Most of our advice on this blog surrounds exercising and selling stock options after they vest.

But did you know that you can (sometimes) go ahead and pay taxes on your options before they vest?

You can! And it’s via a Section 83(b) election.

This can be incredibly handy for saving money on future tax bills, especially if you know the coming tax year is going to be a big one that bolsters you into a higher income bracket.

So… what is an 83(b) election, exactly?

And how do you take advantage of it?

What’s a Section 83(b) election, exactly?

First off, the name Section 83(b) corresponds directly to the Internal Revenue Code section the election corresponds to.

When you make this election, you’re able to recognize (and pay taxes on) income from restricted stock and stock options before they’re vested… when traditionally you’d have to wait until after the vesting happened.

Whether or not you can even do this depends on your company’s stock plan, but if you are, it’s a nice trick to have up your sleeve when planning taxes.

What are the rules around an 83(b) election?

Assuming your company allows you to do this, there is a catch to making this election:

It must be done within 30 days of exercising your unvested stock options.

To do this, you’ll need a form. The tricky part comes when you realize that, ironically, despite all the forms the IRS loves to use, they haven’t published an exact form for this election type. All they’ve got are a collection of guidelines you have to follow for this election, and a mailing address to mail your election to.

But, if you work for a company that encourages this type of election, your HR department can be a huge help here. They may have election templates they can give you, and provide the details you need to complete the paperwork with the IRS. This is wonderful, because if your elections don’t have everything in them according to the IRS’ guidelines, all that work will be considered invalid.

(If you’re curious about what those guidelines look like, you can see a general example put together by the SEC right here.)

Should I consider an 83(b) election?

If your company allows this type of election, the answer is: Yes, consider it. It could reduce your tax bill in a couple ways:

- You pay ordinary income taxes before your company shares increase in value, giving you a lower amount to pay taxes on.

- The election date becomes your “acquired” date, even if the shares are unvested. If you hold for longer than a year from the “acquired” date, you’re eligible for the lower tax rate that applies to long-term capital gains.

Let’s dig into that first one:

Particularly if you plan on staying at your company for a while (or at least until you’re fully vested), chances are that your stock value will go up as the company gets bigger.

As the stock values rise, then, so does your “profit” when you exercise at your strike price.

If the company has high growth, this “profit” could be significantly higher a year from now… meaning the taxes you pay will reflect that. But, if you do an 83(b) election now, the taxes you pay are based on the “profit” you would get today, not in a year… reducing your tax bill.

Secondly, the earlier you can move back your “acquired” date to qualify you for the long-term capital gains tax rate, the better.

If you believe in your company’s ability to do really well during an IPO, and you’re a year or two out from that IPO date, you can make one of these elections on your yet-to-vest shares, so you can sell them at the IPO and cash out with a long-term capital gains tax rate. (And the ability to cash in on a good IPO price before market volatility has the chance to bring it down.)

