Let’s be clear:

The geo-political possibilities that could happen as a result of Russia invading Ukraine are horrifying, and the human price in lives lost and suffering is unbelievable. Over two million Ukrainians have already fled their own country, including one million children. On the other side of the conflict, the financial impacts the sanctions against Russia are having on everyday, working class citizens are not good.

At KB Financial Advisors, we are not geo-political experts, and we want to stay in our lane. (If you’re looking for more on the geo-political situation, I recommend the excellent reporting from The New York Times, The Wall Street Journal, and The Guardian.)

Beyond the human empathy factor, though, this situation is hitting home for a lot of our clients. Ukraine is a big hub for tech talent, and many of our clients’ companies are being affected by their Ukrainian employees fleeing for safety, taking time off to fight, and helping others.

Here are two great articles on how globalization in business and technology has made this an issue that directly impacts the tech sector:

- The Information: Tech Companies Race to Move Workers Out of Ukraine Hubs

- Wired: Ukraine’s Volunteer ‘IT Army’ Is Hacking in Uncharted Territory

A Timeline of the Ukrainian Invasion & Its Financial Impacts

In a quick recap:

- Thursday, February 24th, 2022: Russia invades Ukraine. This happened after Vladimir Putin repeatedly denied US intelligence reports that he was preparing to do so. (These reports went all the way back to last November.)

- For four days, the rest of the world scrambled to adapt to what was going on.

- Many countries began signaling they would put sanctions on Russia.

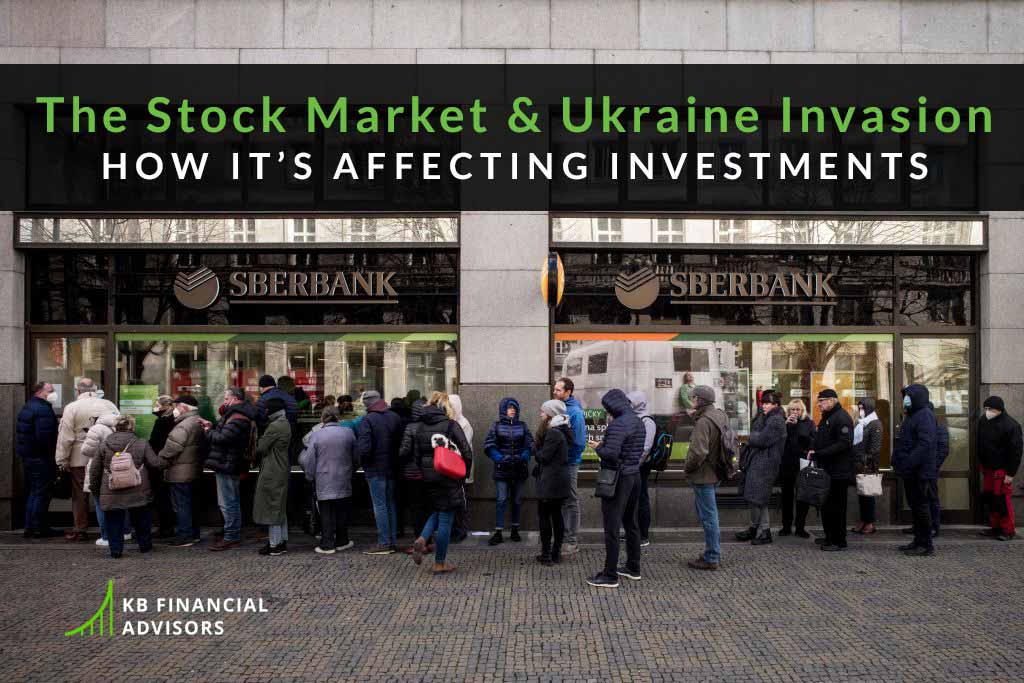

- Sunday, February 27, 2022: Long lines were reported at ATMs in Russia as Russians tried to exchange their Rubles for US Dollars.

- Monday, February 28th, 2022: The world (with a few exceptions, notably China), began a “maximum pressure” campaign of economic sanctions against Russia.

- In the past, this type of campaign has only been used against Syria, North Korea, Venezuela, and Cuba. This isn’t a list of countries Russia would’ve been grouped with since the end of the Cold War and dissolution of the Soviet Union in 1991, but that all changed with Russia’s decision to invade Ukraine.

As a result of the sanctions, when Russian banks reopened on the 28th, the Ruble crashed.

