It’s all over the news, and it’s natural to start worrying about:

Inflation.

Inflation, inflation, inflation. ????????

We’re seeing it at the grocery stores and in the prices of most consumer goods: they’re more expensive now than they were a year ago. It’s impossible to ignore. And many people are starting to wonder what the impact of inflation on the stock market will be, and how well their financial portfolios will survive it.

Where did all this inflation news come from?

Back in August/September 2021, the federal reserve recognized that inflation was higher than they wanted it to be, and higher than they thought it would be at that point in the year… but they felt it was a temporary issue related to Covid.

In March 2020, after all, we basically shut down the entire US economy for a period of weeks, and we’re still dealing with the fallout from that, especially in the supply chain. When you stop producing goods, pent-up demand grows and grows.

So, when the reopening happened, we worked through the supply of goods we had on hand, and then six months to a year later, we started dealing with the gap in production where we weren’t producing goods in the early part of 2020.

So, it’s only natural to expect that the price of less available items would go up. (It’s the basics of supply and demand, after all.)

Why is inflation sticking around?

At first, the federal reserve thought this inflation issue would be temporary, and that we would “move through” the gap in production, and get back to life as usual.

They predicted in the early fall of 2021 that the inflation would resolve itself by 2022… but now it’s early 2022 and they’re changing their tune.

In December, we found out that inflation had risen at the highest rate since 1982, which is the highest in many of our working lifetimes. Meaning you and I have never dealt with inflation like this as an adult. (A lot of us don’t even remember 1982, if we were even born then… it’s been 40 years, after all!)

In short, you and I are dealing with inflation in a way that we’ve never dealt with it before.

At the Federal Reserve meeting in December, they decided they would taper their bond purchases… because they’d started buying bonds as a way to lower interest rates in response to Covid in 2020.

They also said that they expected to raise the Federal Reserve rate in 2022 THREE times… so as we start 2022, we’re dealing with something that the vast majority of our clients have never dealt with before in their working life, so it’s naturally a cause for concern.

Three Important Things to Know About Inflation

Before we dive into what inflation will mean for your stock option plan, there are three things you need to be familiar with:

1) The Consumer Price Index

Any time you hear about inflation, know that the consumer price index is how we measure it. (Here’s a Wikipedia article on how it’s calculated.) When we talk about inflation, it’s in regards to how the consumer price index has changed over the last year. If we look at it in February 2022, for example, we compare it with February 2021.

One of the most important things to know about inflation, though, is the market basket.

The market basket, essentially, is the different goods and services used to measure the change in prices over time… it includes things like food, beverages, housing, utilities, clothing, transportation, etc. (If you’ve tried to buy a car this year, for example, you know they’re a lot more expensive than they were a year ago.)

One caveat here, though, is that inflation is a natural thing for a good, healthy economy. One of the things the Federal Reserve does, for example, is monitor and target inflation. The target they aim for is 2%… so each year, they’d like the market basket prices to increase by 2%.

2) The Federal Funds Rate

The Federal Reserve Bank sets the interest rates that banks use when they’re lending and borrowing between each other.

It’s something most people never think about, but every day, your bank has excess deposits, which is money sitting in the bank that they’re not using. So, in the course of doing business, they periodically lend those funds out to other banks, or borrow those funds from other banks.

The Federal Reserve controls the interest rates these banks pay each other, and how they set that rate affects the rates consumers pay when we borrow money. (Like mortgage, car loan, and credit card rates.)

If inflation persists, then the number one tool the Federal Reserve has to control that inflation is to raise the Federal Funds Rate. They’ll make it more expensive to borrow money, and by doing so, limit the amount of money being borrowed… therefore keeping a cap on inflation. (It’s like putting a lid on top of a pot of boiling water to keep it from boiling over.)

3) How the Consumer Price Index & the Federal Funds Rate Work Together

If inflation goes up, interest rates will start to go up after that happens.

Here are two charts from Macrotrends that show the historical inflation rate by year, and the history of the federal funds rate:

If you check them out, you’ll see a correlation between consumer pricing going up and the federal funds rate going up.

What’s the relationship between the stock market and inflation?

Well… there is one and there isn’t one.

This question usually comes from the fear that if inflation goes through the roof, the stock market will crash: people will get fearful, be very conservative with their money, and they’ll pull out of the stock market.

It’s not that simple.

For one, yes, inflation is part of the information set included in stock market prices. Buyers and sellers, after all, are taking actions based on what they think they know about the future, so inflation would have an impact on that.

But, no, over the long term, especially when you look from year to year, there’s an inconsistent relationship between rising inflation and poor stock market performance, meaning you can’t exactly predict what’s going to happen.

Here’s an article from Dimensional Fund Advisors that looks at historic periods of high inflation and how the stock market performed during those periods.