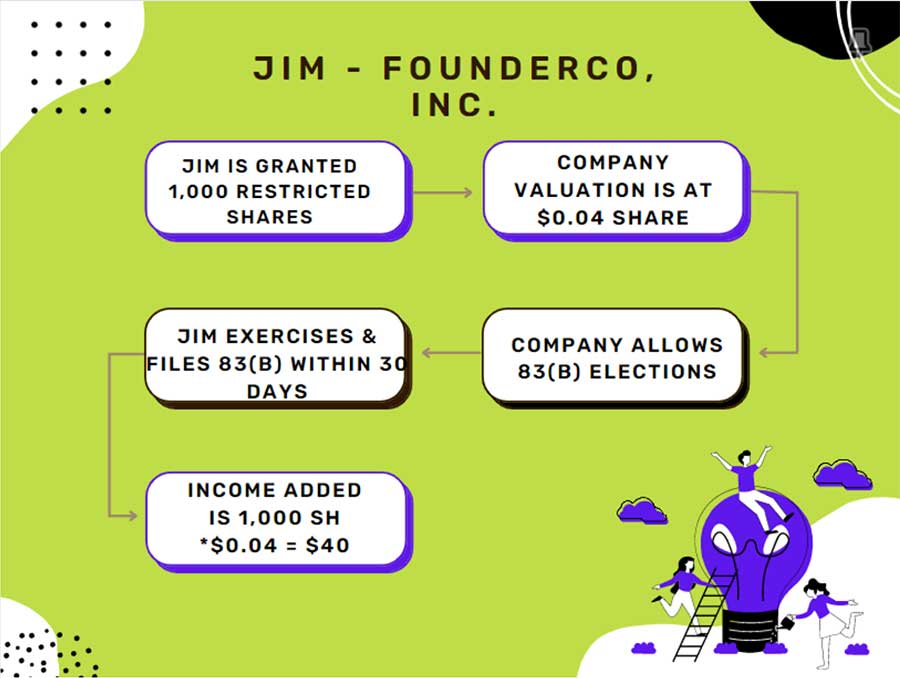

Example 1: The Startup Founder

As a founder, your chances of leaving a company you started are fairly low… so an 83(b) election could be perfect for you.

Let’s take the example of Jim, a founder at FounderCo, Inc.

He’s granted restricted stock in his company, but it won’t vest until he’s been there for at least three years and the company has a liquidity event.

If he can exercise and file an 83(b) when FounderCo’s company valuation is only $0.04 per share, he only adds $40 of ordinary income per 1,000 shares he exercises. His “acquired” date is then set to the date he made the election, regardless of the fact that the share’s won’t vest for another few years. By the time the options vest, any profit Jim makes from selling those shares will qualify for long-term capital gains tax, so it’s a win-win.

