One of the top questions we receive.

How am I doing?

There are many specific ways to ask this, but it usually boils down to this basic question.

- You want to know how you are doing?

- How is your financial plan?

- Where are you relative to your age?

- Where are you compared to your coworkers?

Unlike college, with exams and GPA, your financial plan has no easy comparison.

The comparisons we often resort to are not helpful.

We usually look up. We compare ourselves to others who we assume have more money and make more money than we do.

This isn’t helpful.

Measuring Progress for Busy Professionals

What is helpful? How do you measure your progress?

First, remember to run your own race. The focus of your financial plan should be on you. Your life, your goals, your money.

There is no beneficial comparison to someone else. It does not help.

Still the numbers tell a story. You can measure progress. There are mile markers along the way.

Mile Markers of Wealth

We will look at three mile markers of wealth. With each, we will examine:

- What you should focus on?

- What you need to change?

- What you must do differently?

- How rare each mile marker is?

- How long will it take you to get there?

Amanda, Tech Employee

We will use the example of Amanda to model progress across the four mile markers of wealth. Amanda:

- works in tech

- is 28 years old

- makes $150,000 per year

- has $84,000 in annual living expenses

- has a net worth of $0

We assume Amanda’s income will go up by 6% per year and her expenses increase by 3% per year.

The Three Mile Markers of Wealth

The four mile markers of wealth are:

- Positive Net Worth

- Net Worth Greater than Annual Income

- Net Worth 10x Annual Income

1. Positive Net Worth

Your net worth statement may not be pretty after college. Sometimes getting to a positive net worth is a challenge.

There are student loans to pay off. Plus, living in a big city, like San Francisco or Nashville, is expensive. Your first couple of jobs didn’t exactly pay well.

Somewhere along the way, you reached your first tipping point. The contributions you made to your 401(k) helped. Plus, the declining balance on your student loans and credit cards get you there.

Net Worth = $0

Even zero dollars net worth is not negative. It is positive. It’s not a lot of money (actually no money), but it marks the first tipping point.

This is where Amanda is.

At age 28, Amanda has a net worth of $0.

According to the Center for Economic Policy & Research about half of Americans age 18-34 have a positive net worth.

The focus at this stage is on your career. Your ability to earn more money determines where you go from here

Avoid debt. Freeze and eliminate your credit card balances. You should only use debt that increases income or assets. A mortgage and loans for graduate school are two examples.

Save, Save, Save.

Save 50% of every raise. Start with your 401(k). Once you max out, automate saving and investing outside your 401(k). You can do this through splitting your direct deposit or automating transfers.

Don’t worry too much about investing. Simple target date funds or asset allocation funds will do. Your focus here is on accumulating assets through saving.