(Disclaimer: Dimensional Fund Advisors are who we recommend to our wealth management clients, because we believe they’re the best investment vehicles for our clients.)

Is inflation here to stay?

No one really knows, to be honest… especially when it comes to investing.

When I take my clients back to what was going on in December 2019, it can feel like we’ve lived two decades in the last two years.

But when we stop and go back to December 2019, if we had been told then we would soon experience a global pandemic, that the stock market would crash in March 2020, that we wouldn’t be able to go to the office for two years, and that you’d have to socially distance from your friends and family… we would have thought it was crazy.

In March 2020, we thought it would be “two weeks to stop the surge,” but when people started saying we might not go back into the office until June… that felt like absolute insanity.

The deadline kept getting pushed back, and here we are, two years later, living in a totally different world.

No one can predict the future, and no one knows whether this inflation is here to stay, but what we do know is inflation IS something you should be prepared for, especially in your financial plan.

In this interview with Nobel laureate Eugene Fama of Dimensional Fund Advisors, he said:

“Historically what’s happened is, when there’s a spike, the spike persists for a long time. Inflation tends to be highly persistent once you get it. Once it goes down, it tends to be highly persistent on the downside. You’ve got to be prepared for that. Predicting next month’s inflation may not be very hard because this month’s inflation can be a pretty good predictor of next month’s inflation, or next quarter’s inflation, or even the next six months’ inflation. Persistence is a characteristic of inflation.”

Based on this, you can see that inflation isn’t like the stock market where it’ll go up and down drastically multiple times in one year… it tends to follow the path it’s on, and it moves slower than the stock market.

So, there will be times when inflation goes high and stays high for a long, long time… and we need to be prepared for it. Most of us have been fortunate that inflation has been fairly low during our lifetimes, so we’ll have to wait and see if this current spike is here to stay.

How should you prepare your financial plan for inflation?

The fact of the matter is, whether it happens this year, five years from now, or ten years from now, a rise in inflation will happen: it’s just the course of history.

Having a financial plan in place that’s hedged against inflation will make sure you’re prepared when it does happen, whether this current spike is it or not.

Step One: Financial Plan

The first place to protect against high, unexpected inflation is your general financial plan. (Which is your basic spending, and not anything “extra” like your stock option plan.)

First, make sure you’ve got a plan to pay off your debt, especially any debt with high or variable interest rates.

Managing debt is crucial to building wealth, and if you have high or varying interest rates, you’re leaving yourself extremely exposed… if the federal funds rate goes up three times in the next year, for example, the rates you pay on those loans will eventually go up.

Second, changing your spending habits is a great way to hedge against inflation. It means getting good at operating a budget.

Since most of our clients are highly-paid professionals, I encourage them to think about their life and career as a small business.

If a small business has $500,000 to $1 million in annual revenue, and they don’t keep their books, you’d naturally know that’s not a smart way to operate a business.

But, a lot of highly-paid professionals don’t keep their books. One of the toughest questions for my new clients to answer is what their monthly expenses are, and the number they give me is only based on rent + utilities + loan payments. They often have no idea what they spend on things like food, clothing, and travel.

My favorite budgeting tool is YNAB, which stands for, “you need a budget.” It will show you exactly what your expenses are, and help you quantify the impact inflation is having on your finances.

I’ve personally been using YNAB for about seven years, and I can take a category like clothing and tell you exactly how much I spent on it in 2021, 2020, 2019, etc… so I can see the impact inflation is having on my family, and make better-informed spending decisions to limit the impact of inflation.

If you’d like a financial planner to help you identify and manage spending adjustments you might need to make, book a call here to see if working with KB Financial Advisors would be a good fit.

Step Two: Stock Option Plan

After getting your financial plan on solid footing, you want to prepare your stock option plan against inflation.

When doing this, the first thing to recognize is that your stock price is more important than taxes. It’s the number one mistake I see clients making, and it’s because stock price is unpredictable (it changes daily), but tax rules are fixed and easy-ish to predict.

We all default to what we think we can understand and control, so since taxes are the “fixed” thing we can rely on, we use that to plan how we’ll use our stock options, rather than the unpredictable nature of stock price.

When you engineer your stock option plan around taxes, you run the risk of making taxes the top priority, when really, they’re just a bump in the road, and not something to plan your long-term finances around. There’s a difference between being tax-aware and tax-scared.

The first thing to do, then, is to set a target price you’d like to sell at. It’s not based on analyses or formulas, it’s just a simple statement of, “If I could sell my stock at $___, I’d be really happy.”

As your advisor, when you get to that price, I’d encourage you to start selling.

The risk you run is that when the stock starts going up and you get to that price, you think it would be better to “wait and see” how high it goes… but when a stock price drops, it drops fast.

