In my last blog post, I talked about tax withholding.

And while withholding can feel heaven-sent for most people, especially those with set, predictable salaries, it doesn’t always work for everyone.

Particularly if you earn commissions, have irregular income, or are fully or partially self-employed, quarterly tax payments should (likely) be a part of your regular financial hygiene.

What is an estimated tax payment?

For most people filing taxes, it feels like we “pay taxes” once per year, when the books are closed and everything’s said and done.

However, it couldn’t be further from the truth.

The IRS doesn’t just want you to pay once per year… they want you to pay as you earn.

For those of us with a regular paycheck, that means that we’re actually “paying taxes” twice per month, or even weekly.

But if you have income that’s beyond your base salary, and you’ll have a tax balance of over $1,000 as a result, you’ll want to make estimated payments.

An estimated payment, essentially, is an additional payment of taxes to the IRS throughout the year so you can lower the balance owed on your tax return, and avoid underpayment penalties.

How do I calculate an estimated tax payment?

Knowing you need to make quarterly estimated payments is one thing… but knowing how much to write the check for to send to the IRS is another thing completely.

The IRS has two methods of calculating how much you need to pay to avoid underpayment:

- You must pay in at least 90% of the tax for your current year

-OR-

- You must pay in at least 110% of the tax shown on your prior year tax return

The nice thing about this is that you can choose whichever amount is less, and not have to deal with an underpayment penalty. These amount boundaries are known as your “safe harbors,” and as a frugal person myself, I’m all about choosing the lower of the two safe harbors.

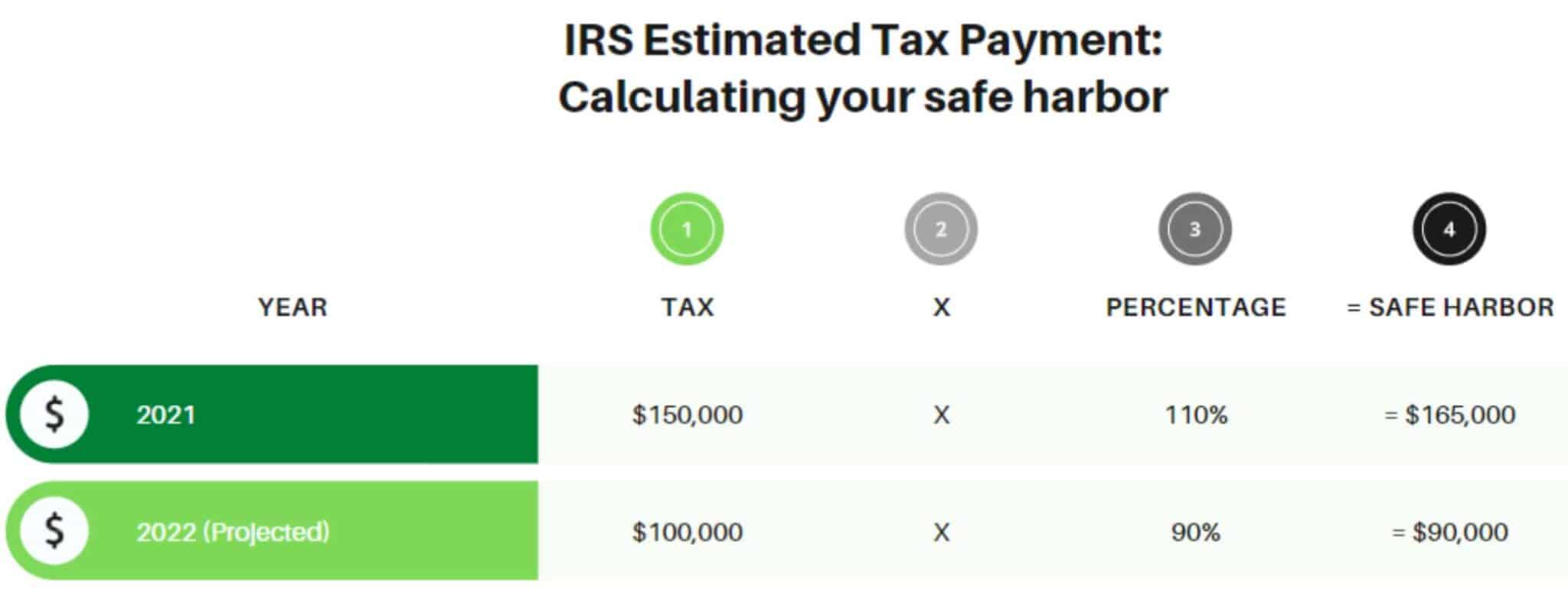

For example, if you had a $150,000 tax liability in 2021, but your only project a $100,000 liability for 2022, this is what you two safe harbors would look like:

If you’re thrifty like me, that $90,000 safe harbor looks a lot better than the $165,000 safe harbor. ????

If you work with your payroll department and realize you’ll have $89,500 of withholding from your paycheck, you actually won’t need to make estimated payments, since your balance would only be $500, not $1,000 or more. ($90,000 – $89,500 = $500)

But if you have a side income from freelancing or a side business that’s making up the $90,000 2022 projections, you might only have $50,000 in withholdings.

If that’s the case, you’ll still need to have $90,000 paid to the IRS by January 15th to avoid penalties and interest assessment.