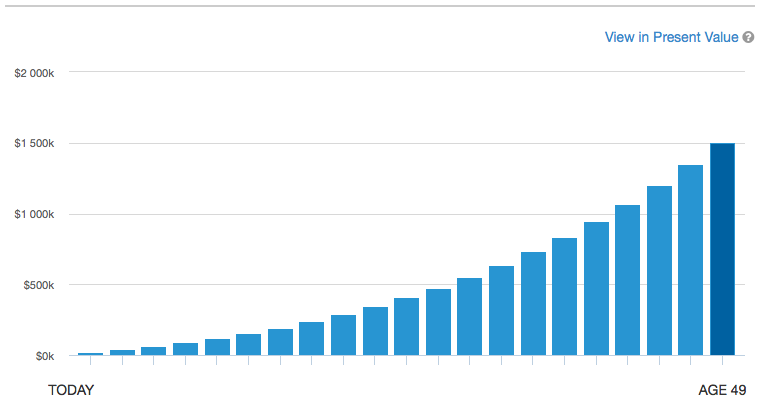

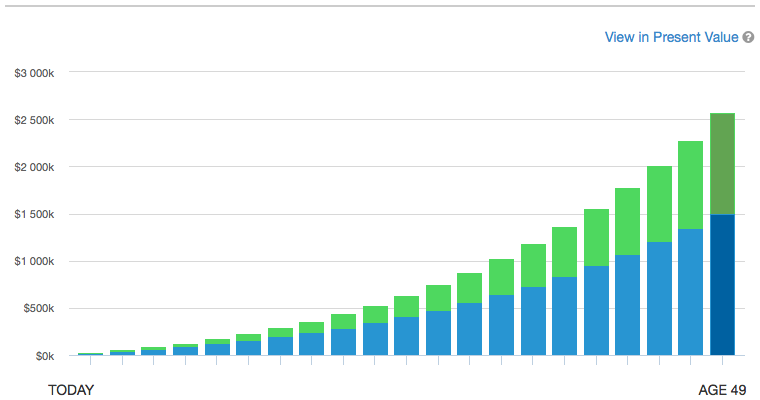

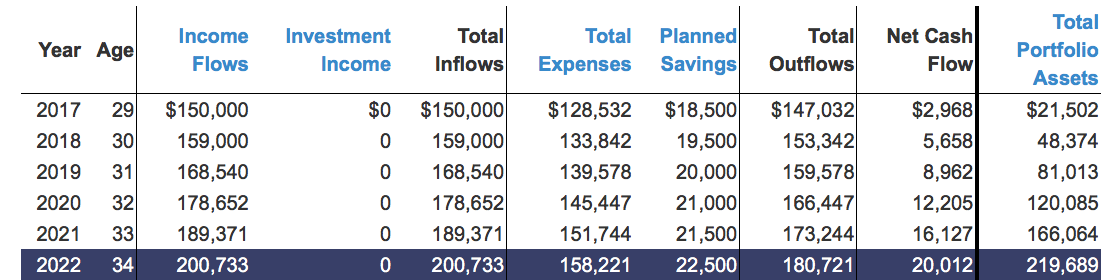

Amanda’s progress from $0 to $$

Amanda arrives at a $0 net worth with the ability to save 10% of her annual income. She starts saving 50% of every raise.

This alone adds up over time.

Amanda avoids accumulating this saving as cash by contributing to her 401(k). The 401(k) contributions go into the default target date investment.

Amanda is well on her way.

2. Net Worth > Income

The second mile marker is the point at which your net worth becomes greater than your income.

It is impossible to quantify how rare or common this stage is. I expect less than 25% of Americans age 18 to 34 reach this stage. The percentage increases with age but is likely a minority percentage regardless of age.

Develop a Wealth Mindset

Change the way you think about money. Think more about assets and less about income. Your financial plan starts to become bigger than your paycheck.

Consider expenses based on lifetime costs and value. Don’t be cheap.

Buy and accumulate assets. Start thinking about buying your first real estate.

Develop a tax plan that extends beyond this year.

Go Beyond Your 401(k)

As you save 50% of your raises, you will max out your 401(k). Don’t stop there. Open a taxable, investment account.

Direct your extra savings into this taxable account. Automate the investing process. Do not accumulate large amounts of cash.

How Long Will It Take?

With the changes she made at $0 net worth, it should take Amanda six years.

We often see clients take ten years to reach this stage. Not because they fail to put in place the steps described here. But, because their income and net worth start to hop scotch.

- Year One – income $200,000; net worth $201,000

- Year Two – income $225,000; net worth $219,000

- Year Three – income $225,000; net worth $230,000

- Year Four – income $300,000; net worth $284,000

You may bounce around this mile marker for a few years. Your income starts to slow and your savings catch up at some point.

3. Net Worth 10x Income

There’s no need to ask, question, or doubt. You are wealthy if your net worth is ten times your annual income.

The focus at this point is on the third component of total wealth, surplus. What you do with the investments you have is more important than the income you earn.

Your financial plan extends way beyond your paycheck. You have true wealth and flexibility.

What If I …?

Our clients start to ask big questions as they explore the possibilities of their wealth:

- What if I pay for my kids to go to Harvard?

- What if I take a job earning half of what I make now?

- What if I take off twelve months to travel?

The questions all probe at the idea of, “How far will my money go?”

How long will the money last?

Depends on your expenses.

It’s not uncommon to look at scenarios where the money lasts 20 to 30 years with no income at current expenses.

Most people do not stop working. You will continue earning an income. The changes you make to your life will be incremental.

Recognize that you are wealthy. It will be hard for you to use the money in your lifetime without self-destructive behaviors.

What legacy can your wealth create? What larger purpose should the money serve?

This Mile Marker is Very Rare

Like Net Worth > Income, there is no way to measure the prevalence of this level of wealth.

It is very rare.

How long will it take?

Amanda is on track to reach this mile marker at age 59. A total of 31 years.

The truth is most people do not get here by saving.

Most of the clients we work with will experience some type of sudden wealth event to reach this level.

Want to learn more?

Start by considering ways to design a financial plan that can get you to 10x your income:

Realize the Possibilities

The one thing you need to change at this level is to realize the possibilities. You are wealthy. Your financial plan is no longer focused on saving a percentage of every pay check.

Act like it.

Forget about retirement. Expand your time frame. Focus on a lifetime of wealth. Wealth that will outlive you. Wealth that could last for generations.

