Want to know how to save $420,000 in taxes on stock options?

File the 83(b) Election

Filing an 83(b) election is the secret to creating years of wealth in one moment. Don’t let the opportunity pass you by.

In certain circumstances, you can save a significant amount of income tax by making an 83(b) election. If you are allowed to exercise stock options before they vest (early exercise), there is usually a tax advantage in making an 83(b) election. This is often the case when you join a startup company.

Many startup Companies allow you to do an early exercise to provide the ability to save income tax. But, early exercise alone will not provide any tax advantage. You must make the 83(b) election within 30 days of exercising the option to get the tax benefit.

Is an 83(b) Election for Me?

An 83(b) is not for you if you are at a public company. You will receive Restricted Stock Units (RSU). The 83(b) does not apply.

You may be able to early exercise if you are at a tech company that has raised multiple rounds of funding. But, you may be too late. The strike price could be too high to make an 83(b) election attractive.

An early stage startup is the sweet spot for an 83(b) election. You will have 30 days after you take the job to make this work for you. Act now.

What is an 83(b) election?

83(b) refers to a section of the internal revenue code (the tax rules) that govern the taxation of employee stock options.

There are three events associated with stock options:

- Grant – You are granted stock options. Your exercise price (strike price) is based on the fair market value (FMV) of the shares at the time of grant.

- Vest – Later (usually a year later) your options start to vest. The exercise price stays the same. You hope the company is successful and the FMV goes up.

- Exercise – You can exercise shares as they vest. The difference between your FMV and exercise price is taxable income.

The three events usually happen in this order: grant, vest, and exercise. The exercise triggers a tax bill because the value of the shares has increased.

An 83(b) election allows you to avoid the tax bill.

You file an 83(b) election. Instead of paying tax as the shares vest and you exercise, you exercise all the shares now. Your exercise price and FMV are the same. There is no tax bill.

Types of Stock Options and Taxes

You pay ordinary income tax at the time you exercise vested nonqualified stock options (NQ). The difference between the exercise price and the FMV is taxable income on the day you exercise.

You can also incur alternative minimum tax (AMT) at the time you exercise vested incentive stock options (ISO’s).

If the company allows early exercise, you can be taxed at that time by making an 83(b) election.

Nonqualified Stock Options (NQ) = Ordinary Income Tax

Incentive Stock Options (ISO) = Alternative Minimum Tax

You can save tax by filing an 83(b) election when the stock value is low. If you exercise early, the fair market value and the strike price will generally be the same amount. In this case, you will pay no tax at the time of exercise and start the capital gain holding period. All by filing the 83(b) election.

83(b) Election: Exercise Price = Fair Market Value = Zero Tax

420,008 Reasons to File an 83(b)

Let’s say for example that you take a job at a startup. Your salary is $150,000. You paid the alternative minimum tax last year and expect to again this year.

The start-up grants you 40,000 incentive stock options (ISO) with an exercise price of $0.01. Your stock option agreement allows you to early exercise.

You early exercise all 40,000 ISO. Your cost to exercise is $400. The exercise price and fair market value are the same. Your tax bill is $0. You file the 83(b) election within 30 days.

Four years later, the company goes public. You sell your shares after the lock up for $65 per share.

Your cash proceeds from the sell are $2,600,000.

Your net after subtracting the cost to exercise is $2,599,600.

What happened:

With the 83(b) election you avoided paying ordinary income or the alternative minimum tax. Waiting to exercise would have involved one or the other.

The worst outcome would have been waiting to exercise and doing a same day sale after the IPO. This would have converted all your $64.99 per share gain into ordinary income. Taxed at rates as high as 40.8%.

With the 83(b) election your entire gain is taxed at long term capital gains, with rates as high as 23.8%.

Your possible tax bills:

$2,599,600 taxed as ordinary income = $1,004,713

$2,599,600 taxed as long term capital gain = $584,705

Total Tax Savings = $420,008

Limitless outcomes exist between filing an 83(b) election and a same day sale after an IPO. The two approaches are at two extremes.

But, the example, based on an actual client case, illustrates the power of an 83(b) election. The power grows when you consider the impact of the tax savings over time.

