On Your Way To Wealth

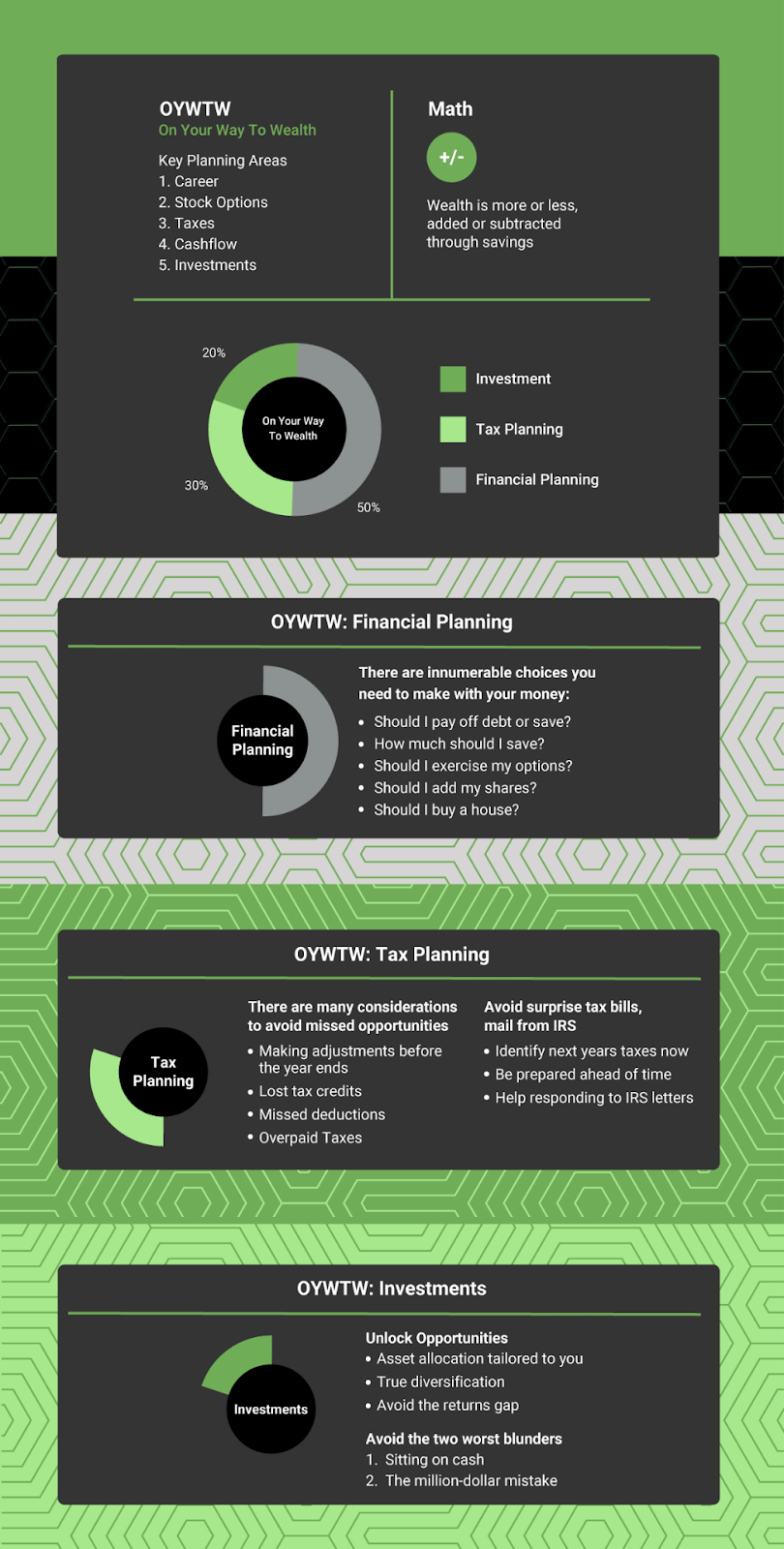

On Your Way to Wealth is designed to celebrate your progress towards financial independence and help you navigate the complexities of building wealth.

On Your Way to Wealth is perfect for busy professionals who are early in their careers, dealing with stock options for the first time, or have less than two million dollars in their investment portfolio.

Whether you’re looking to buy a house, maximize your 401k contributions, handle increasing tax bills, or start a family, we’ve got you covered.

We’ve built On Your Way to Wealth around three proactive touch points that occur every year: your tax return, a plan update with a tax projection, and an annual meeting. During these touch points, we’ll review the progress you’ve made so far and discuss the things that are on your mind as you look ahead to the next year.

And the best part? You’ll have unlimited support. Whenever a question pops up or something unexpected happens, just shoot us an email and we’ll be there to plan with you in real-time and provide the answers you need.

Get started on your financial independence.

Schedule a call with one of our experts.