You’ve always received refunds, but now all you have is a massive tax bill. What gives?

Filing taxes isn’t a springtime highlight for most, but knowing a tax refund is right around the corner certainly sweetens the deal.

What happens when tax season is stripped of its only silver lining, though?

Many of my clients swear they’ve “always” received refunds, but now, they seem to owe more and more each year. These busy professionals are building wealth to gain financial independence, which makes the financial setback of a large tax bill especially frustrating.

So, what gives?

After advising countless clients in this position, I’ve chalked it up to three primary reasons most of them received tax bills.

3 reasons you owe tax money

1. Your withholdings don’t keep up

Many of the professionals I advise are high performers at work, which means their pay tends to increase every year. When they begin reaching higher marginal tax brackets, like 35%, the withholdings simply stop keeping up.

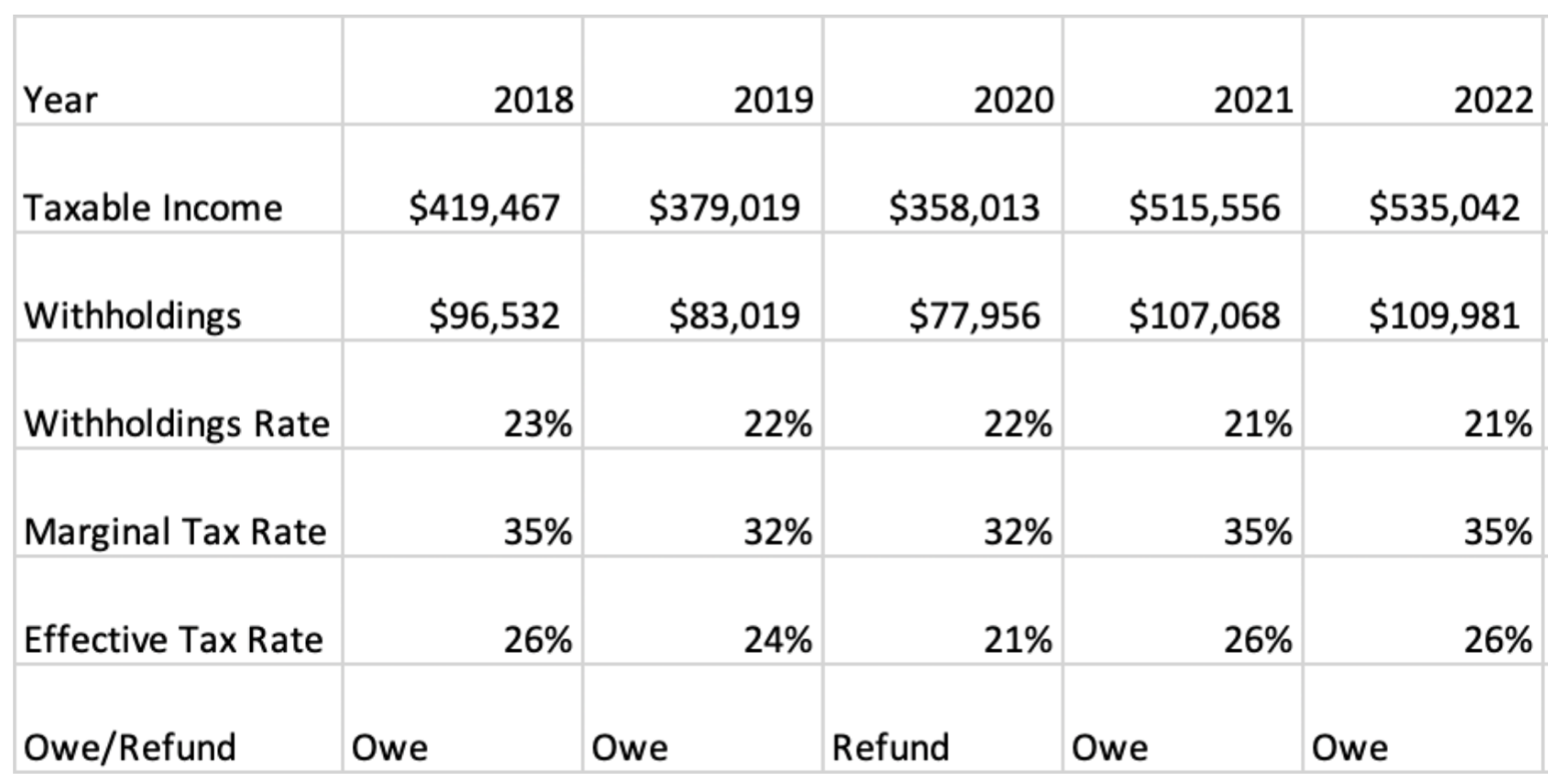

The table below shows a real-life snapshot of one of my clients’ tax information over the last five years. We’ll call her Alyssa. Historically, Alyssa received consistent tax refunds and now she’s wondering what changed and why she owes a significant amount of money.

