I ask them to tell me more about why they’re so interested in a 10(b)5-1 plan, I’ll often hear that they want to take advantage of swings in the stock market… or that their boss told them their stock might pop, and they don’t want to be locked out of selling during a large price increase.

I’m not saying these are bad reasons, but I do want to explore the idea of how a 10(b)5-1 plan helps you avoid missing out, as well as some past client experiences I’ve seen with 10(b)5-1 plans.

Past Experiences With 10(b)5-1 Plans

To be honest, my past experiences with 10(b)5-1 plans have been a mixed bag.

While a 10(b)5-1 trading plan can help you avoid missing out, it’s not a sure thing. No matter how much planning we do around employee stock options, we’ll never be able to eliminate the one variable that’s the most important to the outcome of your plan, which is: “What will the stock price do in the future?”

Because no one knows.

What happens if the stock does really well?

What happens if you have a Zoom in 2020 situation?

Let’s assume that early in 2020, you were sitting on a bunch of shares or options in Zoom, and you wanted to put together a 10(b)5-1 plan. Around the time you’d be doing this, pre-Covid, Zoom was trading around $75 per share.

There’s no way you can tell me you would’ve put together a 10(b)5-1 plan when it was trading at $75 per share, and as part of that plan, you’d have said, “I think there’s a possibility of a global pandemic that’ll make everyone super reliant on our technology. I want my 10(b)5-1 plan to account for our stock going from $75 to $500 per share this year.”

No way.

So, when we’re talking about putting together a 10(b)5-1 plan for a stock that will do well, you need to realize that you’ll majorly under-sell yourself.

And just like you can miss out by a stock going up and then back down outside of your trading window, it’s also possible for you to miss out by designing a 10(b)5-1 plan with prices that are way too low.

Asana during 2021 is another example of this.

During 2021, if you were designing a 10(b)5-1 plan early in the year when the stock was trading at $30 to $40 per share, I find it impossible to believe that you’d write it into your plan that the share price could get up to $100 per share before the end of the year.

So, if the stock ends up performing really well, there’s a high chance you’ll actually under-sell yourself and miss out as a result, because a year from now the price you chose in your 10(b)5-1 plan could seem really, really cheap.

What if the stock does poorly?

This has been the story with just about any tech stock in 2022.

If you’re reading this post in December, for example, and you’ve got a 10(b)5-1 plan you designed at the end of last year or the beginning of this year, there’s a really good chance that no trades have occurred within your plan. Stocks have done nothing but go down… and I’ve never seen anyone design a 10(b)5-1 plan with a stock price lower than at the time they wrote it.

But… if the stock is going to come back up again… what’s the problem?

If the sole purpose of the 10(b)5-1 plan was to keep you from trading at prices that were too low, it’s done its job. But what about the risk of being locked into a plan like this when you really need to trade because you need cash?

You could be stuck in the situation of having no cash from trades, but still having to pay taxes you owe as a result of option exercises you did last year, or RSUs that have vested.

What if the stock does crazy things?

We all remember Robinhood after its IPO.

Shortly after their IPO, the stock spiked all the way up to more than $50 per share, but since then, has declined all the way down to less than $10 per share.

If you had a 10(b)5-1 plan in place prior to the IPO that could take advantage of the big spike right after the IPO, there’s a possibility it would’ve worked in your favor.

The most important thing in your 10(b)5-1 plan, though, no matter how the stock performs, is the price you set those trades to execute at.