So often, I see clients who blow past their target price, don’t sell, and regret it. Below are three examples from this past year that we’ve helped clients through:

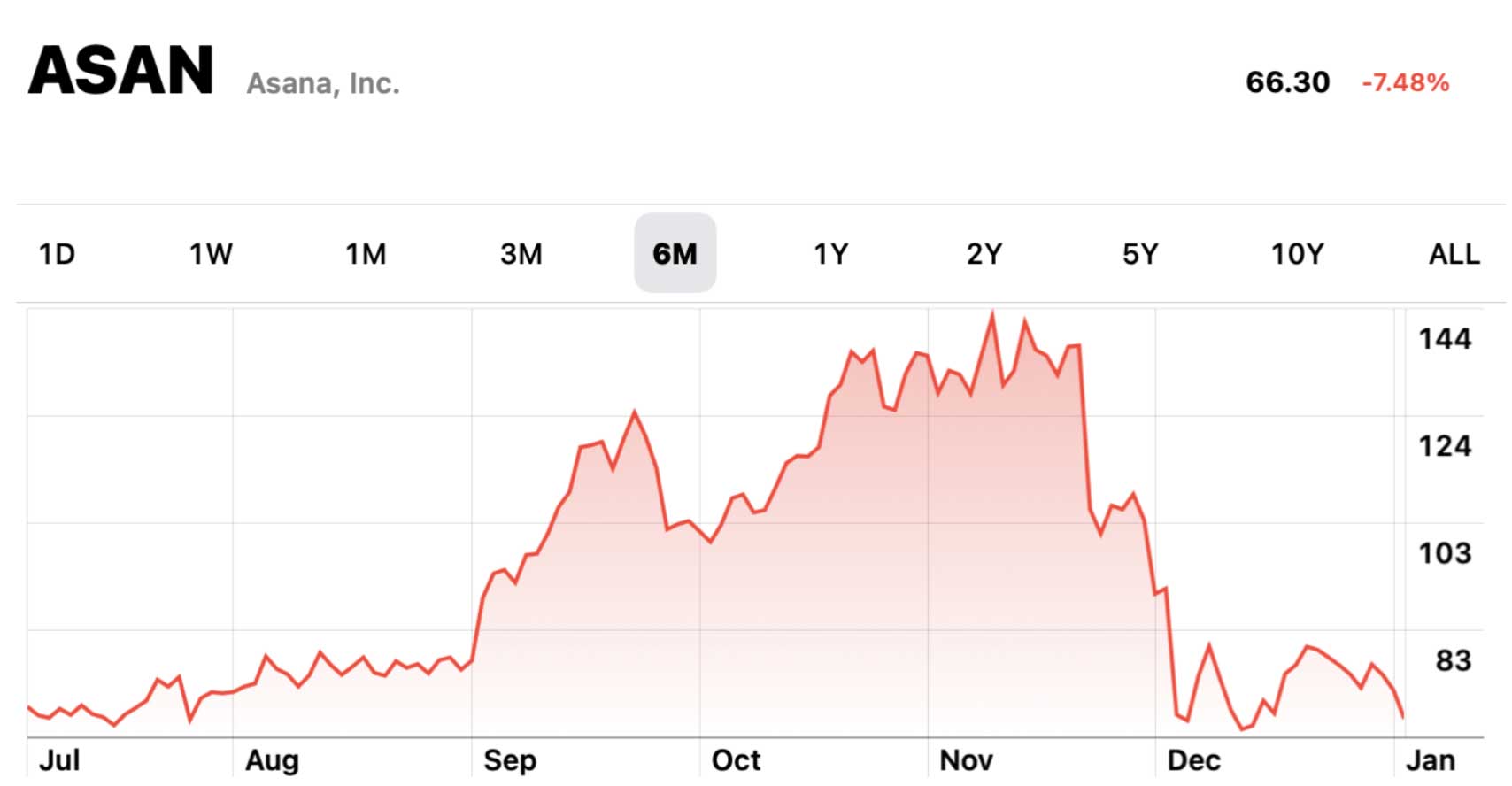

Through October and November 2021, Asana got up to $140+ per share. At the time of writing on January 4, 2022, it’s trading at only $66 per share.

[et_pb_image src=”https://kbfinancialadvisors.com/wp-content/uploads/2022/02/inflation-post-docusign.jpg” title_text=”inflation-post-docusign” _builder_version=”4.14.7″ _module_preset=”default” global_colors_info=”{}”][/et_pb_image]

Docusign got all the way up to $300+ per share, but now it’s at $150 per share. It dropped 40% in a single day. (Can you imagine what a nightmare that would be for someone who was “holding out” for a little higher price just because it was doing well?)