The exchange rate went up from 70-80 rubles per dollar to as high as 160-180 rubles per dollar.

Everything in Russia became 25% to 30% more expensive than it was the week prior. (To put this in perspective, just imagine that over one weekend, your company decided to only give you one paycheck per month instead of two.)

Long lines formed in Moscow subway stations because digital payment methods like PayPal and Apple Pay no longer worked since the United States and many European countries decided to kick Russian banks off SWIFT, which is the international financial transaction reporting system.

Also, The Moscow Exchange, which is Russia’s largest stock market, is still closed as of March 8, 2022, when I’m writing this post. This is the longest closure of the Russian stock market ever. The second longest closure was after the 1998 Russian financial crisis. (Interestingly, this was what led to Vladimir Putin’s ascension to power in 1999.)

Times like this are why good financial strategies are so important…

As a financial advisor, my life’s work is all about how money works in the world, and how people make choices with their money.

I decided to become a financial advisor in September 2008, when that financial crisis was in full swing. I realize that a lot of my clients may have been in college or high school at that time, and I appreciate that the weight of that crash may not have had the same affect on them as it did me.

But when you think about how major banks in the US and Europe were failing left and right, it’s easy to imagine the kind of turmoil it would put us in now if the same order of events were to happen today.

How are the stock market and the Ukrainian invasion linked?

What I want to do with this post is answer questions about how this situation is affecting or could affect the US stock market and investment portfolios that rely on the stock market.

The two key impacts Russia’s invasion of Ukraine has on the stock market

When something major happens in the world, especially something that affects the economy, the first thing we ask ourselves at KB Financial advisors is, “How does this affect our clients?”

A big part of our role is to help them navigate economic uncertainty.

When we design financial plans, the first goal is survival. We want our clients to have antifragile investment plans so that whatever happens, even with great economic uncertainty, they don’t have to make bad financial choices just to create cash flow for living expenses. (We would hate for you to have to sell assets, like stock or real estate, at crash-level prices to get cash, when the purpose of those assets was to give you a substantial future return.)

For this situation in particular, there are two important impacts to consider:

- The companies our clients work for

- The money we invest for our clients

How the companies our clients work for are now performing in the stock market

To get an overall picture of how our clients’ companies are performing in the stock market, I like to use the Renaissance IPO ETF. This ETF has been in a slow, steady decline since November 15, 2021.

The market as a whole has been going down since then, but this particular segment of the market (which is recently IPO’d tech companies) is going down faster than the rest of the market. Right now, they’re leading the market’s decline, just like they led its increase over the last decade. It makes me thinks of Talladega Nights:

Please excuse the silly humor in an otherwise serious blog post, but the tech industry soared to great heights over the last 10 years. Now, however, it’s going down *really* fast… faster and in a bigger way than the market as a whole.

I dug a little deeper and pulled data from Yahoo Finance for the Renaissance IPO ETF, and looked at adjusted close and daily trading volume over 14-day and 30-day rolling periods since November 15, 2021.

Interestingly, I didn’t see any noticeable change in either (adjusted close or daily trading volume) since the invasion began on February 24, 2022. This could be good news, because when the market is volatile, you’ll often see these numbers going up and down like crazy.

That said, it is still early. Things may change in a week or two.

So… what does this mean?

If you believe, like I do, that market prices reflect the aggregation of all available information, you might say that the Russian invasion of Ukraine was already priced into the stock market. (Numbers-wise, nothing has happened yet that has “surprised” the stock market. And since the tech sector was already on a downward trend, the intelligence that Russia might invade Ukraine could’ve been something that was taken into consideration by the market’s movers and shakers.)

This isn’t to say it won’t have a different impact in the future… but we haven’t seen the kind of market whiplash we saw with the onset of the COVID pandemic in March 2020.

Note to the reader…

I originally wrote this post on March 3. On March 7, the US stock market experienced its single largest daily decline since March 2020. So the market appears to still be repricing the impact that Russia’s invasion will have.

The Renaissance IPO ETF’s overall pattern continued. Losses were in line but also greater than the broader market.

How our clients’ overall stock market investments are performing

When we invest money for our clients, there’s a series of choices we help our clients make.

We have a general starting point, but we have to make sure the specific investment vehicles we use work for our clients on an individual level. Most often, we use Dimensional Fund Advisors’ (DFA) ETFs and mutual funds.

DFA specializes in designing investment vehicles based on lessons learned from historical prices.

