You know them well:

- Surprise tax bills

- Single tech stocks

- Too much cash

Together they will leave your financial plan bloodied and bruised. We will explore each mistake. Plus three ways to flip the script and turn your plan into a real killer.

It’s Not Your Fault

Well, maybe it is. Just a little bit.

You started out of college making little to nothing. Then things changed. First, you got promoted to Senior Developer. Big time!

You leveraged the Senior Developer position into a manager’s job. Then came the IPO and five hundred thousand dollars worth of stock.

The manager’s job took you to a director level post after a few years. The director level brought a big bump in salary, bonus, and equity. The scale of the change in income is dramatic.

Your job requires a lot and leaves little time for managing the details of your financial life. You have an idea what you should do. But, where do you find the mental space to do the research and make the decisions?

The result is you make lots of money but fail to make the progress that should come with your high income.

Three mistakes kill your ability to build wealth and get flexibility.

Taxes

The IPO was a real eye opener.

You received a combination of stock options and restricted stock units (RSU). Not knowing what to do, doing nothing was the easiest choice.

The IPO triggered restricted stock units that were earned but not vested to vest all at once. This resulted in a large tax bill that you did not expect.

It’s a bitter pill to swallow.

AMT and the Cost of Being Disorganized

Early in your career, our tax planning would focus on avoiding the alternative minimum tax (AMT). It’s possible to avoid the AMT at income levels of $117,000 as a single taxpayer and $156,000 as married filing jointly.

Note, the numbers here are estimates as the exact combination of income and deductions that triggers the AMT will vary.

Now, your income is too high. The AMT is unavoidable. Our focus is on not going past the AMT and back into ordinary income tax rates.

Your AMT tax rate is 28% up until the point you go past the AMT. Once you go past the AMT and back to ordinary income tax, your rate jumps from 28% to 39.6%.

How do I avoid this:

You avoid this by limiting your income below the end of AMT. The alternative minimum tax ends around $588,000. There are some ways to do this:

- Selling Investments – wait to sell

- Stock Options – wait to exercise

Planning for the AMT is complex. We put together tax plans over multiple years that include assumptions about present and future income.

We may be reducing income or increasing income from one year to the next based on where you are in relationship to the AMT. It pays to work with an expert adviser who knows the subject.

Uncovering Hidden Stock Option Opportunities

There is a tax cost to being disorganized with your stock options. The cost is less direct and represented by missed opportunities.

The biggest missed opportunity is to early exercise and file an 83(b). Early exercise is a unique opportunity. The risk represented by uncertainty is highest, but the cost to exercise is the lowest.

Once you start to vest, the uncertainty remains high, but the cost goes up. You get stuck trying to weigh the uncertainty versus the rising tax bill. It’s a bad place to be.

By the time an IPO rolls around, the uncertainty is gone, costs are high, and the opportunity diminished.

Be ready to early exercise:

- Keep enough cash so that you can early exercise

- File the 83(b)

- Keep good records

An early exercise can keep costs low, avoid a future tax bill, and unlock hidden opportunities.

Single Stock

The IPO was great. All your restricted stock units (RSU) vested. You held the shares because the stock went up and you were unsure when to sell.

A year later, you left for another company and exercised all your vested stock options. You walked into your new job with $500,000 of your old company’s stock.

Things were good at first. The stock climbed. At the peak, your $500,000 turned into $1.4 million.

But, what goes up:

First, there was the missed earnings call. Earnings were higher than last year but did not meet expectations. Then the tech sector softened.

Your $1.4 million went the other way. All the way back down to $540,000. You went along for the entire ride.

What happened:

- It was going up. You thought, “Why sell now?”

- It went down. “Yeah, but it will go back up”

Not having a plan in advance of an IPO. Unsure when to sell. Leaves you exposed to the fortunes of one company. A company you may no longer work for.

Single stock exposure can kill your financial plan.

Cash

You did one thing right…

You saved money.

As your income went up, your savings followed. Cash started to pile up in the bank account. There was no time to decide what to do. Like the single stock the cash just added up.

You now have $350,000 in the bank. You add $48,000 in new savings to that amount every year.