2022’s 10(b)5-1 Example: Shockwave Medical

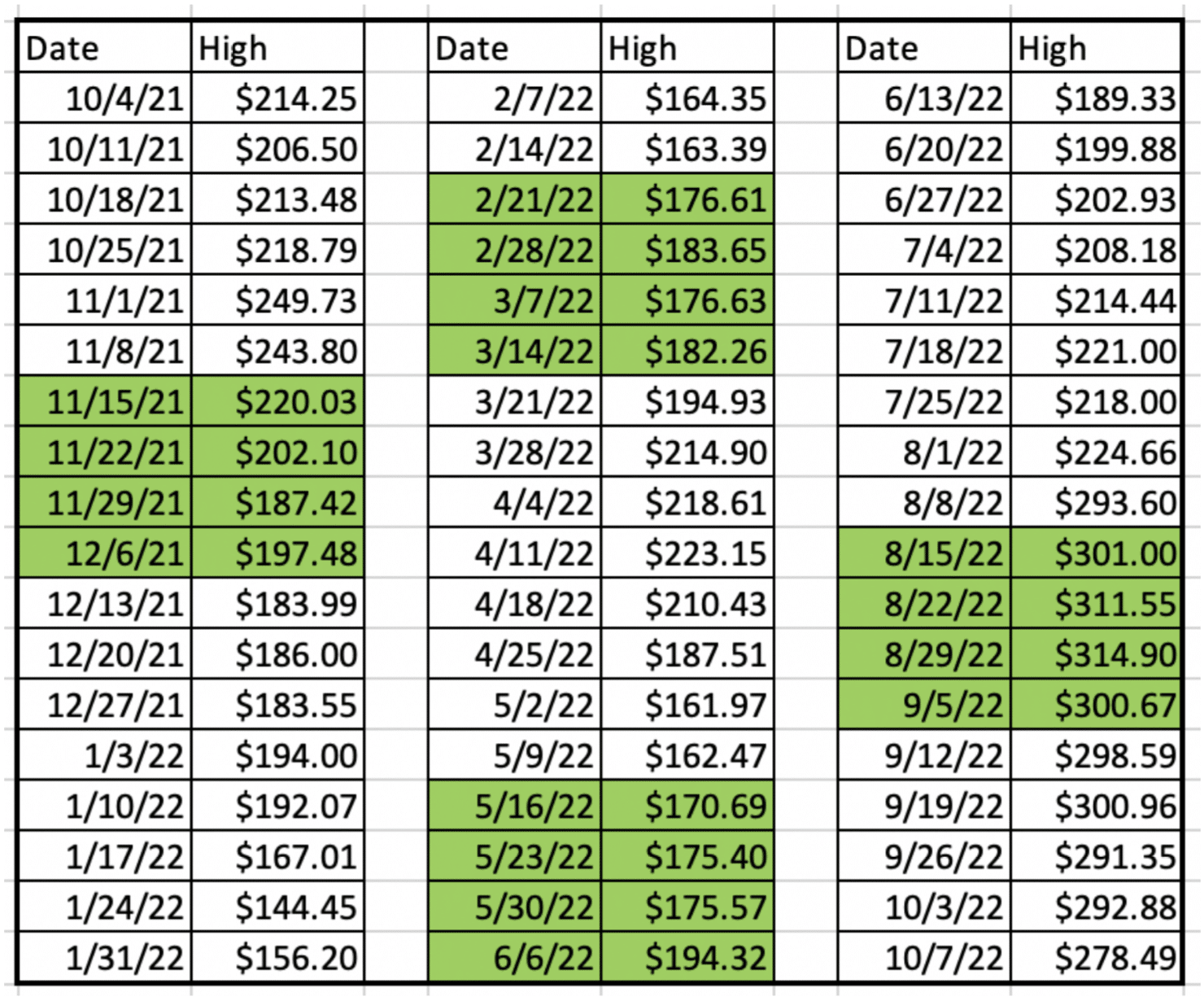

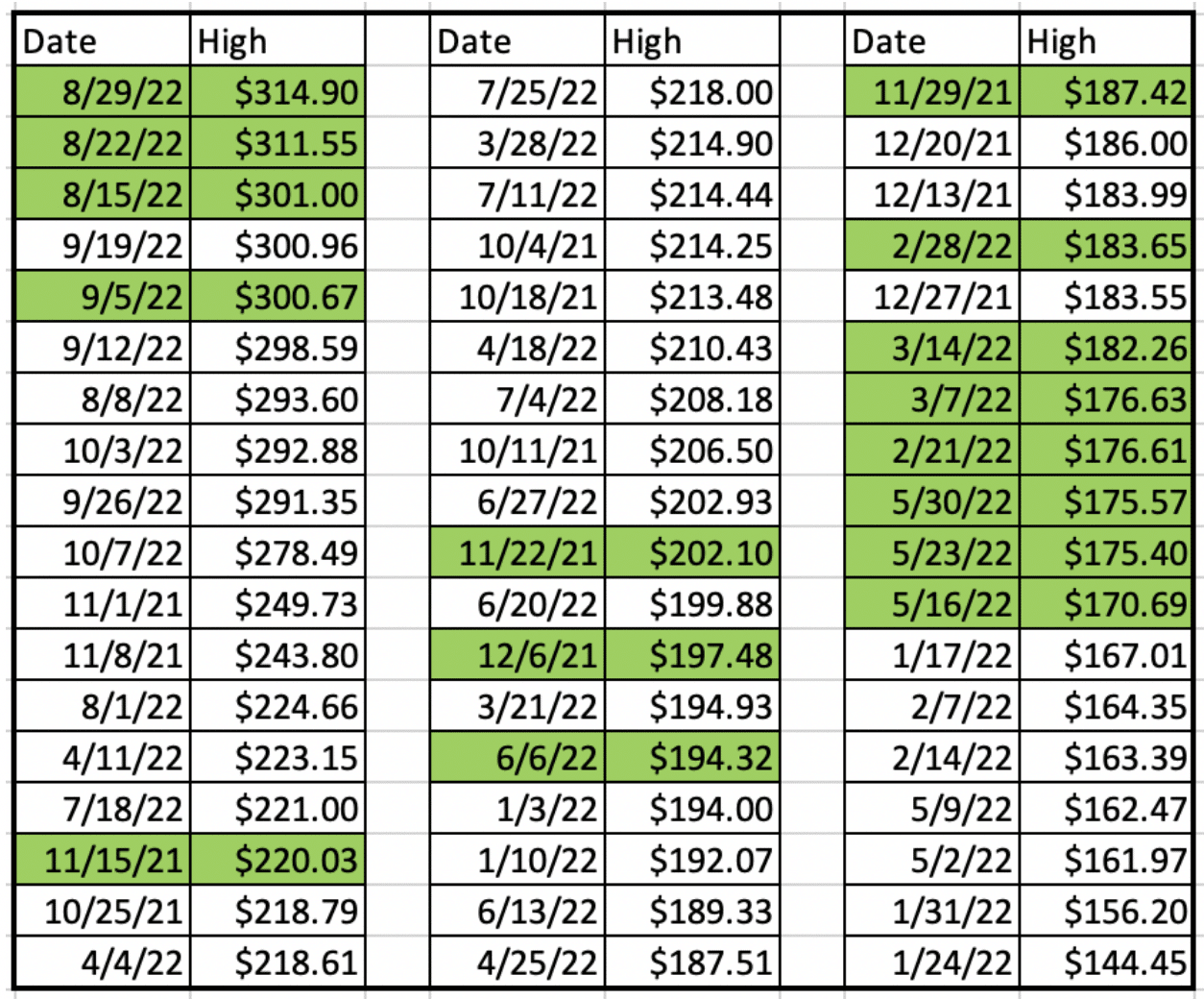

So far, Shockwave medical is bucking the trend of everything going down in 2022. It’s also been trading over a wide range, with a lot of movement in the last year.

If we look at the stock chart (October 2022), we can see a 52-week low of $113.36, and a 52-week high of $314.90—178% higher than its lowest price.

To look at how beneficial (or not) a 10(b)5-1 plan might’ve been to a Shockwave Medical employee, I downloaded historical weekly prices over the last year from Yahoo Finance, and then highlighted the four weeks after each quarterly earnings call in green. (I got this info from their investor relations website.)

For the purposes of this article, we’ll consider those four weeks following those earnings calls (again, highlighted in green) as open trading windows for their employees.

Then I sorted by price instead of date to see how many of the top third weeks fell within open trading windows.

Five out of sixteen weeks occurred during the open trading windows. (31%)

It’s also important to note that the top three weeks, and four of the top five weeks all fell within open trading windows.

Let’s go back to October 2021, at the price of $214.25, and assume you were drafting a 10(b)5-1 plan at that time.

Looking at the information we have here, it could’ve worked really well for you, assuming all the trades would’ve executed at a price higher than $214. If that were the case, all trades would’ve been in the top 40% of weekly high prices.

BUT, with hindsight being 20/20, your best course of action would’ve been to forego the 10(b)5-1 plan, and execute all your trades in the August 2022 trading window.

It’s an interesting catch-22, isn’t it?

Does a 10(b)5-1 Plan Make Sense for You?

Here are four ways to know when a 10(b)5-1 plan is right for you:

