No one likes an unexpected tax bill. ????

No one.

And yet, it happens all the time.

Even to smart people. Really smart people.

Especially, in our experience, smart people with stock options.

Why is that?

And how can you make sure you avoid getting an unexpected tax bill or a slap on the wrist from the IRS for accidentally not paying enough from your paycheck throughout the year?

That’s what I’ll go over in this article.

But… shouldn’t my HR department take care of withholding tax on stock options for me?

To an extent, yes, your HR department will withhold some tax on your stock options. (Just like they do with your normal paycheck.)

But this doesn’t always work as well as it does with your base salary, because stock options are considered supplemental wages.

It’s easy to realize that salespeople earn supplemental wages via commissions every time they close a deal, but supplemental wages aren’t limited to commissions… they include bonuses, overtime pay, payments for accumulated sick leave, severance pay, awards, back pay, retroactive pay increases, payments for non-deductible moving expenses, and, of course, stock options.

And, yes, your HR department will withhold some money for taxes from your supplemental wages, but the federal government sets the supplemental wage withholding rate at 22%.

But if your total income falls in a tax bracket that’s higher than 22%? Your supplemental wages will be taxed at higher than 22%, which means you’ll owe more than however much has been withheld from your paycheck.

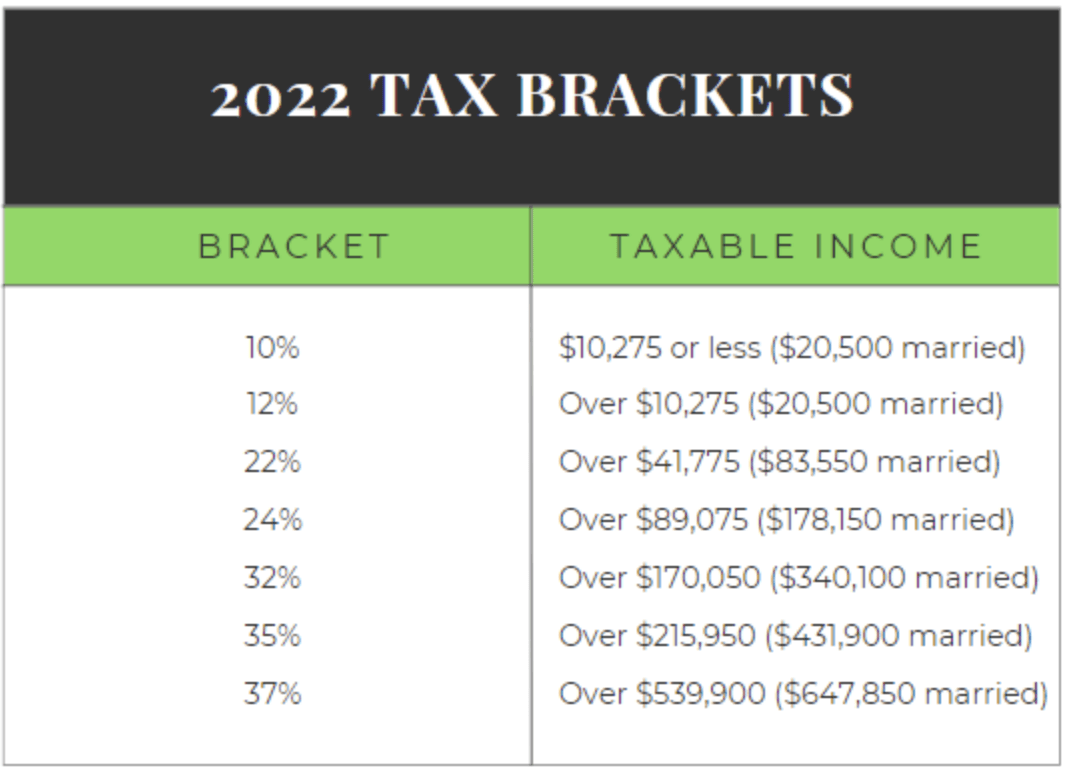

For example, check out this chart of 2022 tax brackets:

According to this, if you’re a single person who earns over $89,075 (or $178,150 as a married couple filing jointly), you’ll run up a 2% deficit on any and all of your supplemental wages.

