How do you calculate missing cost basis? What lessons can you learn? What might you want to do differently in the future? This post will answer those questions and more.

What is cost basis?

Cost basis is the total price you paid to buy an investment. You calculate your capital gain or loss by subtracting the price you paid to buy and from the price you sold the investment for.

Total Price Sold – Total Price Paid = Capital Gain (positive) or Capital Loss (negative)

Let’s say you buy 15,000 shares of stock at a price of $7 per share. Years later you sell the 15,000 shares at a price of $23 per share. Total Price Sold = 15,000 x $23 = $345,000 Total Price Paid = 15,000 x $7 = $105,000 Capital Gain = $345 – $105 = $240,000 Prior to 2011, investors self reported cost basis. Now, brokerage firms and companies that facilitate the buying/selling of stocks and bonds report cost basis to the IRS.

What to do with missing cost basis

From time to time, our clients cost basis is missing. It is always investments bought before working with us. The cost basis goes unreported. The client doesn’t have accurate records of when they bought and what price they paid. This is a problem. From our previous example: $345,000 taxed at the maximum capital gains rate of 23.8% is $82,110. Compare this to $240,000 of actual gain taxed at 23.8%, which equals $57,120. Missing cost basis triggers $24,990 in unnecessary taxes. So we step in to calculate the cost basis from historical data. Doing this is interesting. The results of the investments for which cost basis is missing are often less than superb.

How to calculate missing cost basis

Let’s say you sold positions this year that you bought years ago. The cost basis is missing and you need to come up with something before next April. Create a spreadsheet. List the positions that you purchased in one column. In the second column, input your best guess on the date of purchase. Input the number of shares purchased in the third column. Use a tool like Yahoo finance to come up with historical prices. Then you can use the transactions report for the account in which the positions were sold to determine the sales proceeds. Subtract the amount paid at the time of purchase from the amount received at the time of sell to determine your missing cost basis.

Missing cost basis and bad investing

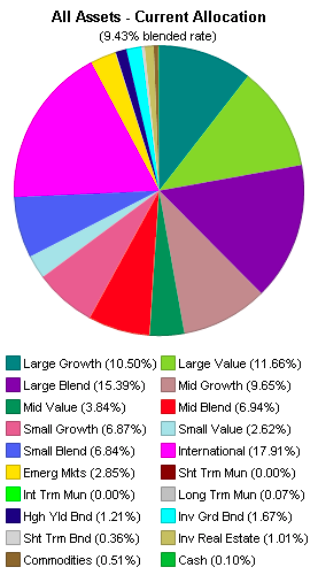

This example is based on an actual client case. The client had five mutual funds that were all purchased ten years ago. Preparing to buy a house and needing to fund the down payment, all five positions were sold. The five mutual funds had names like: Selective Premier World Growth Personal Strategy Value… The names are impressive. The performance is not. The five positions contained 1785 individual stocks and bonds. The five funds had the following diversification and expected annual return.

The actual return of over that 10 year period is very different than the expected return Expected Annual Return = 9.43% Actual Total Return = 5.67% Ouch! It gets worse when you compare the five mutual funds to a similar portfolio of index funds. Put this in perspective. Your expected annual return is 9.43% each and every year. Your total return based on expectations is 94.3% (9.43% per year times 10 years). Your total return for the entire ten year period was only 5.67%.

What you could have done

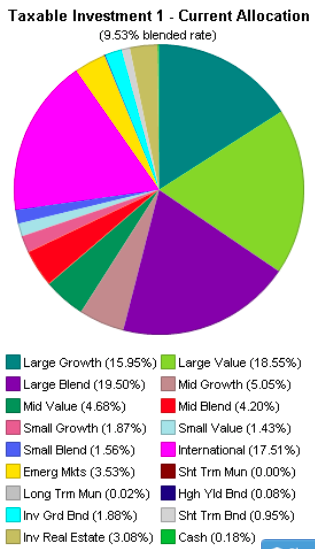

Opportunity cost is a way to compare investment or financial decisions. You look at what you could have done instead. Let’s say that instead of those five mutual funds, with their fancy names, you invested in three index funds. What would your performance have been like over the last ten years? We use four funds to approximate the expected return and asset allocation of the original five funds:

- US Total Stock Market Fund based on the CRSP US Total Market Index

- Developed Markets Fund based on the FTSE Developed All Cap ex US Index

- Emerging Markets Fund based on the FTSE Emerging All Cap Index

- US Total Bond Market Fund based on the Bloomberg Barclays US Aggregate Index

Your diversification and expected return would be:

The four mutual funds actual, total ten year return is 50.47% a difference of 44.80% This is a huge opportunity cost!

The high cost of bad investing

The client in our example used the money from selling the five mutual funds to buy a house. Let’s assume you need a $260,000 down payment to buy a house in San Francisco. How much money do you need to invest now to fund that down payment in ten years? At a total ten year return of 5.67%, you would need: $246,049.03 At a total return of 50.47%, you would need: $172,791.92 Bad investing costs you $73,257. This has real life consequences like buying a smaller house or waiting longer to buy. It’s not what we want to achieve with investing. These types of returns on a portfolio of five mutual funds over 10 years are unacceptable. But, we see this over and over again. We see it when we calculate missing cost basis on investments bought before working with us. We see it when we examine the portfolios of prospective clients. You can do better.

