*New enhancements for QSBS apply after July 4, 2025. Refer to How Does QSBS Work (2025 Edition) for more.

If you were around when a corporation was still small but it’s become large (like as a founder or one of the first employees), you may have stock that qualifies for the Section 1202 exemption… which basically means you don’t pay capital gain taxes upon the sale of those shares. These shares are known as qualified small business stock with specific requirements and unique strategies like QSBS stacking, packing, and rollovers.

To be considered a QSB (qualified small business) corporation you must have had gross assets under $50 million or less at all times before and immediately after the shares were issued.

Provided that you’ve held the QSBS (qualified small business stock) for at least five years you can exclude the greater of 10 times your initial investment or $10 million in gains.

It’s a pretty sweet deal, to say the least.

But just like everything in the stock market and tax world, the benefits aren’t always this cut and dry.

Like… what if you have to sell your QSBS at a loss?

Or you haven’t met the five-year holding period?

Or your gains are over that 10 times your initial investment or $10 million threshold?

What does this mean for my taxes?

And can you still take advantage of the QSBS tax treatment of these shares?

That’s what I’ll be answering for you in this article.

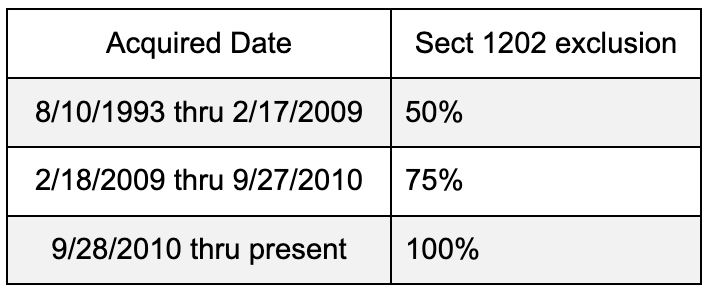

Note: for QSBS gained before 2010, the Section 1202 exclusion rate isn’t 100% like it is for QSBS acquired after September 28, 2010. Here’s a chart to show you what those rates are:

It’s also important to know that this exclusion applies to Federal taxes, but some states such as California don’t follow this exclusion. When you’re planning to sell QSBS, it’s important for you and your financial advisor to calculate what you’ll owe to the state from your sale.

QSBS Stacking and Packing: What if my gain is over the $10 million or 10 times my initial investment limit?

Admittedly, this is a very good problem to have.

If you’re looking at a $10 million or higher payday, most people might just suck it up and pay the extra taxes beyond that $10 million gain.

But you’re not reading this blog post because you’re “most people.”

You’ve got an inclination that there might be one or two ways around this… and you’re right.

Here they are:

1. Irrevocable trusts to loved ones (aka “QSBS Stacking”)

As the owner of QSBS, you can gift shares to non-grantor irrevocable trusts for the benefit of your children or other immediate family members.

Within these trusts, each one qualifies for its own $10 million gain exclusion.

These trusts, however, do limit the ways you can access your money. Each type of trust functions differently, so it’s important to understand what type of trust you’re choosing and what the parameters are around it. (And if you’re not a financial genius in the world of trusts, I’d suggest talking with a financial advisor.)

Additionally, these trusts cannot be granted retroactively as a way to increase your QSBS exclusion. Meaning you need to plan ahead before the sale of your shares. You’ll want to put enough wiggle room in each trust to allow for growth to that $10 million threshold.

2. Invest more money into your company (aka “QSBS Packing”)

To increase the threshold of 10 times your initial investment, it’s important to make sure your 409A valuations considers things beyond just initial cash investments.

It can include things like intellectual property or other “property” contributed to the founding of the company.

But if you’re zeroing in on cash investments, you may not have had the funds at the start of the business to invest much.

But, as time went on and your business grew, you may find that you can contribute more cash to the company… which would increase your value of “amount invested,” giving you a higher threshold for the 10 times initial investment rule.

You can infuse cash into the company by purchasing Series B preferred stock shares.

Keep in mind though, these Series B transactions must be completed at least 18 months before you sell your QSBS and the business must have a legitimate need for the investment.

What if I haven’t held my QSBS for five years?

So… you haven’t had your QSBS for five years yet, but you’re still antsy to do something with them?

One way is via Section 1045 rollovers.

The basic concept here is that you defer your gains by investing the proceeds of your QSBS sale into more QSBS within 60 days.

It doesn’t increase your exclusion amounts per se, but it does help you avoid paying those taxes for a period of time… and you can use it even if you’ve only had your QSBS shares for six months.

What if I have to sell my QSBS at a loss?

Selling shares at a loss is a bummer.

You bought into these shares with high hopes, and for one reason or another, the company couldn’t stand up to meet your long-term expectations.

Fortunately, QSB shares do have a special loss treatment in case you have to sell the company at a loss, or the company becomes worthless.

As a couple, you can claim up to a $100,000 deduction each year against your ordinary income, which is significantly higher than the $3,000 a couple can claim per year for normal stocks sold at a loss.

(And if you’re a serial entrepreneur and have multiple QSBS companies operating, this is an interesting strategy to help you optimize taxes.)

QSBS tax treatment rules can save money in multiple ways. Talk to your financial advisor for more.

In short, QSBS tax treatment is wonderful and complicated all at the same time.

One must-have rule of thumb though, is that you have to be proactive in using advanced strategies like QSBS stacking, packing, rollovers, and you can’t try to implement them retroactively once the sale is done.

If you need someone to talk your selling plans over with, book a discovery call with us to see if you’d like to use our team as your financial planners.