We’re all seeing it:

It feels like every other week there’s another LinkedIn announcement of one company or another downsizing its workforce, especially in the tech industry.

Which means a lot of people have already had to switch their jobs this year, and because of the public nature of these layoffs, a lot more are thinking about it.

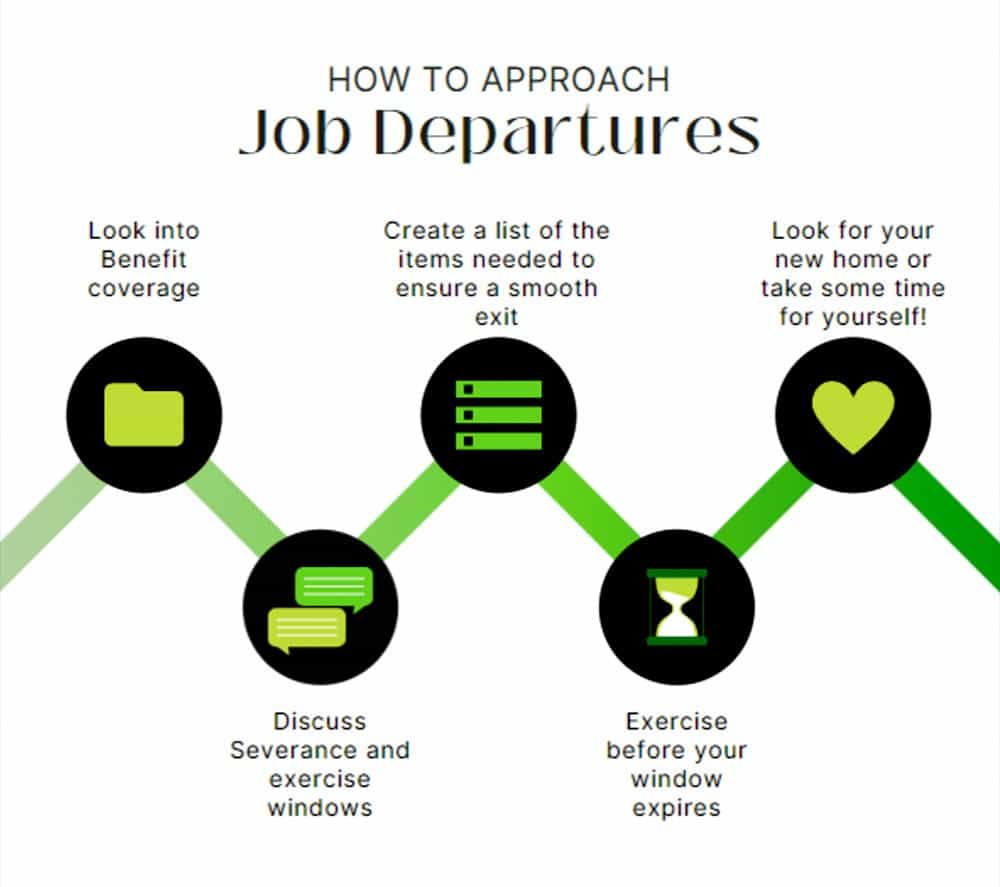

So whether you’re leaving your company because you’ve been laid off, you’re preemptively trying to get ahead of “budget cuts”, or you’re just tired of your old position and want a new one… here are your top 3 tax considerations to keep in mind when leaving.

1. Severance Pay

For the most part, severance pay will only apply to you if you’ve been laid off and aren’t leaving your company of your own volition. (So if this section doesn’t apply to you, feel free to scroll down to the next one.)

Normally, tech companies will at least give you some kind of exit payment, but there isn’t any set formula or government regulation for what you’ll get. We’ve seen all kinds of things:

- A flat percentage of your current salary

- A certain number of weeks of your current salary

- Your normal bonus amount

Keep in mind though, that just like your regular paychecks, you’ll have payroll taxes, social security, and medicare payments withheld.

Additionally, since severance pay isn’t salary, it’s considered “supplemental wages,” which is a fun tax hurdle to navigate. (I’m being sarcastic.)

For whatever reason, the US government and some states decided it would be a good idea to set holding limits on supplemental income. For example, the federal withholding limit on supplemental wages is 22%, but if you fall in a tax bracket higher than 22%, you’ll end up owing more to the government than gets withheld from that payment type.

So, once you’ve got that pay stub for your severance payment in your hands, touch base with your tax planner to make sure you’re avoiding any potential penalties and interest assessments. (And if you’ll need to pay extra, go ahead and allocate those funds for the job, so you don’t come up short later.)

2. Benefits Coverage

If you don’t have a new job lined up to jump into the next business day after leaving your company, you’ll at least need to make sure you have some kind of health insurance coverage… as well as any other type of benefits you need to keep yourself going while you land your new gig.

If you’re lucky, your old company may work with you to include a payment for a set number of months for your benefits after laying you off, or offer some discounted rates on insurance for employees while you search for a new job.

If you’ve hit your deductible, or need to consider other benefits like FSAs, HSAs, life insurance, or disability, set up some time to talk to your HR department about your options, and how they’ll be handled upon your exit.

Or, you could have to foot 100% of the bill for COBRA coverage. Yes, it’s expensive, but it is temporary, and with medical expenses being what they are, it’s almost always better to have some kind of coverage just in case something happens.

And then there’s the 401k. It’s pretty rare that a company will let you keep the money where it is, so you’ll want to rollover your balance to your new company’s 401k, move it to your IRA, or consider some other options. Each person’s situation is different here, so it’s always best to defer to your financial advisor for advice to make sure you’re making the right moves and getting the most out of your money.

3. Vested Stock Options

If you’ve got ISOs or NQSOs, you’ll need to make some really important time-based decisions.

You’ll have a small window, between 30-90 days depending on your stock plan agreement, to exercise any of your remaining options.

If you go past this time, you lose the ability to exercise your vested options; no exceptions.

It’s harsh, but it’s the reality of switching jobs.

If you have time to get a plan together before leaving, plan around cash flow on these exercises, as you’ll at least have to pay your strike price to exercise whatever options you have available.

You may also need to talk to your financial advisor to do some tax planning around withholding shortfalls and the alternative minimum tax (AMT), if it will apply to your exercise amount.

Sometimes, ISOs get converted to NQSOs during an exit, which moves your tax hit to a higher ordinary income bracket… which makes it even more important to be on your toes and communicating with your financial team at this time.

Leaving Your Company? Plan Ahead. (If You Can.)

To be clear, these “top 3” tax considerations doesn’t mean these are the ONLY three things you’ll need to consider from a tax perspective when you’re leaving a company.

And if you’re in the situation of having been laid off, I know thinking about all of this can feel incredibly stressful and overwhelming.

My suggestion?

Take a deep breath and take your time. You’ll be focusing on a major life decision soon, which is finding a new job.

If you receive a severance payment, continued benefits coverage, and option exercises, your cash flow might permit you to take some time off during this transition, which I think can be an incredibly healthy thing to do. (Life is short! Enjoy it!)

Even if you were blindsided by a layoff, try to see it as a gift to breathe deep, reorient your life to your true goals, and maybe even get into freelance work or a totally new career path if that’s something that excites you.

If you’d like some help talking through the tax and financial aspects of leaving your company, grab a time with one of our expert team members here.