Most people are pretty giddy when they get their first job with a stock options package.

After all… what is there to not be excited about?

If you’re confident in your company and your teammates’ abilities to do their jobs well, it’s a built-in opportunity to grow your wealth that doesn’t require a massive sacrifice, investment, or a long-term savings plan: you just show up and do your best.

But there’s another layer of a stock options package that some employers offer, and it’s what I want to talk about today:

Employee stock purchase plans. (Also called ESPPs, in shorthand.)

And how does an ESPP work?

What makes ESPPs different from typical stock option plans?

To help you understand this difference, many find it helpful to look at it this way:

Stock options are often considered a form of compensation; something you earn in exchange for doing your job.

ESPPs, on the other hand, are something entirely different.

They’re not a stock option plan; they’re a benefit to use alongside a stock option plan, if you have one.

Most often, under an ESPP, your employer will make post-tax deductions for you from your paycheck, in the amounts you choose, to accumulate purchases of the company stock.

Two Types of Employee Stock Purchase Plans

While I’m all for using an ESPP if you have one, it’s crucial to know which type of ESPP your company offers, because they can be taxed very differently, and therefore require a different approach to planning.

More than likely, your ESPP will fall into one of these two categories:

- A qualified section 423 plan

- A non-qualified plan

Qualified Section 423 Employee Stock Purchase Plans

Under these plans, you can purchase company stock at a discount without having to pay taxes on the discount. It’s treated as a non-taxable item.

Non-Qualified Employee Stock Purchase Plans

Here, the discount between the fair market value and what you pay for your shares is taxable, and it’s taxed at your ordinary income rate.

For qualified section 423 plans, the benefits are both the automation of accumulating money to purchase shares, and the tax benefits.

For non-qualified plans, the benefit is simply the service of having your money deducted from your paycheck and the stock purchased on your behalf.

Know Your Offering Period & Plan Limitations

If there’s one thing accountants know, it’s that details matter. If certain details are off in a financial plan, especially numbers or date-specific details, it can throw everyone for a costly loop.

Since we want you to get as much as possible out of your ESPP, knowing your offering period and your plan limitations is crucial before you decide which steps you’ll take, or how much money you’ll contribute.

Situations vary between employers, but here are some rules of thumb to keep in mind as you think about your ESPP:

The Offering Period

- The offering period is measured from the time you start your payroll deductions to accumulate cash and use that cash to buy shares. An offering period could last 24 months, for example.

- Most plans run six month purchase periods within the offering period. At the end of each purchase period, you use the money you’ve accumulated within those six months to purchase stocks.

Contribution Amounts

- Most plans will allow you to contribute anywhere from 1% to 15% of your paycheck.

- Section 423 plans are limited to no more than $25,000 worth of stock purchases each calendar year.

Company Discount

- The largest discount allowed by the IRS for ESPPs is 15%, but your company’s discount percentage may be smaller.

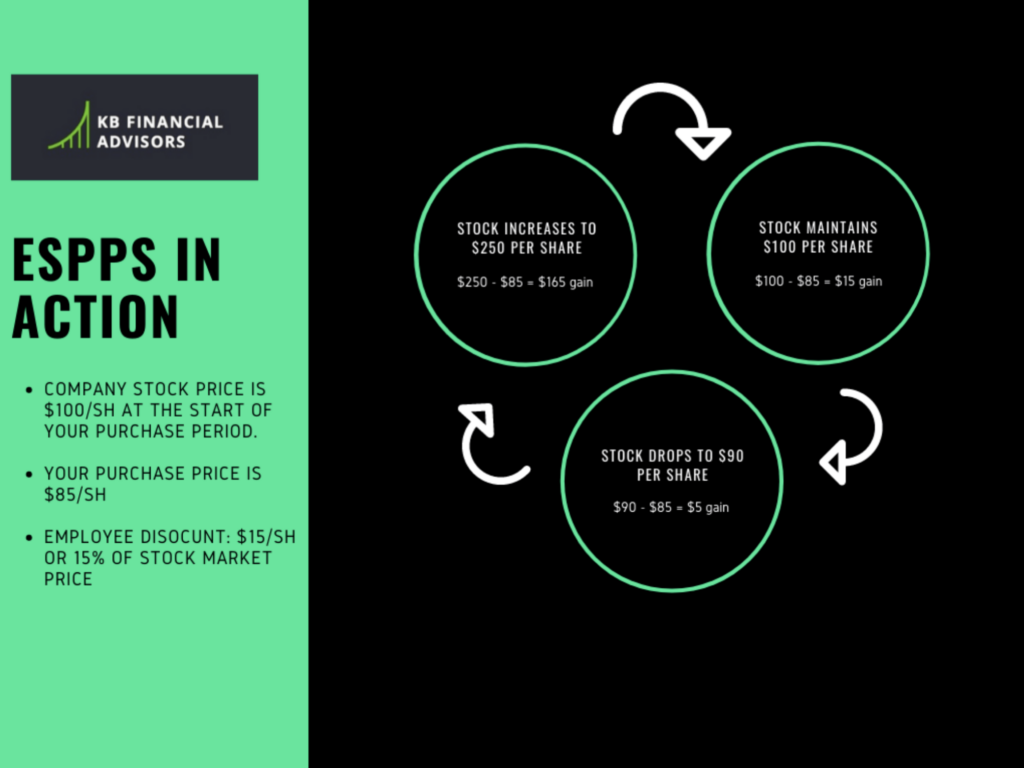

- The discount is given on the market price of the stock either at the beginning or the end of the purchase period, whichever is lower. See the image below to see this discount in action.

ESPPs: Always a Benefit

Because ESPPs guarantee you a percentage-based discount on the market price, you automatically start off in a beneficial position with a built-in gain.

But, when you get the help of a financial team that has deep-rooted expertise in stock option benefits and taxes, you can come up with the best strategies to get the most out of that benefit as possible. (Not to mention, coming up with a strategy to sell the stock options after you purchase them… making those financial gains a reality in your bank account.)

Reminder: Keep Track Your Transactions for Taxes! ⚠️

Because the two types of ESPPs are so different in how they handle taxes, keeping track of what you do, when, and the exact amounts is crucial.

Your employer and brokerage house will probably keep some records for you, but needing an adjustment to what they report is not an uncommon occurrence… and we don’t want you to have to pay more taxes than you owe, or to get a scary letter from the IRS in the middle of your summer vacation because you didn’t pay enough. ????

That, and the amount of time you hold your shares before you sell them is important. (If you hold for less than a year, your gains are taxed at the ordinary income rate, but if you hold for more than a year, they’re taxed at a lower rate for long-term capital gains.)

Using the previous example as a basis:

$100.00 per share = Company price of stock at time of purchase

$85 per share = Employee purchase cost

$15 per share = Discount

$275 per share = Gross proceeds upon sale

- Nonqualified plan taxable gain: $275 less ($85 + $15) = $175 gain per share

- Section 423 plan taxable gain: $275 less $85 = $190 gain per share

As you can see, the amount you’re taxed on depends on the type of ESPP you’re enrolled in, and the taxation rate is also important, and depends on *when* your buying and selling happened. (If you sell more than a year after the purchase, you qualify for lower tax rates on long-term capital gains.)

Needless to say… it’s a great move to work with a financial and tax professional in situations like these. (And you can talk to our team about doing so by booking a call here.)