A five-year snapshot of a client's tax information.

- Taxable income tells you how much of what you made last year you’re actually paying taxes on.

- Withholdings is the amount withheld from your paychecks. Taxable income and withholdings — which are two numbers you can pull directly from your tax return — do the best job of telling you why you owe so much each year.

- The withholdings rate isn’t on your tax return, but you can calculate it by simply dividing withholdings by taxable income.

- It’s important to understand the difference between the marginal and effective tax rates, which should both be on your tax return. Your marginal tax rate (which you can think of in terms of tax brackets) is the one-dollar-more rate, and it represents how much additional tax you’ll owe for every additional dollar of income you make. Your effective tax rate represents your average rate across all the tax brackets that apply to you. In other words, your effective tax rate tells you what percentage of your income will actually go towards tax payments. You can calculate your effective tax rate by dividing your total tax owed by taxable income.

Back to the example, Alyssa’s effective tax rate started at 26%, then dipped to 21%, and returned to 26% in the last two years. On the other hand, the withholdings rate started at 23% and has consistently decreased every year since, down to 21%. Notice how from 2021 to 2022, Alyssa gained $19,486 of taxable income at a 35% marginal tax rate, which resulted in her owing $6,820 of additional taxes that year. Meanwhile, her withholdings only increased by $2,913 that year, widening the gap between the withholdings rate and effective tax rate. The reason Alyssa suddenly began owing so much money is because her withholdings rate continued to decrease despite her rising effective tax rate. What I’d recommend for clients in a similar position is to adjust their withholdings and make estimated tax payments, otherwise their tax bills will likely grow each year.

The moral of the story is that as you earn more money and reach higher tax brackets, your withholdings simply don’t keep up. This is precisely why you (and Alyssa) owe so much in tax payments now.

This withholdings issue underscores the importance of working with a financial advisor over a long period of time. When your advisor gets to know you and your finances over multiple years, it opens the door to building a deeper understanding of your circumstances and it helps them detect these kinds of financial blind spots earlier.

2. Supplemental wages

The most common reason our clients have high balances due at tax time is supplemental wages. These include annual bonuses, sales commissions, restricted stock units (RSUs) vesting, or the exercise of nonqualified stock options (NSOs). Certain withholding rules apply to supplemental wages, one of which is that the standard withholding for them is 22%.

With your salary, there’s a withholdings table based on how you complete your W-4 form — whether it’s when you start a new job or update your W-4 at an existing job. Unlike increasing salaries whose withholdings rates increase alongside them, supplemental wages’ withholdings don’t scale. As you gain supplemental wages, your employer doesn’t withhold more money. They typically withhold 22% federal for supplemental wages less than $1 million, and it’s only after your supplemental wages exceed $1 million that employers withhold 37%.

One client we recently advised — we’ll call him Ryan — had more taxes due than usual because of his supplemental wages. Ryan’s W-2 showed $1,413,672 in wages, and the statement of taxable income behind his W-2 revealed that $475,573 of his wages was from the vesting of RSUs.

With standard supplemental wage withholding at 22% federal, the gap between what’s withheld and what Ryan owes at a 37% tax bracket is $71,336 — that’s the minimum amount he would owe in his tax return unless he takes preventative measures. Ryan isn’t alone; many of our clients were previously blindsided by incredibly high tax bills they weren’t prepared to pay, making tax season feel like a stressful game of roulette.

3. Income with no withholdings

Another reason you may owe more money than usual is if you have a high income with no withholdings.

Early on in your professional career, your taxes tend to be pretty simple: every year, you’re either breaking even or receiving a small tax refund. But as you progress your career and build your wealth, you’ll probably experience things like investment income, the exercise and hold of incentive stock options (ISOs), and capital gains. As your financial circumstances become more complex, you’ll likely have increasingly more income with no withholdings.

Let’s dive into the complicated types of income that make your taxes less straightforward:

-

- Investment income includes interest and dividends. For instance, one of our clients has a taxable investment portfolio worth $7 million, from which they received $86,000 in dividends. At a 37% tax bracket, those dividends significantly increased their tax payment. The client’s portfolio also earned them $14,000 in interest last year, and that number is only expected to get higher as interest rates increase. Don’t get me wrong, earning more interest from your investments is a great thing. You just want to be mindful of the fact that having more income with no withholdings on your tax return results in a higher tax payment.