[et_pb_image src=”https://kbfinancialadvisors.com/wp-content/uploads/2022/02/inflation-post-peloton.jpg” title_text=”inflation-post-peloton” _builder_version=”4.14.7″ _module_preset=”default” global_colors_info=”{}”][/et_pb_image]

Before a popular TV show character died on a Peleton bike, it was trading at ~$100 per share. After that, there was a huge one-day drop, and it’s currently trading at only $33 per share.

This is why target price is so important: more than worrying about inflation or taxes. Once your portfolio gets past a certain point, we will plan for taxes, but since selling your shares is an investment decision, deciding (and acting) on a target price is crucial.

To make sure your target price stays realistic, you can monitor it and adjust it quarterly, so by the time you get to your open trading windows, you have a properly re-evaluated plan, and you’re confident in how (and if) you’re going to act during that window.

Ideally, you’ll have quarterly check-ins with your financial advisor set up around your trading windows, so you have your plan, you know your target price, and then within each trading window, you can adjust. If you’re above your target price, you’ll sell some, and after you’ve sold, it’s okay to adjust your target price to a higher number.

What you don’t want is for your price to go down and let yourself freeze up as a result. Holding your shares for two years or more, if that wasn’t part of your original plan, is a bad move.

Step Three: Investment Plan

After your financial plan and stock option plan are hedged against inflation, the next step is to look at your investment plan.

One of the best protections against inflation is a 30-year fixed-rate mortgage. It’s something no one thinks about, and it’s not one of those popular pieces of advice you’ll find in trending online, but it is so important.

Below is a chart from Macrotrends showing 30-year fixed rate mortgages going all the way back to almost 1970. This is really cool to look at, because my parents’ first mortgage was in the early 80s, and at that time they got a 10% interest rate as part of a federal first-time home buyer program, and they were sooo excited to have a rate that low. The interest rates at that time were between 16% and 19%.

[et_pb_image src=”https://kbfinancialadvisors.com/wp-content/uploads/2022/02/inflation-post-parents-me.jpg” title_text=”inflation-post-parents-me” _builder_version=”4.14.7″ _module_preset=”default” global_colors_info=”{}” alt=”impact of inflation on stock market”][/et_pb_image]

Fast-forward about 30 years to me buying my first house in 2008, right before the market crash (perfect timing, lol), and even then, the interest rate on my mortgage was only 6.5%, and I was pumped. I got a special program from the bank where I had no closing costs, no appraisal fees, and thought it was awesome to only pay 6.5%.

Today, those same 30-year fixed mortgage rates are at 3.11%.

If we assume that this inflation is here to stay, over the next 15-20 years, the 30-year fixed-rate mortgages will go from 3% to 6% to 12%. Imagine how good you’ll feel when everyone else trying to buy a house is dealing with 6% to 12% interest rates, and you’re still paying 3% on yours. It’s incredible, and boggles the mind that banks even offer such low rates. (But, the reason they’re willing to do it is because most people don’t stay in their homes for that long, so they know that even if they give you a 30-year mortgage, the bank will probably only have it on the books for 5-7 years before you refinance or move. But if inflation kicks in and you stay in your house, that fixed mortgage rate is incredibly cheap compared to what a new mortgage would cost in a high-inflation economy.)

Inflation Protected Securities

When most people think of protecting their financial plan and investments against inflation, this is what their mind jumps to.

The most common type are TIPS, or treasury inflation-protected securities. They’re bonds issued by the US government, where the principal value of that bond is indexed to inflation. (This article from Schwab is a great post with common FAQs about TIPS.)

As an example, though, let’s talk about a typical $10,000 bond paying 3%.

The principal on that bond is $10,000, which is what you pay if you’re buying it as a newly-issued bond. Then, over the life of the bond, you receive 3% annual interest, and when that bond matures, you get your $10,000 back. (This is how a typical bond works.)

With TIPS, you’ll still pay the principal to buy the bond, and you’ll still get the 3% interest rate, but what you receive in interest and what you get paid back when the bond matures vary based on inflation. They’re sort of like insurance against inflation, but there is a price to pay for that protection… if inflation is low and stays low, those TIPS will under-perform, similar to government bonds that aren’t indexed to inflation. But if unexpected inflation kicks in, those bonds will perform really well.

If you look up a Vanguard TIPS bond index fund, or a DFA inflation-protected securities fund, you’ll see that over the last couple of years, those funds have performed really well, because from March 2021 onwards, we’ve seen higher-than-expected inflation.

Being aware of how these funds work and could fit into your portfolio would be a great thing to talk to your financial advisor about.

How to Handle the Impact of Inflation on the Stock Market

As you can see, the impact of inflation on the stock market is not a simple subject… but it *is* something that can be hedged against with some smart, measured planning.

If you don’t have a financial plan you’re confident in yet, get in touch today for a discovery call, and we’ll be happy to walk you through how working with KB Financial Advisors can help you make sure you build solid wealth for your future.