It was a Friday, and I’d just wrapped up a long week of work in our San Francisco office.

I was excited to get home, and at first it seemed like any other week: get to the airport, grab some breakfast, and hop on the plane home to my wife and children in Tennessee.

That’s when it started.

First, the flight was delayed for 30 minutes due to technical issues.

That’s also when I had my first regret: if I knew I’d be delayed by 30 minutes, I could’ve grabbed my favorite breakfast burrito from The Grove before coming to the airport.

Then, another text that we were delayed even more.

Then another.

And another.

Finally, the last text came through: flight canceled.

That’s when my second regret happened: if I’d known the flight would have been canceled, I could’ve left a day early, and already be home with my family instead of around a bunch of frustrated passengers in an airport. (Or, at the very least, stayed in the office to get a day’s worth of work done instead of wasting that time in the terminal.)

I went back to my hotel, and started dealing with the loss of the situation:

I was facing another night in an empty hotel room, and couldn’t see my family for another day.

Lesson: When to Sell Shares After an IPO

Believe it or not, there are a lot of lessons in the story of my canceled flight for gearing up to sell your stock options and shares after an IPO. They revolve around understanding what’s likely to happen, and what could happen… and the point that there’s a difference between the probable and the possible.

When I was leaving for the airport that morning, the probable outcome was that my flight would leave on time, and I’d land a few hours later safely in Nashville, just as planned.

The possibilities were, however, unlimited.