- The exercise and hold of ISOs also results in income with no withholdings. Once you trigger the alternative minimum tax at a rate of 28%, your tax payment can drastically grow, especially if you’re dealing with six or seven figures’ worth of ISOs.

- Capital gains occur any time you sell investments.

Even though income like qualified dividends or long-term capital gains are taxed at preferential federal rates (aka lower rates than you’d owe on your paycheck), these income sources quickly add up, and before you know it, you’re owing hefty tax payments every year.

Other things to help you win tax season

If you’ve read this far, you understand your taxes aren’t as simple and straightforward as they once were, and that you can expect to owe money from here on out.

There are a few more things you’ll want to know about your evolving tax situation:

Understand you’re a target. It’s no secret income taxes fund our federal government. So, when you hear politicians say things like “the rich should pay their share,” they’re not talking about your grandma who has $5 million in an IRA; they’re talking about you and other taxpayers with high incomes. Over the last decade, the “rich” threshold has shifted. For instance, President Obama’s administration proposed additional taxes on those earning more than $250,000. Under the current administration, the line seems to be $400,000. In other words, proposals calling for tax increases usually only affect taxpayers earning more than $400,000.

As a target, you must recognize that you may receive stress-evoking notices from the IRS. The best way you can avoid getting an IRS notice is by properly preparing your tax return, or having someone who’s worked with high-income clients like you prepare it. One of the main things that trigger IRS notices to our clients is when they fail to provide us with all of their tax documents. For every tax document you receive, the IRS receives their own copy, and a big part of their job is to ensure your tax return matches up with all the information they receive from banks, investment firms, and employers. Any discrepancies will make you prone to receiving a notice.

Watch out for 1099-B and K-1 forms. One of the crucial documents the IRS looks at is your 1099-B form, which each one of your brokerage accounts issues. When you receive multiple 1099-Bs, it’s easy to miss one of them. Be sure you report all of your 1099-Bs because virtually every client who forgets to provide us with all of these forms tends to receive an IRS notice.

Another form to be aware of is your K-1. Many of our clients who reach a certain level of wealth begin making private, novel investments, like in venture capital and general partnerships. Many of these investments generate K-1s that usually aren’t available by April. These delayed forms force you to file an extension and drag your tax return throughout the year instead of completing it in April.

Think about taxes holistically, now that they’re more complicated. Make taxes part of your annual financial plan instead of something you only think about in March and April. This holistic approach allows you to budget and plan for taxes throughout the year, which is important considering you’ll spend more money paying taxes than on any other expense category. To put this into perspective, a 35-year-old couple who makes $400,000 and plans to retire at age 65 will spend $5,505,917 in federal income tax through the remainder of their career. That’s way more money than you’ll ever spend on groceries (even at Whole Foods) and it calls for more planning.

Don’t treat your taxes like a slot machine. Don’t plug the numbers into an online program on April 14, pull the handle, and see what happens. You want to go into tax season with a solid idea of what you’ll owe.

Work with an advisor who understands your situation, and at the very least, have them complete an annual tax projection for you. Knowing what you’ll owe next April gives you the chance to make adjustments before December 31 to lower your taxes.

Believe it or not, many of my new clients have previously paid more taxes than they actually owed. It’s because they either did their own taxes or worked with a preparer who didn’t know what they were doing. That’s why it’s important to pay only what you owe and work with an advisor who can identify opportunities for you to pay less and save money. Think of your taxes — not your daily coffee — as a primary area to save money. Finance gurus usually tout budget hacks that involve lifestyle changes, but busy professionals should look into their taxes instead. Remember, coffee isn’t your largest expense category; taxes are.

Complicated taxes are a good thing. Despite the added hassle of reporting multiple sources of non-salary income, complicated taxes are a sign you’re on the right financial path.

The income your career pays you is what funds your taxes, savings, and investments — it’s ultimately what helps you reach financial independence (the goal of most busy professionals). You want to get to the point where your salary is not as simple as salary withholdings and a small refund. You want to view supplemental wages and income with no withholdings as reassuring milestones on your path to financial independence.

As you continue to build wealth and have increasingly complicated taxes, you’ll need to make estimated tax payments, which a financial advisor can help you calculate. This crucial step will help you dodge the estimated tax payment penalty fee and a hefty tax bill in April.

You’re not in Kansas anymore

I hope you’ve accepted that your taxes will continue to become more complicated from here on out. Remember, it’s a good thing.

The best thing you can do to combat negative side effects (like surprise tax bills) is to be proactive

Win your next tax season by having the right financial advisor on your team. At KB Financial Advisors, we’ve helped countless busy professionals identify their tax blind spots, save money, and avoid massive tax bills.

Book a call today to talk to myself or another expert on our team about mastering your taxes.