Compound return on good decisions is the ability to connect your daily decisions with a common thread. One good decision leads to another. It is the most powerful force in life and money.

Think of the lives of other successful women and men. Are they the product of one moment? Winning the lottery? Or, years of progress in pursuit of a consistent vision?

The only time we celebrate lottery winners is when they receive the “big check”. Life after these get rich quick moments is a sad reality.

Success is a combination of experience, decisions, and opportunity. It comes slow at first. Hard to notice from one year to the next.

Progress becomes steady as you continue. There are moments of rapid pace along the way too.

Think About Your Own Life

Five years ago, where were you? How did your life then compare to now? What was your income?

The progress is impressive. It’s surprising to think about.

What about the possibilities for the future? Where will you be five years from now?

It’s easy to recognize your past progress. Hard to imagine the future. We are too quick to declare peaks and place ceilings on our life.

You doubled your income in five years after college. Why can’t you repeat that in the next five years?

As a father, I observe how fast my children grow. The change is undeniable.

Why not expect the same growth from yourself?

Your Biggest Money Problem

Too many decisions. Too little time.

The list of decisions is exhausting:

|

|

Each decision leads to a hundred more. The choices are always multiple. One decision leads to many possible outcomes. The complexity of your life is unlimited.

Few people love these money topics enough to put in the time to find the right answers. I read 26-38 hours per month, and I am still searching for better answers to your questions.

Besides your time is better spent elsewhere.

Focus on your career. Pour your time and energy into the source of your income. Income is the fuel for your financial plan.

What Do Most People Do?

Faced with the complexity of your financial life. What do most people do?

They don’t know what to do. They delay.

Or, they chose the default option. Life like technology always has a default.

Eventually, you have to chose. Most people rush to a decision just to mark the choice off a long list of to-dos.

The results:

- Delayed Action

- Poor Choices

The cost accumulates over time. The cost is the lost opportunity to arrive at good decisions faster.

We examined the power of an 83(b) in another post. The cost of delaying that decision would have been $744,179 over ten years.

We work with some clients who are great at saving money. But, the money just piles up in the bank.

In one example, the cost of accumulating that cash was $596,020 in missed returns over 5 years.

The costs continue to increase as the years add up. It’s like two ships passing in the night. One always moving forward. The other falling further behind.

A Complete Understanding of Wealth

Wealth is everything of value. Not all wealth appears on an account statement.

But, the focus of our work is on the wealth that does or soon will show up on an account statement.

Total Wealth

When we talk about wealth, we are not just focused on:

- Retirement

- House

- College

- A Year Off

Our focus is on transformational wealth. Reaching new levels of prosperity.

Transformational wealth is taking past opportunities. Opportunities given by your parents, education, or experience, and leveraging into new opportunities.

New opportunities to create wealth that lasts a lifetime.

Four Parts to Total Wealth

This more complete view of wealth includes four parts.

1. You – relationships, knowledge, skills

This is always the most important piece in the present. Your family and friends will be who you turn to during tough times. Your professional network is the best source of new opportunities.

You are paid an income in tech based on your knowledge and how rare your skills are.

Your health and mental outlook can support or hinder your ability to build wealth.

You are always the most important piece in the moment.

2. Income – salary, stock options

This is where your human capital (see number 1 above) gets converted into money.

Income and stock options turn your talents and abilities into dollars.

Income is easy to understand. The company pays for your contributions. The turn around time between contribution and dollars is short.

Stock options are a little bit harder. Stock options represent a promise to share in a future reward.

Your contributions now drive the company’s future success. Your stock options convert past contributions into current dollars, when success arrives.

3. Surplus – investments

This is the money that remains after you pay living expenses. It is extra. It is the surplus.

You Won’t Get Rich By Investing!

In our earlier example, $400 exercised 40,000 stock options that turned into $2,600,000. No investment portfolio can provide that kind of return.

Your investments are a surplus because if you knew a better use (higher return) for the money you would pursue it. But, higher returns always involve higher risk. Like one client’s grandfather said, “You only want to have to make your money once.”

The goal of investing the surplus is to grow what you already have. We want to take part in global progress. It’s like a giant train, get on board and avoid missing out.

Investing the surplus is important because it beats leaving your money in cash. Investing is powerful over the long run. But, it takes a long time to create transformative wealth.

3. Imagination – see a better future

Imagination is the ability to see and create a future better than your present. Of the four parts, imagination has the greatest potential to create wealth.

What do you need to create wealth with imagination?

Confidence is important. You must believe in your abilities. You must be able to hold onto the future you see even if your vision is not shared by others.

Imagination also requires flexibility. You need the ability to change, grow, and not get stuck.

You have to see it.

I often feel like I see a future for my client’s that they do not see for themselves. On Your Way to Wealth is designed to help you get to $2 million.

