How can I help my loved ones with educational expenses?

529 Plans & Secure 2.0 Changes!

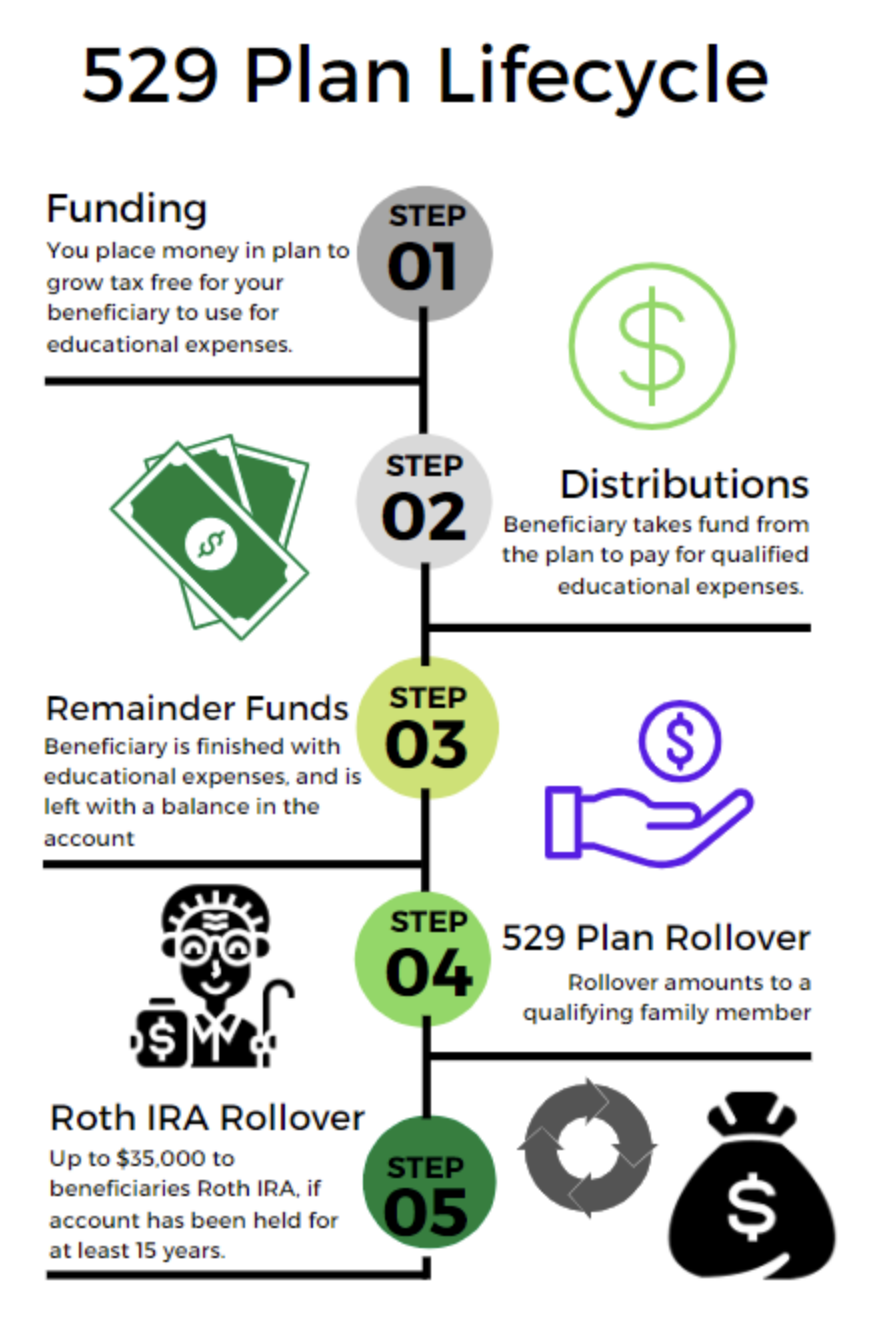

We all want the best for our kids, family members, and those special to us. One of the best ways to start off our loved ones with a secure future is putting away funds for education and schooling expenses. Every day you hear of crippling student debt burying the youth of today, so most of us want our loved ones to avoid bearing those costs. Maybe you even have some personal experience with that scenario. A great shelter we can create is called a 529 plan.

Expanding on the topic – 529 plans are qualified tuition programs meaning a program that is established and maintained by a State or Agency. A 529 plan can be used to purchase tuition credits on behalf of the beneficiary of the plan. The great thing is the money contributed within a 529 plan is able to grow tax free. Distributions from the plan, as long as used for qualified expenses, are not includable in the beneficiaries income.

Some of the expenses that count as a qualified expense are as follows:

- $10,000 per year for private school education for grades K- 12

- $10,000 in student loan repayment

- Secondary education tuition and fees

- Books and supplies for post secondary education

- Computers, softwares, internet costs for postsecondary education

- Room and board for school (as long as the beneficiary is enrolled at least half time)

Tuition and fees normally come to mind for college, but the IRS has expanded these fees to include vocational and trade schools and public or private schools. An important factor to remember in today’s era is that the tuition and fees do not need to be in person classes, it can be classes that do not require physical presence on campus.

So it’s a no brainer – put the funds away. However, the next question that comes to mind is how much? There is no definitive way to ensure we have enough money or too much money in the plan to cover your beneficiary’s educational expenses. Luckily, the IRS is giving our beneficiaries a nice break in the form of remainder funds. They give you two choices:

- Rollover 529 funds to a qualifying family member’s plan

- Rollover 529 funds to the beneficiary’s Roth IRA

Rolling over 529 plans to a qualifying family member’s plan can be a great way to use remaining funds. A qualifying family member is brothers, sisters, foster children, adopted children, nieces, nephews, aunts, uncles, in-laws and first cousins. Once they obtain the funds in the new 529, the same qualifying distribution rules that applied, now apply to the new beneficiary. It can be a great way to help other loved ones with their own educational needs.

In December 2022, the Secure 2.0 Act was passed and created another great use for your loved one’s 529 plan. Effective in 2024, the Secure Act 2.0 will allow beneficiaries of 529 plans to rollover funds to the beneficiary’s Roth IRA. However, to do these rollovers of unused funds, a few rules must be meet:

- The account must have been held for at least 15 years.

- No more than $35,000 of unused funds can be rolled over to a Roth IRA (lifetime).

- Any contributions to the 529 plan within the last 5 years (and earnings on those contributions) are ineligible to be moved over to the Roth IRA.

- No more than the annual limit can be rolled over to a Roth IRA in a year (for 2023, this amount is $6,500). These rollovers reduce the amount you are eligible to contribute to the Roth IRA that year.

All of a sudden, you now take some of the guesswork out of how much to contribute to your loved one’s plan. Stepping away from this article, your takeaway is knowing the earlier you start the plan, the better (even if you don’t fund it). 15 years is a long time to hold an account, get the clock ticking early so that your beneficiary can have more options as their disposable. This is not just a tax saving method but also a great way to set up our loved one’s for a more lucrative future.