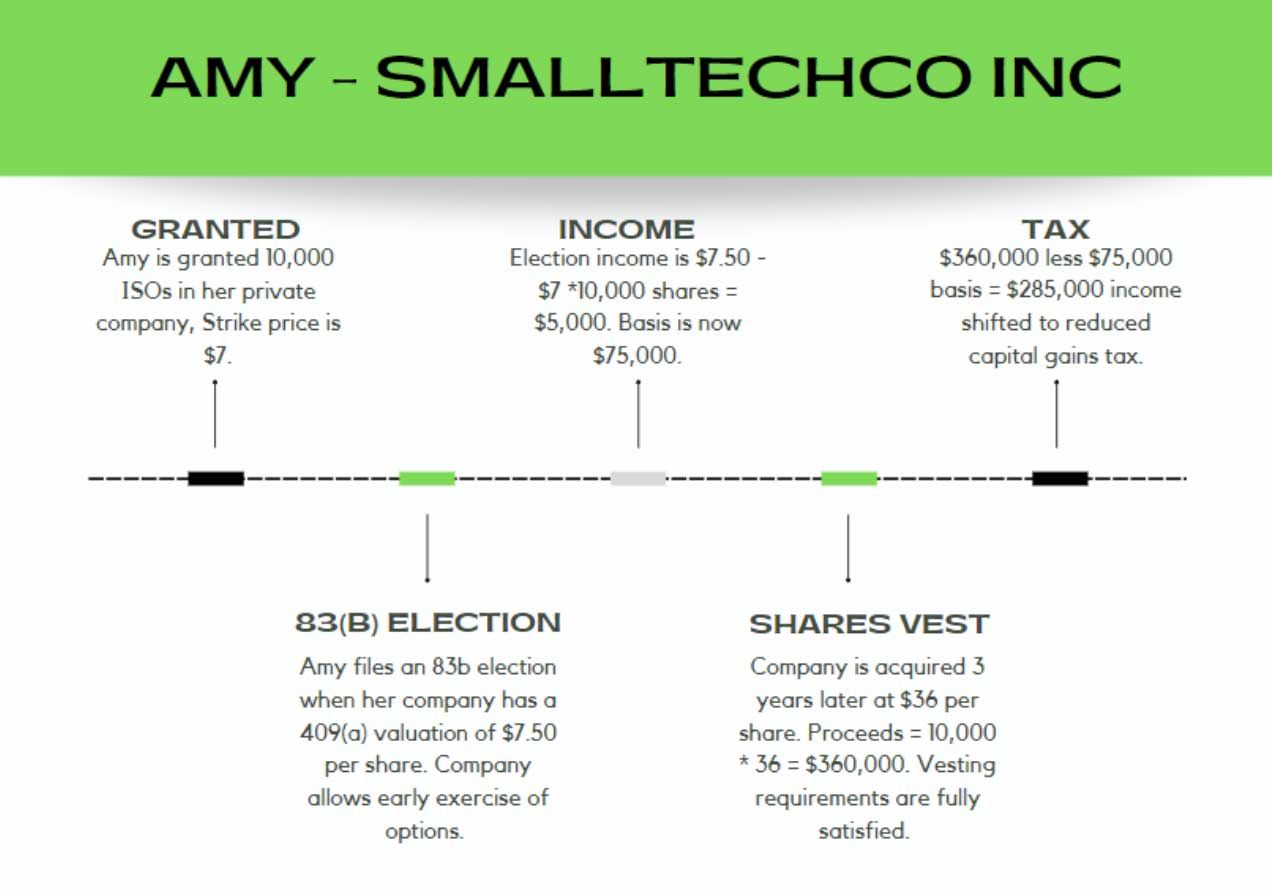

Example 2: Employees with Stock Options

As the Director of Engineering at Smalltechco, Inc. Amy was granted 10,000 incentive stock options with a strike price of $7.

One year later, the company went through a 409(a) valuation that placed the share value at $7.50, $0.50 higher than Amy’s strike price.

Amy likes where the company is going, so she does an early exercise of her options, paying $70,000 for her shares, and files an 83(b) election within 30 days of doing so.

Because of the election paperwork, she realizes $5,000 in ordinary income, bringing her total basis to $75,000… but she only pays ordinary income taxes on the $5,000.

Three years after Amy files her 83(b) election, the company gets acquired at $36 per share, so Amy’s gross proceeds are $360,000. Since Amy worked for the company for three years, her shares were fully vested.

$360,000 (gross proceeds) – $75,000 (basis) = $285,000 net proceeds Amy has to pay tax on.

However, because she “held” the shares for more than a year, she qualifies for the long-term capital gains tax rate. If her ordinary income rate is 37%, this means her long-term capital gains rate is 20%, which saves her nearly $48,000 in federal income tax just by making the election.

When Should I Avoid an 83(b) Election?

83(b) elections can be wonderful, but they’re definitely not for everyone or every company.

If you’re not confident in your company’s ability to have a successful liquidity event, you may want to pass. If a company ends up folding, the election won’t do anything for you, and you could’ve used the money elsewhere in your investing plan.

The math of an 83(b) election works in your favor when the market price is either low or close to your strike price. If there’s already been a high appreciation in your company’s shares, or you’re getting really close to a liquidity event, you might want to opt for a different stock options strategy.

Not to mention, all the cash it takes to exercise and pay your initial ordinary income taxes will have to come out of pocket. If you can’t afford that kind of cash liability, don’t make the investment.

Risks of Making an 83(b) Election

The largest risk, of course, is forfeiting your shares.

This can happen via employment termination, death, or failure to meet performance requirements, among other things.

If you’ve made an 83(b) election on forfeited shares, you will have already paid ordinary income tax on them, but you’ll never be able to actually own or sell any of them.

The other risk, of course, is that the stock never appreciates much in value. If this happens, you don’t really save much by paying your taxes on those shares early, and you could’ve used the money to invest elsewhere.

The outcome: should I or shouldn’t I do an 83(b) election?

When an 83(b) election pays off, it can pay off in your favor big time.

But the key word in that last sentence is when. And if.

Just because you go through the motions and do the paperwork doesn’t mean this tax strategy will pay off for you: there are a lot of “if”s to consider:

- If your company does well in the marketplace

- If share valuation continues to rise

- If a liquidity event even happens at all

- If the company doesn’t fold

- If you’re employed long enough for your shares to vest

- If you have a lump sum of cash that will allow you to exercise, that isn’t better-used somewhere else

But if you think you’re in a position at a good company where this type of election would be a good fit for you, we’d love to talk to you about it! Book a call here to talk to one of our expert advisors.