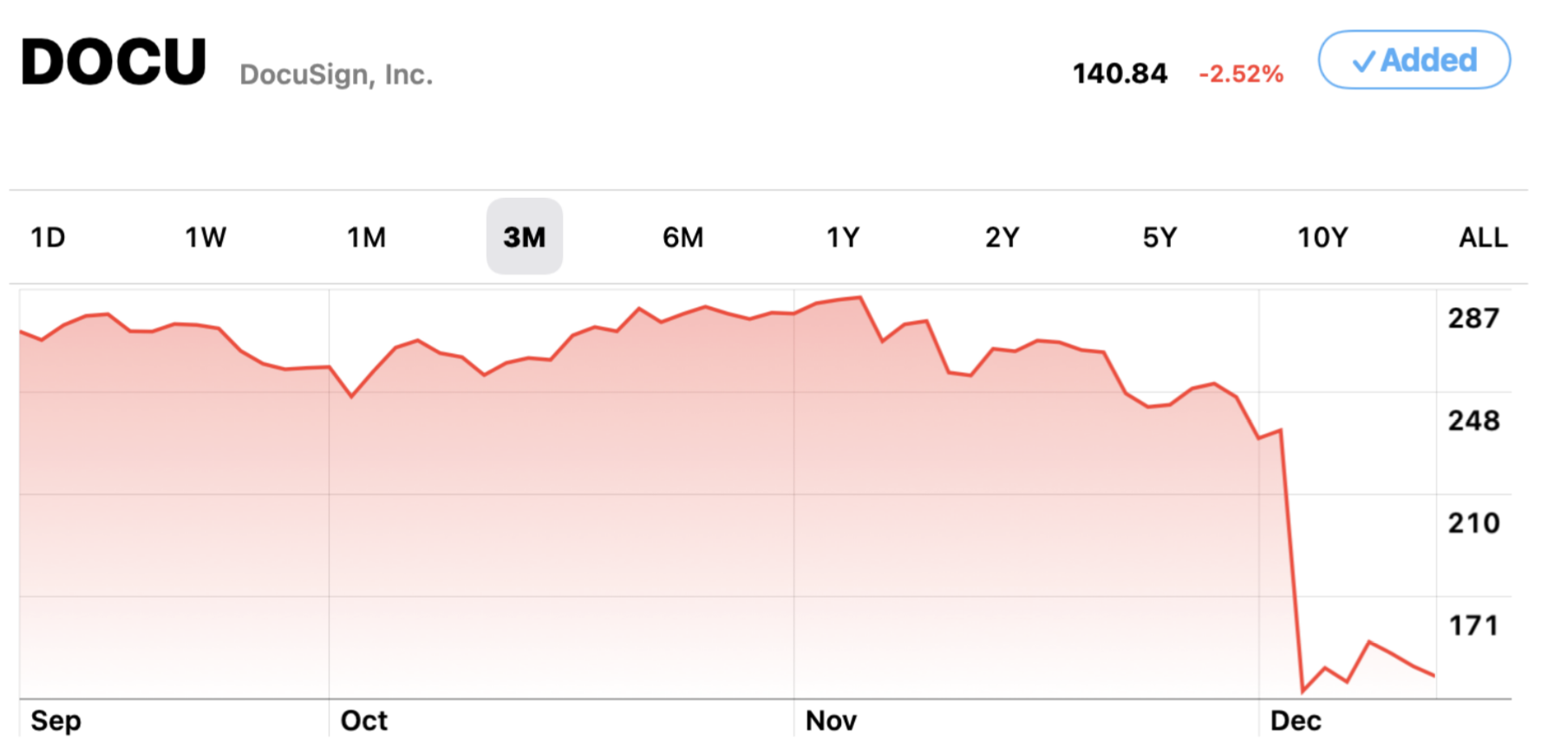

A Lesson From Docusign’s 40% Drop in Stock Price

At the same time that my flight was being delayed and canceled, something interesting was going on in the stock market.

It started off as a normal day for the stock market too: it was up as a whole, but there was a headline that read “Docusign Down 40%.”

Everyone who worked at Docusign, went through the IPO, and had shares or stock options, had an expectation for how things would go… and a 40% drop in share price was not part of those expectations.

I’m sure they all knew that it was possible for the stock to go down… but they probably didn’t figure for 40% in one day. (I mean, who would expect that?!?)

So, as you’re dealing with your IPO, it’s important that you know the difference between what’s likely to happen, what could happen, and that your financial plan has a path for both: what’s likely, AND what’s possible.

First: Identify Your Intent for Your Options or Shares

Before we even talk about taxes, which is where most people begin their IPO planning, decide what your intent is for your stock options and shares.

Chances are, there likely won’t just be one thing you intend to do with your options… there might be a lot of specific things you’ll want to do.

Usually, the things you want to do with your shares and stock options will fall into two different categories:

- Sell

- Hold & sell later

The point of this exercise is to know what you WANT to happen… because ultimately, your desires and how your stock performs are more important than taxes.

Stock Price: There are No Good Surprises

The most important thing in your plan is the stock price and how your stock performs in the market.

It’s THE one thing we can’t predict, and no one knows how your stock will perform… but it matters more to the outcome of your plan than anything else. (And when to sell your shares after an IPO, especially if you’re doing a hold strategy.)

Because of this, it’s important to realize that one bad day for your company’s stock can destroy the best tax plan.

The stock market drops much faster than it rises, after all, and when it comes to your stock’s performance and how your stock does day-to-day in the stock market, there are no *good* surprises—only bad ones. (Unfortunately.)

It may (and can) go down a lot faster than you expect.

Selling Based on Stock Price

Because of this, it’s good to put together a plan based on your intentions with your stock options AND the share price in the market.

If your intent is to sell, you’re wanting to get cash out ASAP while minimizing taxes.

The very first thing to do, then, is to sell your RSUs. These are the least tax-advantaged form of shares you can have, because as soon as they vest, 100% of their value is taxed as ordinary income. (You’re basically getting a cash bonus in the form of shares.)

Then, if your intent is to sell, you’ll want to exercise and sell non-qualified stock options (NSO) next. These are similar to RSU in that when you exercise, 100% of the value is taxed to you as ordinary income… the only difference is that nothing happens until you exercise, so you do have some say in when those taxes get triggered.

Finally, if you want to sell, we can talk about your incentive stock options (ISO). Even if your plan is to sell, it’s smart to execute an exercise and hold strategy for your ISO… but when you know your goal is to sell ASAP, when you exercise to begin the hold is really important.

We want you to have maximum flexibility, so we want to guard as much as possible against your stock price starting to go down. The ideal, then, is to exercise and begin the hold in January so that during each of your four quarterly trading windows you can re-evaluate your decision to see if exercising and holding continues to make sense, of if you’d rather do a disqualifying disposition in the same year you exercise to wipe out any alternative minimum tax (ATM) that might have been triggered by the exercise and have your ISO treated like NSO from a tax perspective.