What does this mean for paying taxes on your stock options?

If you have a non-commissioned role within your company, you might not be used to dealing with supplemental wages on your yearly tax return, so your stock options vesting could take you by surprise.

Stock options, after all, usually come with conditions: time required to vest, performance, a liquidity event happening, etc. The payments (or potential payments) of stock options won’t happen until you meet those vesting requirements, and they could take years.

And just so we’re clear, stock options can include any of: employee stock option plans, employee stock purchase plans, nonqualified stock options, disqualified dispositions on incentive stock options, restricted stock units, and stock appreciation rights.

So how does withholding tax on stock options and supplemental wages work?

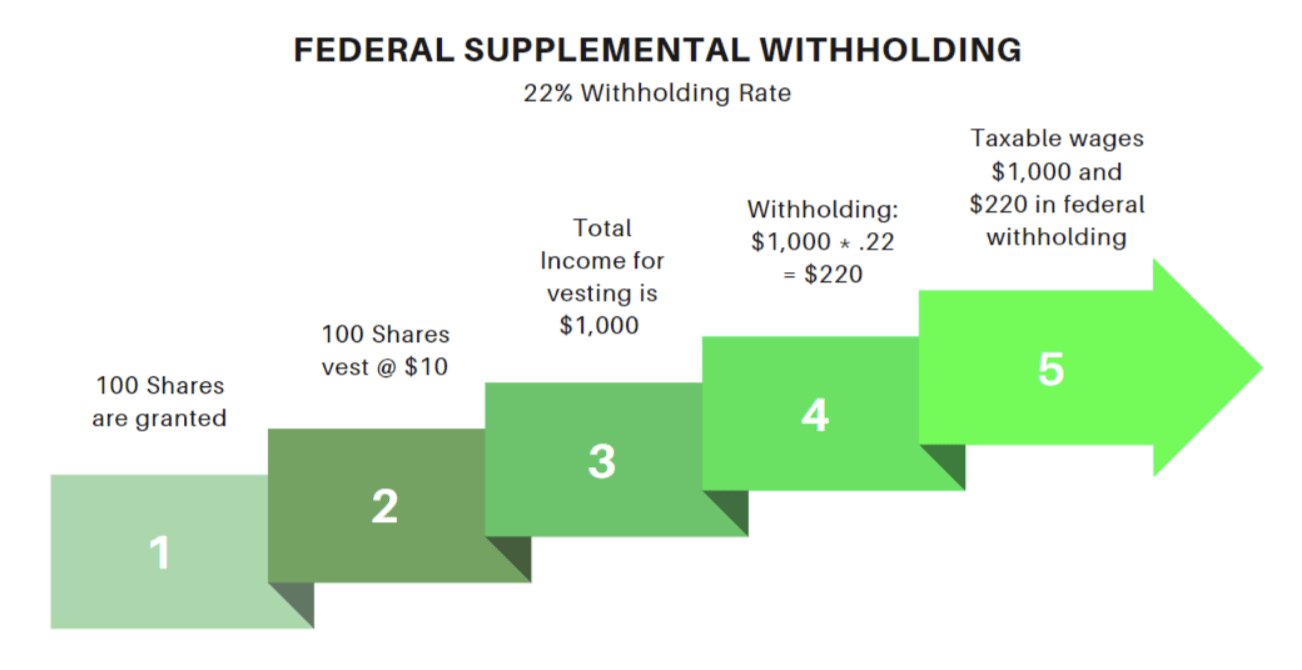

If you earn less than $1 million in supplemental wages during a given calendar year, you’ll pay a flat 22% withholding rate on those wages per federal guidelines.

If you earn more than $1 million in supplemental wages in one calendar year, the rate jumps to 37%.