Since the $90,000 safe harbor minus your $50,000 of withholding equals $40,000 extra, that’s how much you’ll need to pay in quarterly increments (or estimated payments) to the IRS so you don’t face penalties.

Since quarterly estimated payments have quarterly deadlines, that means you can divide that $40,000 by four and pay $10,000 each time.

I know cutting a $10,000 check to the IRS is no fun, but if you get to April and your balance owed is only $10,000 instead of $100,000 (remember, we’re projecting a $100,000 tax liability, which gives you a $90,000 safe harbor), that’s a much easier check to write.

What happens if I don’t make quarterly estimated tax payments? Or I forget?

Like I mentioned, the IRS essentially wants their cut of your money the instant you get paid.

If you get to April and haven’t paid them enough in the last calendar year, they’ll charge your both penalties and interest.

Once you miss the amount you were supposed to pay in each quarter, the IRS charges you 5% of the amount owed per month, up to a cap of 25%. This is called a “failure to pay proper estimated tax” penalty. To add insult to injury, they also charge interest at the established rate released. Presently, that interest rate is 6% – up from 3% just last year. Ouch. ????

So let’s go back to our example. Your current year liability is projected to be $100,000 – you selected the 90% safe harbor, meaning you need to pay in $90,000 throughout the year. You had $50,000 in withholdings.

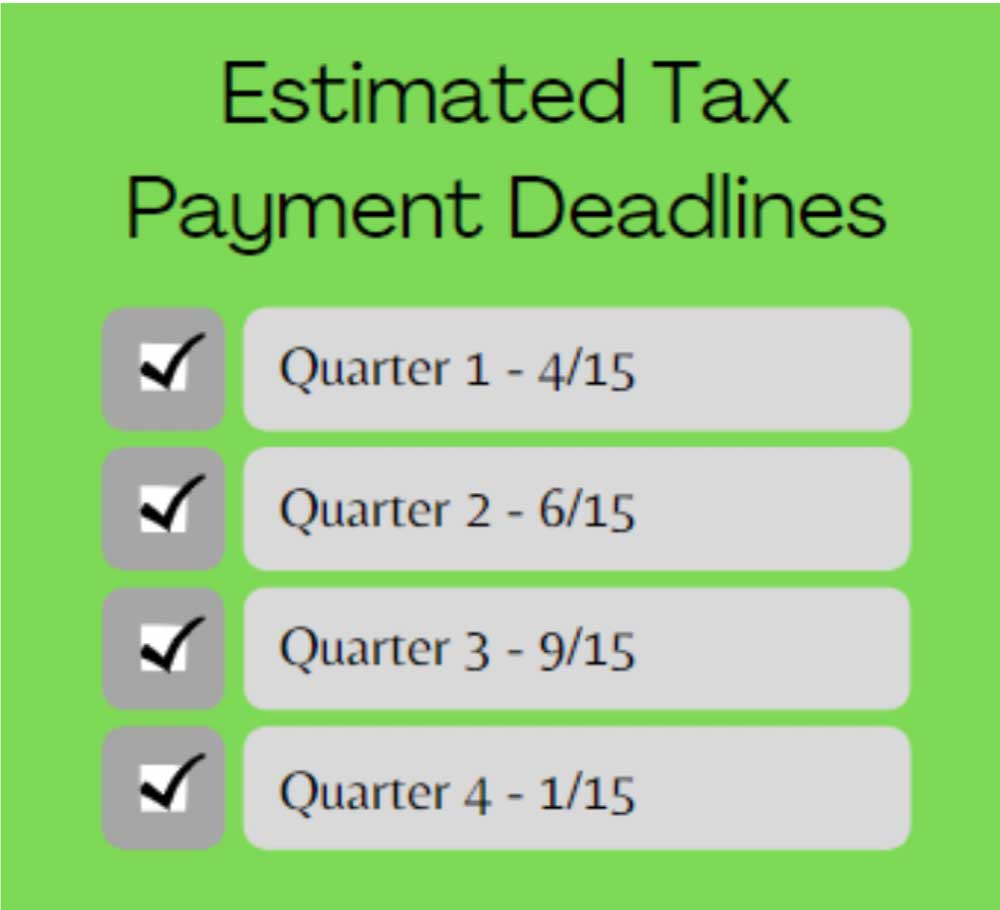

That would make your quarterly estimated tax payment deadlines as follows:

- $10,000 by 4/15/2022

- $10,000 by 6/15/2022

- $10,000 by 9/15/2022

- $10,000 by 1/15/2023

Let’s say you totally forgot to pay the first quarter, but caught up on June 15th with a $20,000 payment. Then, you forgot again until it was time to pay your taxes on April 15th, and had a $30,000 tax bill that you paid.

You’d have an underpayment penalty somewhere in the range of $340 plus interest for the outstanding penalties. It’s not fun to pay, but it’s also not the end of the world. (Of course, there’s so much you can do with $340, that we’d much rather you keep that cash in your pocket!)

Need help planning quarterly estimated tax payments?

Do you think you’ll need some help catching up on quarterly estimated tax payments… or at least making sure you’re within your safe harbor zone?

We’ve got you covered!

Book a discovery call here about our financial and tax planning services to see what we can do for you.