Intent: Holding Your Stock Options

If you want to hold your stock options (you don’t want to cash out ASAP), and you know you’ll sell at some point in the future… but probably not this year, here’s what you can do:

The very first thing you’ll want to do is identify a target price. This is some stock price that’s higher than what the stock is currently trading at. There’s no right or wrong answer here… it’s up to you, and is really just a best guess.

The way I like to help clients figure out this price point is to get my clients to answer this question: “If I could sell at $____, that would make me really happy.”

Write down your target price, because it will be really important to you later on. (Because if the stock rises to that price, you’ve already decided that you WILL start selling.)

This way, you won’t run the risk of continuing to hold, hoping to sell at a higher price, only to watch the stock price fall, and with it your chance of hitting your pre-determined financial target with your options.

If you do intend to hold, you’ll also want to do the math to figure out what your break-even point is.

This is important any time you’re exercising and holding ISO… it’s a tax minimization strategy, but your stock price is still the most important factor.

Here’s how you figure it out:

“If I exercise and hold today at today’s stock price, how low can the stock fall before I lose the advantage of the lower tax rate?”

This will vary based on your ordinary income tax rate and what your long-term capital gains rate is, but it’s usually going to be around 15% to 18%, which you can convert into actual prices.

For example, if the stock price is at $150 now, you’ll start to lose the advantage of holding if the stock price dips down to $135 or $130.

If you’re going to hold, you’ve got to be willing to accept the risk, so you need to think about this… if you notice the stock price starts to fall, will you get really anxious, change your mind, and just want to sell? THIS is why you need to think about this ahead of time.

Tying it Back to the Docusign ‘Tragedy’

As a financial planner (and with a lot of extra time on my hands because I was spending another night alone in a hotel room), I started looking at Docusign’s stock price history to figure out a point in time when the stock price on that day would have had a break-even price equal to the price after the 40%, single-day drop.

I had to go all the way back to June 2020.

Which is a key thing to think about: for 18 months (an entire year and a half), that stock was trending up. The employees probably thought they were in a really good position, they liked what they were seeing, and in ONE day, they lost 18 months worth of progress… and it would likely be a very slow climb back up to the top, if it ever got there again.

I don’t tell this story to fear-monger: I just want people who decide to hold to be willing to accept the risk of what all those untold potential outcomes might be.

A Solid Holding Strategy

Once you’re aware of not only what’s likely to happen but what could happen, the key to holding is to first be honest and make sure you’re totally okay with accepting the risk of what all those possibilities could be.

RSU?

No.

Don’t do it.

DO NOT hold these.

Sell your RSU ASAP, even if you are sticking with an overall holding strategy.

Nonqualified Stock Options?

With NSO, you have some choices.

Nothing happens with these until you exercise… so if you want to hold and wait to sell, the way to do that with NSO is to do nothing. Don’t exercise, just wait. Then, when you get your target price, exercise and sell.

ISO?

With ISO, the holding strategy is to exercise and hold. It’s still a good idea to exercise in January, but it isn’t 100% necessary when your intent is to hold onto the shares regardless of what the stock might do. The point is, you want to exercise and start the holding process, so you can begin that 12-month clock on long-term capital gains.

Once your ISO qualify for long-term capital gains, the idea is still to focus on your target price before you start selling. (And the key is to start selling… you won’t necessarily sell everything as soon as that target price is hit, it just means you start the selling process. You may decide to choose a new target price, for example.)

Deciding When to Sell Shares After an IPO

Long story short:

It’s best not to be caught short-handed.

Thankfully, when I got stuck in San Francisco for an extra night, it was fairly easy for me to check back into my hotel.

But when you’re dealing with things like closed trading windows, an unpredictable stock market, and an endless outcome of possibilities, it’s best to have a solid plan with a few contingencies in case things start to go awry.

It might not be as easy as just waiting one more day to resume your plans… they could get thrown for a loop completely, or take years to recover.

If you don’t have a solid plan for your stock options and your company’s IPO is happening soon (or happened recently), I’d be happy to meet with you to figure out if our financial planning services are a good fit.