Prior to working with us, most of our clients used index funds, like a Vanguard target date fund, the SPDR S&P 500 (ticker SPY), or the Vanguard Total Stock Market ETF or index fund.

Put simply, the goal of an index fund is to minimize tracking error. It wants to mirror the index, and it has that as its sole objective. Most index funds are market cap weighted, which means they simply buy the stocks of their index in the proportion that the stocks are within the index. (For example, at the end of 2020, Apple represented about 5% of the US stock market. Therefore, a US stock market index fund would be made up of 5% Apple shares.)

Index funds don’t ask what’s best for you as an investor… it’s just the thoughtless, automated tracking of an index.

The reason we like DFA is because they avoid this thoughtless tracking and instead choose what’s best for investors based on historical market data. (So it’s not just based on speculation either.)

DFA International Equity Funds & Their Approach to Investing in Russia

DFA has invested in Russia with their international equity funds since 2009.

After they decided that including Russia in these funds would be a good idea, the next question was to decide how to do it. At that time, DFA didn’t like the listing standards for the Russian stock exchange, so they decided that the only way their funds would invest in Russia would be through depository receipts in the US or London.

In 2014, the same year Crimea was annexed, DFA became concerned about Russia’s treatment of foreign investors and decided to underweight Russia relative to a market cap index, meaning they would hold less than what Russia represented in the overall emerging market. (A typical emerging market index would market-cap weight Russia at 3% to 4%.)

The DFA All World ex-US Equity Fund: A smart way to diversify globally

The international equity fund we most often use for our clients at KB Financial Advisors is the DFA All World ex-US Equity fund (DFWIX). We like it because it gives our clients the greatest diversification by including 10,132 individual stocks in both developed and emerging markets, giving you the greatest diversification at the lowest possible cost.

A comparable index fund would be the Vanguard FTSE All-World ex-US (VFWAX). It’s a market-cap, weighted index fund that represents the entire global stock market, minus the United States.

The difference, though, is that the DFA fund doesn’t have the thoughtless automation of an index fund. Because of this, the DFA fund only has 0.23% of its funds invested in Russia. (This is $2,300 out of $1 million.)

The Vanguard fund, on the other hand, has 0.8% of its funds invested in Russia, which is $8,000 for every $1 million. (Almost 4x more than the DFA fund we use.)

Diversification in global bond funds: To invest in Russia, or not? That is the question.

Since diversification is so important, we also invest our clients in global bond funds, including the DFA Five Year Global fixed income fund, which invests in government and corporate bonds in the US and around the world, with maturities of five years or less.

This specific DFA fund has zero exposure to Russian debt, because Russia is an ineligible country for this fund. Within this fund’s investment policy, it explicitly says they won’t invest in Russian debt… which likely goes back to the last Russian financial crisis in 1998. The crisis eventually resulted in Russia defaulting on their government debt in 1999… and default is one of the risks you want to mitigate when investing in bonds.

If you were to buy into the Vanguard Total International Bond Fund, on the other hand, it includes 0.4% of Russian debt.

Personalizing Your Portfolio Even More: Separately Managed Accounts

For our clients who have an account value of over $3 million, we can do a DFA separately managed account (SMA) that employs a world ex-US large-cap strategy. It focuses exclusively on American depository receipts, which are the stocks of foreign companies who use depository receipts to list their stock in an American stock exchange.

This SMA strategy with DFA includes 377 individual depository receipts. Within that strategy, our clients can customize it in 215 unique ways… and one of the customization options is to exclude individual countries.

For example, a client using this strategy could decide the humanitarian crisis caused by Russia doesn’t line up with their values, so they want to exclude their investment dollars out of Russia. We could quickly make an adjustment to their SMA to exclude the five depository receipts of Russian companies, and then our client has a completely customized fund for themselves that perfectly replicates their values.

How to Manage Your Stock Market Investments in Light of the Russian Invasion of Ukraine

We’re continuing to monitor the situations in Ukraine and Russia, just like we’d monitor any other situation that has the potential to have an impact on our clients. Each new economic concern gives us an opportunity to question and test the recommendations we make to our clients.

Even though this unfortunate invasion will likely have a strong economic impact, it doesn’t have to mean bad things for your personal investment portfolio… especially if you’ve built a strong, antifragile investment strategy.

If you want help making sure your investment strategy is antifragile, or if you like the idea of setting up a separately managed account so your investments can better line up with your values, feel free to book a discovery call here.