A random, unexpected letter from the IRS is never something you want to receive — especially when that letter is a CP2000 notice, informing you that you owe them money. ???? (Money beyond what you’ve already paid in taxes after filing your return and paying the bill in full.)

The way the IRS communicates often makes the situation worse. The lack of information, context, or explanation can cause even more confusion, and that confusion can lead to fear when a mysterious letter tells you that you owe tens of thousands of dollars in taxes and you have no idea what it’s talking about.

Not only is the initial notice alarming, but you can immediately feel extreme stress and anxiety at the thought of having to untangle this mess. How will you find the time (and energy) to fight the IRS? Should you even bother, or should you just pay what they say you owe and get it over with?

If that’s what you’re thinking, STOP.

Do not pay anything until you understand whether or not the notice is accurate — or if the IRS made a mistake. It happens, and more often that you might think.

What is a CP2000 Notice and Why Did You Get One?

If you filed a tax return and inadvertently omitted some income that was reported to the IRS on a 1099 form, you can expect to receive a CP2000 Notice in the mail. It might not happen immediately, however, so it can be a bit of an unpleasant surprise.

Even worse, it may take the IRS a year to generate this notice — and you’re on the hook for any late payment penalties and interest because of the delay.

A mismatch between your 1099s and your tax return isn’t the only reason you might receive this notice. A CP2000 often relates to an unreported form 1099B showing sales of stock related to stock options or RSUs.

The income related to these stock sales is normally included on your Form W2, and unfortunately, omitting a Schedule D that would show these items is a common oversight.

Since the income is already reported on form W2, the basis of the stock equals the selling price and the Schedule D results in a zero capital gain.

However, the CP2000 Notice calculates a proposed additional tax on the entire selling price. Therefore, you may receive the notification that indicates you owe quite a large amount due — but that notice may be incorrect.

How to Read the CP2000 Notice

To determine if your notice was sent in error, or if you truly do owe more in taxes, you need to know how to read the CP2000.

The notice will provide a detailed calculation of the proposed change to tax followed by an Explanation of Changes. This Explanation lists the Securities sold and shows the name of the Brokerage firm that issued the form 1099B.

It also shows the amount of sales proceeds shown on the return compared to the amount reported to the IRS by others. The cost basis information on the CP2000 Notice may not include any cost basis reported on the missing form 1099B — and therefore, the calculation of additional tax is incorrect.

If you feel you received a CP2000 Notice in error and the IRS got it wrong, you’ll need to prove it by finding the right forms and submitting a notice of your own: a Response to the IRS Notice.

We recommend having your tax professional prepare this with you, and help you through the process.

Locating the Forms You Need to Prove Your Case

You may have multiple brokerage accounts that are used to sell stock options and RSUs. Often, an Employee Awards account is established by your Employer for you at a brokerage firm (E-trade, Schwab, Morgan Stanley are all common ones).

You may also hold these shares in your own brokerage account. You should check all these accounts online for tax forms issued. You can usually find a copy of all form 1099s, which you’ll need.

Once you have these documents, you also need a number of other tax forms to prove you paid the correct amount of tax. These include:

- Form W2, which includes earnings from RSUs, as well aso information around any ESPPs, NQSOs, and ISO disqualifying dispositions.

- Form 3922, for ESPP shares

- Form 3921, for the exercise of ISO

- Statement of Taxable Income, which is a detailed summary of RSU and stock option transactions that are reported on form W2

Having the forms isn’t enough. You also need to calculate the correct amount of capital gains for the IRS.

Calculate the Correct Amount of Capital Gains

Your form 1099B usually shows a basis and indicates if the basis was reported to the IRS. Regardless, you’ll likely need to verify the correct basis to include any income reported on form W2.

Often, the form 1099B shows the strike price as basis, so you need to correct the basis by showing an adjustment in column G of Schedule D.

Calculating correct capital gain may be challenging if your stock options, RSUs, and shares transacted over multiple years.

For example, if your RSUs vested this year the earnings from that event would be reported on your W2 — so there’s no issue in this year. But if you sell the resulting shares next year, the year after that you’d receive an IRS notice.

And that leaves you with an IRS notice and tax documents spread over three years. Needless to say, things start getting complicated and it can be even more difficult to untangle all the different parts of this situation to provide the documentation required to prove you don’t owe more in taxes.

How to Respond to the IRS

A Response Form should be included with any notices you receive from the IRS, including the CP2000 Notice. If you do not agree with the proposed changes to tax, check the box “I don’t agree with some or all of the changes.”

Attach a signed statement to the Response Form explaining what you don’t agree with. Include copies of missing form 1099s, as well.

We recommend that you prepare a corrected form 1040 including a corrected form 8949 and Schedule D. Include the corrected forms with your Response Form.

You should not file an amended form 1040, but you may need to file an amended state income tax form.