1) IF you’ve budgeted for taxes… meaning the ones you’ll owe next April, as well as the ones you may owe for next year entirely. For example, if you have RSUs that will vest, you will owe taxes on all those shares whether you sell them or not, so you need to make sure you can cover that bill.

2) You’ve funded your short-term goals. If you have a goal you need to fund in the next few years, like a downpayment on a home, don’t tie up your stock options and shares in a 10(b)5-1 plan if you still have more cash funding to do.

3) You’ve reached financial independence without your stock options and shares. If you’re not reliant on your stock options and shares to ensure your financial health, you have a capacity for the risk that comes with a 10(b)5-1 plan. You can afford to play the long game for a higher price, in other words.

4) You have a lot of money you don’t need left in options and shares. It’s hard to put a dollar figure on this, but the more money you have tied up in stock options and shares, the longer it will take us to work through them. The longer this time frame is, the more likely a 10(b)5-1 plan will work well for you.

Conclusion: Stay Flexible, Whether You Use a 10(b)5-1 Plan or Not

When I’m planning for clients, flexibility is a top priority in a financial plan.

You need to be able to proactively plan for what might happen, and then react to what actually happens… which is why I’m not always a huge fan of 10(b)5-1 plans for a lot of my clients.

With them, you’re giving up a lot of flexibility, and having to make a lot of assumptions about what a stock might do in the future. (Plus, there are countless ways you can get it wrong.)

If you’re thinking about designing a 10(b)5-1 plan, you need to be careful, and take a look at the four ways to know if one is right for you in the section above.

If these four items apply to you, you can consider it with the help of a good financial advisor.

But whether you think a 10(b)5-1 plan would be good for you or not, I and my team would be happy to help you make the most of your stock options and shares.