Most of what you read about saving more money is misguided.

It focuses on the wrong things.

- Saving a fixed percentage of income

- Cutting expenses

The two approaches are the same approach presented in different ways. Saving a fixed percentage of income that is more than what you currently save will mean reducing your expenses. Reducing your expenses will lead you to save some fixed percentage of your income.

Trying to implement the suggested ideas may lead to frustration, giving up, and being worse off than you were before.

A Different Way to Save More in the Future

Early in your career as a busy professional, you have a distinct advantage. Your income tends to increase every year.

We notice it when we prepare tax returns for our clients. It is not unusual to see increases of 5, 10, 20%. There are merit increases, position changes, and job changes. All leading to more income.

Your financial advisor should craft a savings strategy for you. One that allows you to leverage your unique opportunities. Do not settle for the standard advice.

Do something different.

What If You Did This Instead…

Working with our clients, we take a different approach to saving more in the future. The approach we use can:

- Double the progress of your financial plan

- Guarantee that you will save more in the future

- Avoid the pain of cutting expenses now

The one strategy is to save 50% of every raise. Put another way the strategy is to only spend 50% of every raise.

Three Advantages to Saving 50% of Every Raise

There are three major advantages to using the strategy of saving 50% of all future raises.

- You Capture Your Savings in Advance – You decide when you receive a raise how much you’re going to increase your savings by and you do it right then. Plus, you don’t have to worry about cutting expenses now. All your savings are built into future increases in income.

- Avoid Lifestyle Creep – Doing this helps you avoid lifestyle creep. Lifestyle creep is what most people do. It’s a terrible plan. Most people get a raise and do nothing. Overtime their expenses start to creep up. By the time the next raise arrives, they have grown accustomed to their current income level and they’re spending almost 100% of it.

- Be Different – By only spending 50% of every raise, you can do something different. You can decide in advance how and when to increase your savings. You raise your savings percentage little by little so that you don’t even know it’s happening.

How Does It Compare to Saving a Fixed Percentage?

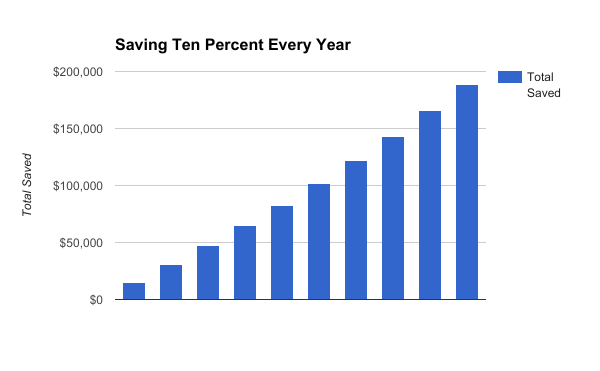

Let’s say you make $150,000 per year and save 10% of your income. You start in year one by saving $15,000. We assume that your income goes up by 5% a year and each year you save 10%.

After ten years, you will accumulate $188,668 in cash savings. Not too bad.

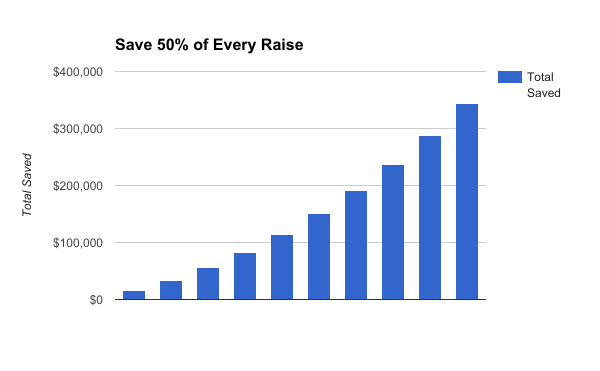

Everything remains the same. But, instead of saving ten percent every year, you increase your savings by half of the annual increase in your income.

How would this one change compare to saving a fixed percentage?

Your total cash savings after ten years…

$343,342

One simple change increased your ten year savings by $154,674.

The Inspiration for Saving 50% of Each Raise

The inspiration is a post written by Michael Kitces:

Don’t Save 10% of Income, Spend (Just) 50% of Every Raise and Systematically Save More Tomorrow

Michael does a great job of demonstrating how this strategy can be superior to saving a fixed percentage of income. The results are impressive.

The goal of this post is to translate what Michael presented as a strategy into real-world results.

We use this strategy with the clients we serve through On Your Way to Wealth. We have learned a lot about how to make this work for you.

Through the rest of this post, we will focus on:

- How to Implement the Strategy of Saving 50% of Every Raise

- Times When You May Need to Pause

- How and When to Get Started Again

5 Steps to Save 50% of Every Raise

There are five steps to saving more in the future by only spending 50% of every raise.

1. Get Raises

You have to make more money to even put this to work for you. Look at where you are in your career. When was your last raise?

Going more than two years between raises may signal the need to change companies. Check your options to see what else might be out there.

You can also let your current employer know that you want to grow. Talk to them about what your next step with the company should be. Ask how you can contribute more. Seek opportunities to develop your skill set.

Once you get the raise, it’s time to do the math.

2. Do the Math

Let’s say you got a raise. Your raise takes you from $150,000 per year to $175,000 per year. That’s an increase of $25,000 or 17%.

Do the math. Take the number of pay periods you have in a year. It’s usually 26 or 24. Divide the amount of your raise by the number of pay periods.

You can find your number of pay periods by looking at your pay stub. Pay periods that start and end on the 1st and 15th, and 16th and 31st indicate 24 pay periods. Pay periods starting and ending on dates that vary month to month indicate 26 pay periods.