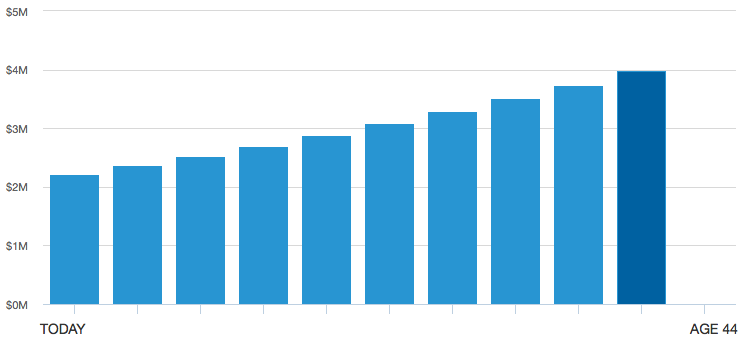

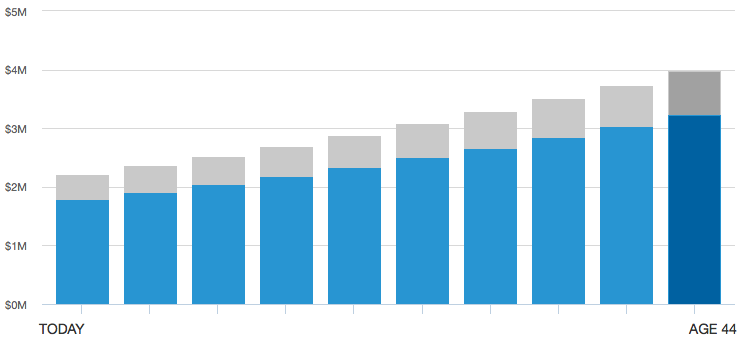

Paying long term capital gains, your net cash after tax will be $2,014,895. Invested in a 60% stock, 40% bond portfolio, your investment grows to $3,969,107 after ten years.

Paying ordinary income tax your net cash after tax will be $1,594,887. Your investment grows to $3,224,928 after ten years.

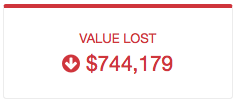

The $420,008 in additional tax adds up to $744,179 in value lost over ten years.

The amount of money you lose by not filing an 83(b) election grows as we stretch the projection out to 20, 30, or 40 years.

Filing an 83(b) election pays a return now. The return only grows in the future.

The Risk, Return Tradeoff with Stock Options

Risk and return are two terms tossed around by financial advisors and writers. It’s important to know what we are talking about. Especially when stock options are part of the discussion.

Risk with regards to stock options has two parts:

- Uncertainty

- Cash

Uncertainty is the worry cost. What are the potential outcomes? How sure are we of success?

Cash is the financial risk. How much will it cost to exercise? If the company goes bust how much do I lose?

You must also consider opportunity cost. You could invest your cash in other ways instead of exercising your options. Other investments may be more sure to produce a return than shares of a start up.

Return is simple.

Return is the net cash you receive after you pay for the exercise and pay taxes on the gain. We must also compare return to the expected return on other assets.

You experience risk the moment you exercise. You put the money down. You receive the shares and all the uncertainty with it.

Return is only experienced when you sell.

Your stock options are worthless until you can sell!

Let us look at risk and return at three points in time from job offer to IPO.

1. Take the Job, Early Exercise, File the 83(b) Election

Uncertainty is the highest. Startups are like white-water rafting. Everyone starts out dry and in the boat. Few remain so at the end.

The likelihood of an IPO is small. The uncertainty of the companies outcome will never be higher.

But, wait:

Your cash out of pocket to exercise will never be smaller. And, you may avoid taxes by making the 83(b) election.

Your potential return is also highest at this moment. Consider our example.

You spend $400 to exercise. In four years, the shares are worth $2,600,000. That is a return of 649,900%.

How many years would it take for $400 invested at 8% to accumulate $2,600,000?

115 Years

The 83(b) election creates the opportunity for transformational wealth.

2. Multiple Funding Rounds

Success seems a little more certain. Uncertainty is lower. Cash out of pocket is higher.