5 Lessons You Must Learn from Missing Cost Basis

There are five lessons to learn from the missing cost basis we have helped clients recover. Each of these five lessons will help you avoid costly mistakes and speed your way to building wealth.

1. Have an Investing Philosophy

There are no perfect philosophies. Each investing philosophy is a model of the way the world works. Models by their very definition are an incomplete depiction of reality. Avoid the mistake of believing there is one perfect way to invest. There is not. We have watched clients and prospects get lost in all the information that is available on how to invest. They research, talk, do more research, tinker, and repeat. The result is lots of activity. It is like watching a dog chase its tail. Lots of motion with no progress. All the research leads to delayed action. The tinkering leads to greater expenses and more taxes. They self-destruct in pursuit of perfection. Stop It! Choose an investment philosophy that makes sense to you. Install your philosophy consistently across all your accounts. Let the philosophy work for you.

2. Keep Good Records

This is less important now. Your account custodian should keep cost basis records for you. Still, you should do two things to avoid missing cost basis:

-

- Verify that your custodian records cost basis. You will usually find this information on their website. The records may be listed as cost basis or gains/loss.

- Save a copy of your gains/loss reports before transferring accounts from one custodian to another.

While you are checking on your records, establish a way to track all your investments.

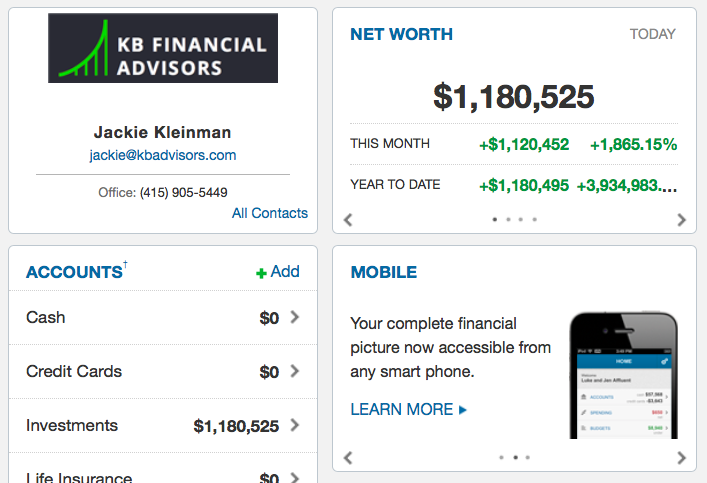

3. Track Your Investments

You need one place to track all your investments. Technology makes this easy. You should be able to log on and instantly see how your investments perform. Here is a screenshot of Way2Wealth. Way2Wealth is the tool we offer all our clients.

Don’t look at it every day. But, look at your performance at least once a year. When you look, know how to make an accurate comparison.

4. Know How to Compare Your Investments

It’s important to have proper benchmarks. A benchmark is a group of market indices that are like your investment portfolio. Most of us have no clear understanding of how our investments are performing. We listen to the news, hear the stock market’s doing well, and expect our investments are doing the same. Choose a benchmark or create a benchmark that matches your portfolio. Know what to use as a comparison. Think back to the example above. We used our Way2Wealth website to model the asset allocation of the five funds. The model is then tied to corresponding market indices to produce an expected investment return. Know your expected return. Gauge years as less than, better than, or absolutely average. Side note, most years will be less than or better than. We get to an average expected return not by having a series of average years. We get to the average by having years that are a lot different than average. That’s why you don’t want to tinker with your investments. The best strategy is to install, automate, and get out of the way.

5. Install, Automate, and Get Out of the Way

Investing should not be hard. Know your investment philosophy. Then focus on simple, consistent action.

The distinct investing advantage of busy professionals…

Busy professionals, who we focus our work on, have a huge investing advantage. You are too busy to pay attention, too tired to care. It is great. Use it to your advantage. Your career and income are your greatest source of wealth. You invest to make sure that your money doesn’t waste away in a free checking account. Use this to your advantage by automating your investing and then ignoring them. Look after five years and surprise yourself.

Don’t Wait, Do It Now

Solve the problem of missing cost basis and end bad investing habits. Get out of your own way. Look through your taxable investment accounts. Having a position (investment) with missing cost basis is a red flag. The missing cost basis may reflect an investment that is no longer a good fit for you. It may be hiding a loser that you need to be rid of.

Implement the 5 Lessons

Put the five lessons to work for you.

- Choose Your Investment Philosophy

- Keep Good Records

- Track Your Investments

- Know How to Compare Your Investments

- Install, Automate, and Get Out of the Way

Automate by using Target Date funds in your 401(k). Outside your 401(k) hire a financial advisor. Successful investing is more about avoiding mistakes than it is about doing things right. You can get started today by scheduling your free call.