Start to think about your money and wealth as separate from you. View it like a business. The wealth is a separate entity that requires careful management.

Adopt a CEO mindset.

Personal growth, learning how to be wealthy, becomes important. Assimilate your old habits and norms with new wealth habits and norms.

Realize that what got you here won’t get you there. Continue to grow and develop your ability to manage larger levels of wealth. Think about what purpose the money should serve. What does having this wealth mean for you? For your family?

Assemble Your Wealth Management Team

Every great business starts with just a few people and a idea. Then, to continue growing, the business needs more people.

Wealth that exceeds 10x your income requires a team. Your wealth management team may include:

- Financial Planner

- Investment Advisor

- Attorney

- Certified Public Accountant

- Loan Officer

- Insurance Agent

- Realtor

Hire the right people. Leverage their knowledge and experience to speed your progress.

Start Here to Measure Your Financial Progress

Start here to determine where you are now and what your next mile marker is. Do these five things now:

1. Focus on Personal Growth

No matter where you are, you are always the most important piece in your financial plan.

Our experience shows that clients who successfully accumulate and manage higher levels of wealth:

- Take a proactive approach to life

- Increase their knowledge in key areas related to wealth

- Develop new ways to think about money

- Adopt new financial behaviors

- Work with skilled professionals

- Focus their time and efforts on the things they do best

Avoid destructive thoughts and behaviors. Break out of limiting ideas and mindsets. Assimilate new ideas into your money personality.

2. Know Your Net Worth

Know what your net worth is. Net worth is the key financial number. Get in the habit of knowing your net worth and monitoring it.

What is my net worth?

Net worth is best explained with a math equation:

Net Worth = Assets – Liabilities

- Assets – All the things you own that you can sell or exchange for cash. Bank accounts, 401(k), investment accounts, car, house, etc.

- Liabilities – All the things you owe. Student loans, mortgage, car loan, credit cards, etc.

I like this simple way to think about net worth. Let’s say we close all your accounts and pile the cash on a table. Then we pay off everyone you owe money to.

How much cash remains on the table? That is your net worth.

Use Tools to Track Your Net Worth

Technology makes it easy to pay close attention to your net worth. There are a lot of free tools available.

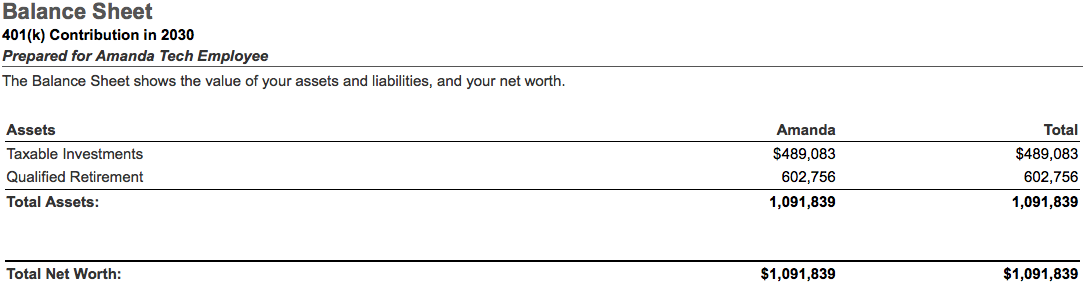

Our clients use our own Way2Wealth website. Way2Wealth lets you link all your accounts and loans in one place. It then monitors your net worth every day.

Way2Wealth also generates a balance sheet report showing the details of your net worth

3. Compare Your Net Worth to Your Income

Identify where you are.

- Do you have a positive net worth?

- Is your net worth greater than your annual income?

- Is your net worth 10x your annual income?

Develop a strategy and a financial plan based on where you are. Identify your key areas of focus.

Make sure your financial plan is yours. Do not run another person’s race. Run your own.

4. Manage the Transitions

Transitions mean change. Change is hard.

Knowing where you are, you can plan for the transitions. Plan ahead to know how your strategy will change as you:

- Achieve a positive net worth

- Move your net worth past your annual income

- Break through to true wealth with a net worth 10x your income

Remember the approach that got you to where you are is not the same approach to get you to the next level.

5. Hire an Advisor

Know where you are and identify the right advisor for you.

- Positive Net Worth – Get answers to your questions. Meet annually to update your plan and check your progress.

- Net Worth Greater than Income – Consider adding investment management if saving lots of money outside your 401(k).

- Net Worth 10x Income – Delegate a lot of your financial planning and investment management work to an advisor. Use your advisor to coordinate your team of professionals.

Get Started Today

Know where you are and move forward. You can start by scheduling a call today.