Let’s say you receive 26 paychecks over the course of the year.

$25,000 increase / 26 paychecks = $962

This is the amount of extra money you receive per paycheck.

Now divide that number by 2. $962 divided by 2 equals $481. Your targeted savings is $481 per paycheck.

Now that you know how much to save, we have to decide where to save. Knowing where to save is important. We want to avoid the killer mistakes of a disorganized financial plan by keeping the dollars invested for you.

3. Start with Your 401(k)

The first and easiest place is through your 401k. With your 401k, you choose a percentage of your pay to contribute.

From the previous example, your targeted increase is $481 per paycheck or $12,506 total. You can divide the total by your annual salary to arrive at a percentage.

$12,506 increased savings / $175,000 salary = 7%

You could capture all your new savings by increasing your 401(k) contributions 7%.

The Limits of Using Your 401(k)

Your 401k is the easiest place to use this strategy, but it is not without limit. You will hit the maximum annual contribution at some point.

The $12,506 that we calculated above is only $5,494 less than the annual limit of $18,000. With a small 401(k) contribution before the raise, you would likely surpass the 401(k) limit.

Once you do, you need a new way to capture 50% of every raise.

4. Split Direct Deposit or Automate Transfers

You can implement the strategy after you max out your 401(k) by splitting your direct deposit.

Set up a separate account outside of your 401k. Send the majority of your direct deposit to your checking account while a small percentage goes to this separate account.

The separate account needs to be a taxable investment account. It should be somewhere other than your bank. Vanguard, Schwab, and Fidelity all offer this type of account.

Wealthfront and Betterment make it easy to open this type of account and get the cash that you deposit there invested.

Sometimes splitting direct deposit is not easy. In this case, you can go to the company that you use for that separate account and set up automatic transfers.

Automatic transfers remove a set amount of money from your checking account on a set day every month. The money transfers from the bank to your separate account for investment there.

The results are the same as splitting your direct deposit. Except with this method all your paycheck goes into your checking account. Then the amount you choose moves from your checking account into your investment account.

Get ready. Once you put the first four steps in place, your progress will speed up. The last step is to keep track of your progress.

5. Track Your Progress

You need a way to measure the progress you make by saving 50% of every raise. We track two metrics for all our clients:

- Net Worth

- Investment Assets

Each time we meet, we review the change in both metrics as a dollar amount and a percentage.

We also provide a tool to our clients to help them track the two metrics between meetings.

You can do this too. The simplest approach is to add up your accounts. The result is your investment assets. Then subtract out your debts to get your net worth. You also need to add the value of your house to net worth.

There are also many online tools that are free and will track these numbers for you. Mint.com is one popular option.

Only spending 50% of every raise will speed up your progress. The math adds up. But, this is real life.

What works well on a spreadsheet will not always work in reality. There are times when things break down.

When the Strategy Stops Working

The strategy of saving 50% of every raise works up to a point. There are times when the strategy starts to break down.

We see our clients go through different stages of their life and career. There is usually a time after college, sometime in your thirties.

During this stage, you have a income that increases every year with low expenses. This can be a great time to use this strategy as a way to increase your savings.

Two Times This Might Not Work

Two examples of when the strategy starts to break down are when you buy a house or have a baby.

Buying a House

Buying a house often means increasing your current expenses. Homeowners insurance, property taxes, and mortgage payments may end up being more than your monthly rent.

This doesn’t make buying a house a bad idea.

Your house is an asset. It’s an important part of building wealth. The increase in expenses represents a shift in savings. While your expenses are going up, you build up equity as you continue to make your mortgage payments.

Don’t let buying a house derail your savings. Manage the transition by quantifying the shift.

- What was your rent before?

- What is your mortgage payment now?

- How much are your property taxes?

- How much did your insurance increase (renters vs homeowners)?

Make a list and calculate the difference:

Mortgage Payment + Property Taxes + Homeowners Insurance = New Expenses

New Expenses – (Rent + Renters Insurance) = Increase in Expenses

Be clear about how much your expenses have increased by. Maintain your current savings. Wait to increase your future savings until your income increases by as much as your expenses.

If your expenses increased by $12,000, wait till your income increases by that amount. Then resume saving 50% of every raise. Your financial advisor can help you track this.

Having a Baby

Another way this strategy can break down is when you have a baby.

Kids are expensive. You may need to shift your future savings to go to the present needs of caring for your kids.

For most busy professionals the largest single expense will be childcare. In cities like San Francisco or Nashville, this expense can run $2,000 to $4,000 a month.

Just like buying a house, quantify the increase. Pause saving 50% of every raise. Let your income catch up before you resume.

Pause, Don’t Stop

You may need to pause use of this strategy at times. The time to do this is when your present needs start to increase along with your income.

Be careful though. Don’t give in to lifestyle creep. Press pause, maintain current savings, and then resume increased savings after a time.

When You Should Save 50% of Every Raise

You should save 50% of every raise anytime:

- Expenses are stable

- Income is increasing year over year

Things like a house, having kids, taking some time off, or reducing your income all represent a pause. They do not represent the end of the strategy.

Don’t wait. Get started now.

Work with your financial advisor to capture 50% of your next raise as savings. We see clients rapidly increase their savings rate in just one or two years. The difference this one change makes is huge.

The time to prepare is now. Use the five steps outlined above to prepare for your next raise. Take action when you receive the raise to capture 50%.

Identify big life moves in advance. Buying a house or having a baby are just two examples. Know when to pause and how to resume saving 50% of every raise.

Saving 50% of every raise is the best way to save more money in the future. It has helped my clients, and I know it will help you.