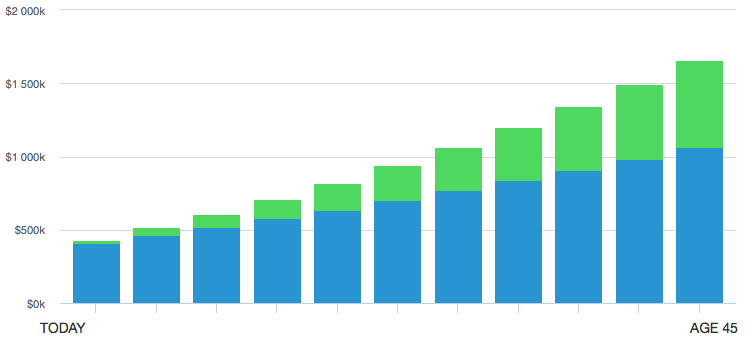

With a bank account earning 1%, you will accumulate $1,057,942 after ten years. But, you are giving up a lot by not investing the cash.

Let’s assume that today you invest the cash in a diversified portfolio earning an average of 8% a year. The $48,000 savings per year gets invested as well.

The result:

Your total after ten years is now $1,653,962. You gained (green bars versus blue bars) $596,020 by keeping the cash invested.

You pay a huge opportunity cost by being too busy to invest your cash.

Start by Realizing… It’s Ok

It’s ok. This is not about changing who you are. Rocking your career, stacking promotions and being disorganized…

still better than…

stuck in your career with a color coded binder for a financial plan.

Accept that your energy is better spent in other. This is true for most people in tech at certain career and income levels.

The key is to find easy ways to organize your plan.

How to Organize a Killer Financial Plan

There are three ways to go from disorganized to an absolute killer financial plan:

- Hire an Advisor

- Plan in Advance for Stock Options

- Automate Investments

A little time invested now in all three will add up to huge gains over your career.

1. Hire an Advisor

Outsourcing is the easiest way to organize your financial plan. Look at the company you work for. How many employees are there? How many people are on your team?

A company starts as idea and grows from there. Early on, it takes just a few people, but eventually capacity limits growth.

Your life and career are past the start-up phase. Add capacity to unlock growth potential by hiring an advisor.

What will my advisor do for me?

Make the right choice. Hire an advisor who is an expert at working with others like you. Your advisor will:

- Help you organize your accounts

- Provide reminders (open enrollment, trading windows)

- Find a system of investing that works for you

- Set targets (how much cash to keep, expected wealth accumulation)

- Tax plan over multiple years

- Provide an annual (at least) review

Just as you meet periodically with your team at work. Working with an advisor will require a small investment of your time. But, it will allow you to multiply your future returns. Returns both in time spent managing money (less) and wealth accumulated (more).

2. Plan in Advance for Stock Options

Decide in advance how to handle your stock options.

Start-Up:

Exercise early if possible. File an 83(b).

Publicly-Traded:

Develop and execute a plan for selling shares after the IPO. Consider a 10(b)5-1 plan. Automate the sell of restricted stock units (RSU) as they vest.

Take the guess work out of handling your stock options. Look to sell when you can and invest the proceeds in a diversified portfolio.

You will be glad you did if the stock goes down. Should the stock go up, you will continue to get new grants of RSU and your raises/bonues will be bigger.

You win either way.

3. Automate Investments

Start with your 401(k). It is the easiest to automate. Increase your contributions until you reach the maximum allowed.

Once you max out your 401(k) you have two options for automating investments:

- Split your direct deposit

- Automate transfers from bank account to investment account

You can change your direct deposit so that part of each check goes into a separate investment account. I have had success doing this with accounts at Fidelity.

You can also automate monthly transfers from your bank account to your investment account. The monthly transfer is usually initiated from your investment account. You choose the amount and frequency of the transfer.

Inside and outside of your 401(k), make your investment choices simple. Use all in one funds such as target date retirement funds when you can.

Make sure the cash that goes into a separate account gets invested. Wealthfront and Betterment make this super easy. Fidelity and Vanguard also offer automatic investment programs.

The key to getting your investments organized is to automate the process.

I tell clients:

“Our goal is to make ignoring your investments the best thing for you to do.”

It Doesn’t Have to Be So Hard

There is a real cost to being disorganized.

- Unexpected and avoidable tax bills

- Big losses from a single stock

- Missed returns from too much cash

Together, these three mistakes can add up to millions of dollars over a lifetime. But, avoiding the mistakes doesn’t have to be hard.

Focus on what matters most to your financial plan.

Delegate some of the work to an expert advisor. Find a simple solution. Automate the process.

Looking for an Advisor

We specialize in your unique needs (stock options, taxes, investing). The first step is to schedule a free call today.