The catch, though, is that only your supplemental wages are subject to the 37% withholding rate, and if you don’t reach that threshold, only 22% gets withheld from your supplemental wages. (You can refer back to the 2022 tax brackets chart above to see why this is a problem.)

Here’s an example of how the 22% withholding tax rate on stock options could work on 100 vested shares:

So… why would I owe more in taxes?

Again, this comes back to that 2022 tax brackets chart I shared above.

If you earn a $250,000 salary with $250,000 in supplemental wages as a single individual, you’ll fall into the 35% tax bracket after your base salary is paid, so you’ll owe the 35% on all your supplemental wages… but only 22% will be withheld.

When you do the math, that’s a $32,500 difference in additional tax you’ll owe on your supplemental wages after your HR department withholds 22% for you.

So, anytime your taxable income goes beyond $89,075 (or $178,150 if married filing jointly) you creep into a tax bracket higher than any withholding that will happen on your vested stock options.

If you only earn a little bit of supplemental wages in one year, it’s probably not a huge deal.

But if 50% of your pay comes from supplemental wages, like in the example above, you see the problem.

Tax planning saves your neck… and your pocketbook ????

This is one of the largest reasons we do tax planning, especially in a volatile stock market.

Stock prices are a huge determining factor in how much income you recognize on your stock options vesting. With changing tax laws and underpayment penalties, it’s crucial to run annual projections on your income to ensure there are no surprises or IRS penalties come April.

The last thing we want is to see your scrambling to raise cash, move funds, or liquidate assets to pay a large bill you didn’t see coming. That’s a fast way to crash your financial plan, and we’re not here for it.

What to do if you know you’ll come up short on stock options withholding

So… what do you do if you know you’re going to get slapped with a huge tax bill in April thanks to your supplemental wages?

Just move the cash into a savings account and wait until April for the bill to come due?

In theory, that approach should be fine, but the IRS isn’t so friendly here.

They want their money, and they want it NOW. (Impatient, much?)

The IRS likes to be paid their due throughout the year, which is precisely why your HR department does withholdings from your paycheck in the first place: so you pay taxes as you earn. (And if you don’t pay a reasonable amount in correlation to what you end up owing, you can get slapped with an underpayment fine.)

Fortunately, there are safe harbors so “good enough” estimated tax payments throughout the year are, in fact, good enough to avoid underpayment penalties, and I’ll go over what those safe harbors are in a future post. (Stay tuned!)

But for now, what you need to know is you can avoid underpayment penalties by paying estimated taxes beyond the withholdings done by HR every quarter:

Q1 on April 15

Q2 on June 15

Q3 on September 15

Q4 on January 15

You can work with your financial advisor or tax planner to determine the amount you should pay. If you need a financial advisor + tax planning team, book a discovery call with us here. We’d love to talk to you!

Some employers offer higher withholding rates

Fortunately, some employers that offer stock option compensation are getting with the times and give employees an option to have 37% of their supplemental wages withheld instead of the 22% for those earning less than $1 million.

The catch, though, is that this varies from employer to employer (some won’t even offer it or know what you’re talking about), and it’s certainly not required to participate in. (Plus, with an election like this, you could end up paying more to the IRS than needed. Some people don’t mind this because they like having a large refund check, but others prefer to keep the money in their monthly budgets to use it in their financial plan ASAP.)

So, to make sure you get the best of bost worlds—no underpayment penalty, but also not overpaying to the IRS—we use tax planning to run projections and hit your targets on the nose.

Want this article in video form?

If you’ve only got a few minutes and want the gist of this article in a brief video summary, check it out here:

Let us help you with tax planning!

If this concept seems a little overwhelming, that’s because it can be–even for the smartest of tech and startup employees.

But don’t worry!

Working with a tax planner who’s been there and done this type of tax planning more times than she can count (*cough* me *cough*) is an easy way to solve it. You make sure you don’t get a nasty surprise bill in April, and that all your other financial moves are taken into consideration with your tax strategy, so you get the most bang for your buck with every money move you make.

Book a discovery call here if this kind of tax planning help sounds appealing to you.

Talk to you soon!