Early exercise and 83(b) are no longer available. Your fair market value (FMV) is higher than your exercise price.

Exercising now will trigger a tax bill.

Your potential return is lower.

There is a direct relationship between risk and return. Risk goes down and your costs to exercise (exercise price plus taxes) goes up. As costs go up your returns go down.

3. Initial Public Offering

Uncertainty is lowest. You have a date when you can start to sell your shares.

Cash out of pocket is highest. The gap (bargain element) between your exercise price and FMV is greater than its ever been.

Any action now will trigger a tax bill.

Your potential return on options exercised now is the lowest it will ever be.

Less uncertainty, more taxes, lower returns.

The 83(b) election is a 30 day window of opportunity. It allows you to exercise when cash out of pocket is lowest and potential returns are highest.

Do not let the thirty days pass by without looking at an 83(b) election.

How to File an 83(b) Election

There are four steps to file an 83(b) election.

1. Negotiate Your Stock Option Package

As part of getting hired at a startup, negotiate your stock option package. Most startups will allow you to choose a combination of salary and stock options.

Salary goes up, stock options go down. Salary goes down, stock options go up.

Decide what combination of options and salary works for you. Make sure your salary is high enough to cover your living expenses.

Always ask for more than the initial offer.

Quincy Larson of freeCodeCamp wrote a great piece on how not to set a bunch of money on fire.

Haseeb Qureshi details how he went from a job at a coding bootcamp to airbnb.

Check to see if early exercise is available as part of negotiating your compensation. Not having early exercise lowers your return and increases your risk.

Again, ask for more.

2. Early Exercise, File the 83(b)

You negotiated. They raised their offer. You took the job.

Early exercise now. You can early exercise at anytime, but you have thirty days to file the 83(b) election.

Your stock option grant starts the 30 day clock. Don’t let it expire. Get your 83(b) election filed on time.

Fidelity provides instructions, a sample form, and the mailing address.

Be sure to complete the form. Turn it into your employer. Mail it to the appropriate IRS address.

Always use certified mail, return receipt requested to file your 83(b) election.

3. Keep Good Records

Keep a copy of your 83(b) election form. Keep the return receipt verifying delivery of your 83(b) election to the IRS.

Keeping good records is important for two reasons.

First, good records help your tax preparer. You will need to accurately record your cost basis when you sell shares.

Second, good records protect you from the IRS.

Stock options and tax are not straight forward. Taxpayers often run into problems with the reporting of cost basis on stock options.

Good records save time and money.

4. Manage Your Career

Help make the company a success. Stock options tie your future to the company’s future.

You are in this together, at least for the next four years (typical vesting schedule).

You will lose the cash paid to exercise any unvested shares if you change jobs before your vesting completes.

Evaluate the contributions you are making to the company and those of the company to your career. Plan to change jobs if necessary after vesting.

We see clients that repeat this process time and again. Take the job, early exercise, file 83(b), contribute to company’s success, improve career, and move on to the next startup.

Filing an 83(b) election unlocks the potential of your stock options. Follow the four steps above to make your 83(b) election successful.

When Not to File an 83(b) Election

There are disadvantages to an 83(b) election.

You must pay the exercise price when you do the early exercise so you are at risk for the amount you paid for the stock. You lose it all if the company fails.

You will incur tax, when you early exercise, if the FMV exceeds the strike price. You cannot recover taxes paid if the company fails. Although you may get some benefit from a capital loss for worthless stock.

Your exercise price is also important.

Costs rise with the exercise price. An early exercise of 40,000 stock options at $0.01 is cheap. Costs rise to $40,000 at an exercise price of $1.00.

Cash out of pocket increases risk and lowers return. Even if you avoid taxes, a high strike price can make an early exercise expensive.

Work with your advisor to determine if an 83(b) election makes sense for you.

Evalaute an 83(b) as Part of Your Financial Plan

Money is money. It does not fit tidiliy into buckets. You cannot view it as seperate from the rest.

You must view your money as a whole. It’s the only way to build a lifetime of wealth.

An 83(b) election is one choice of many as part of your stock option strategy. Evalauate as part of the whole.

Work with an advisor who understands taxes and stock options. You can start by scheduling a free call today.