Learn from Our Clients’ Example When Responding to the IRS

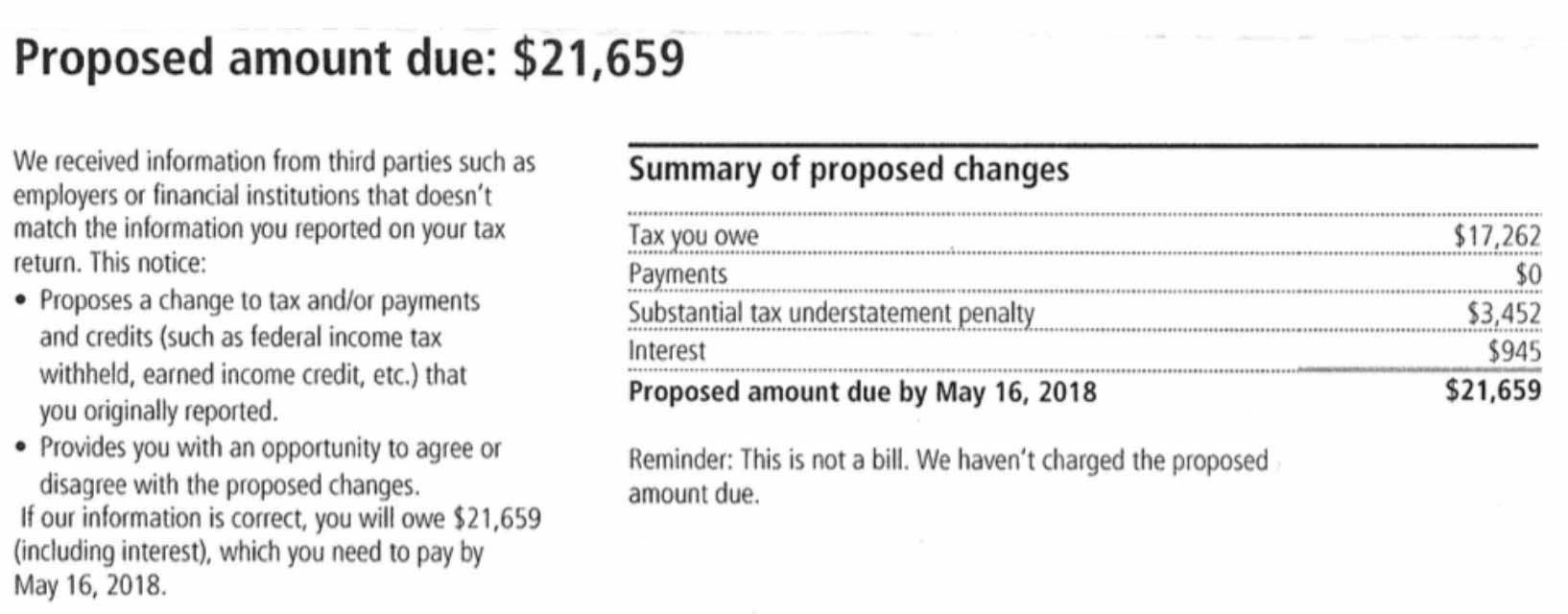

This is an actual CP2000 notice one of our clients received.

Pretty scary, right? Here’s how it happened:

Our client did a same day exercise and sell of 1,400 nonqualified stock options to create cash to purchase a house in 2016.

There were two accounts at Schwab issuing forms 1099-B. One account covered the RSU and ESPP shares and was included on the tax return. The second account covered the NQSO and was missing from the tax return.

The IRS issued a CP2000 Notice in 2018 for $21,659 — and as you can see, that included a “Substantial Tax Underpayment Penalty” of $3,542.

You won’t be surprised to hear we then received a frantic email from our client who had no idea what was going on.

We got to work and began by tracking down the missing 1099-B that was needed to prove the tax return had been done correctly.

When we found it, we saw something interesting. The missing 1099-B indicated that the cost basis of the 1,400 shares had been reported to the IRS. The CP2000 Notice indicated the same.

But, from the CP2000 Notice, it was clear that the IRS ignored the basis and treated 100% of the proceeds as taxable income.

And that, of course, was wrong, wrong, wrong!

We drafted a response disagreeing with the IRS notice and included all necessary documentation and explanation to show why they got it wrong — and wrongfully sent the CP2000 notice to our client.

The result? Our client didn’t owe a thing. In fact, they went from a $21,659 bill to a $15 refund.

Don’t Panic If You Get a CP2000 Notice from the IRS. You Might Not Owe a Thing!

Don’t be scared into paying taxes you don’t owe. Should you receive a notice from the IRS, reach out to your tax professional immediately.

They should be able to help you evaluate the situation, track down the necessary forms to prove your case, and see if something like a CP2000 was actually issued in error due to mistakes made at the IRS.

But you can also prevent this from happening to you.

Before you file your tax return, make sure you have all form 1099s from all brokerage accounts. Then, enter all necessary information regarding whether the basis was or was not reported to the IRS (this information is specified on the form 1099B).

That should help eliminate the error — and protect you from paying taxes you don’t actually owe.

Still Freaking Out a Little Bit? Get in Touch.

We get it: even though there’s a good chance this CP2000 Notice from the IRS might be a mistake, there’s always that tiny, tiny chance it’s not. And you definitely don’t want to mess things up. If you need a tax professional seasoned in handling these issues to help you out, click on the button below to schedule a consultation with us.