But, when I talk to someone about getting to $2 million, I am often greeted by stares of disbelief.

The progress is obvious with some of our long-term clients. One client, shown a graph of their progress, remarked, “Look at that. You took our piggy bank and turned it into a nest egg.”

Do not let your current struggles blind you from the march of progress in your own life.

Remember that all great businesses start with an idea and the confidence to pursue it.

Know Where to Focus

You will know where to focus with a complete understanding of the four parts of wealth.

I shared the four parts of wealth with a friend who has more than $1 million surplus. She lives in San Francisco. Her response was:

“I have money. But, I don’t feel like I have a surplus.”

Exactly!

Viewing your investments as a surplus. Understanding the other parts of wealth. You will know where to focus based on your life.

Should you focus on…???

Wealth Creation

Put your efforts into parts one and four… You and Imagination.

Improve your skills by going back to school. Work your network to land a better job.

Haseeb Qureshi details his experience going from a job at a code bootcamp to airbnb. He first tried mass mailing resumes and got nowhere. But, with the help of his network, he got competing offers from Google, Yelp, airbnb, and others.

Partner with others to develop the idea that only exists in your imagination. Start working nights and weekends. Develop something to take to market. Test and refine. Create wealth from just an idea.

Wealth Conversion

I met with a couple in San Francisco. They both grew up in a rural area of Virginia. We all laughed when I said:

“Make hay while the sun shines.”

We laughed because they knew what I was talking about.

It’s time to convert income to wealth (make hay) when your income is up and the sun is shining.

Our tech clients know they have it good. Their incomes are at all time highs.

They also know it can’t last forever. Tech does not treat its elders well. Seniority is not always a plus.

The pace is grueling. You wonder how long you can keep it up.

Convert income to wealth by saving money. Use stock option events to convert wealth in bulk.

Up until a point, converting income to wealth will have the biggest impact on your plan. Investing only becomes impactful once you have significant investments.

Wealth Management

Saving money is less important once you have significant investments. At some point, your money starts to out work you.

The money can earn money faster than you can convert income into wealth. This is the time to focus more on using the wealth you have.

You have a surplus and having wealth creates questions:

- How will I use it?

- What does having it mean?

- What are the possibilities?

- Who am I now that I have money?

Wealth management is capitalism at its best. Money making money. Your wealth becomes a powerful force.

Wealth accomplishes a lot of good given the right care and direction.

How much do I need?

How much wealth you need to focus on wealth management depends on your location and your life. Living expenses in your area are a big factor.

It takes $2 million in investments in San Francisco. You only need $1 million in Nashville, where our second office is.

Two Parts to Compound Return on Good Decisions

Compound return on good decisions has two parts. Each is powerful alone. The true power is combining them together.

1. Compound Return

Global progress is a powerful force. Compound return gives you a piece of the progress.

Do not waste your wealth in a free checking account. Keep your dollars employed and active.

The impact over a lifetime is huge.

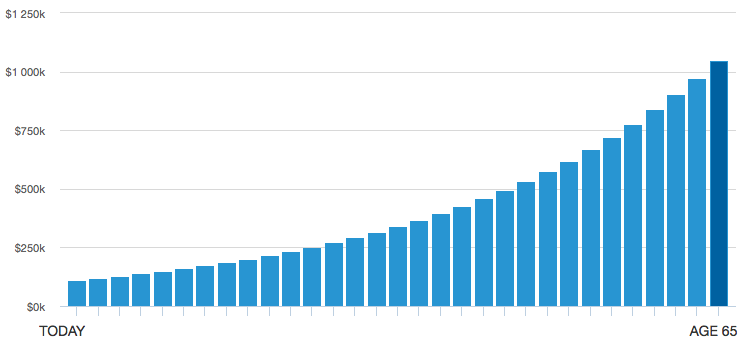

You start with $100,000 invested in a portfolio of 60% stock and 40% bond. Your progress after:

- Ten Years = $213,308

- Twenty Years = $455,002

- Thirty Years = $970,557

Powerful and steady. Put compound returns to work for you by investing your surplus.

2. Good Decisions

Good decisions is the ability to take action in pursuit of a common vision. You set the course. You make the choices.

Your choices move you forward in pursuit of your vision.

The impact of good decisions is harder to define. I have historical returns data going back to 1927 to back up our assumptions for compound return.

You will invest in thousands of companies in more than one hundred countries. Our average expected investment return is easy to define.

You are one individual. There is no average for your life. It takes imagination to pursue your vision.

Rather than reduce its worth. The fact that good decisions are harder to define makes them more valuable.

There is no average expectation so there is no limit on what could be. Good decisions carry the expectation of greater return with greater risk (uncertainty).

A Tale of Two Tech Employees

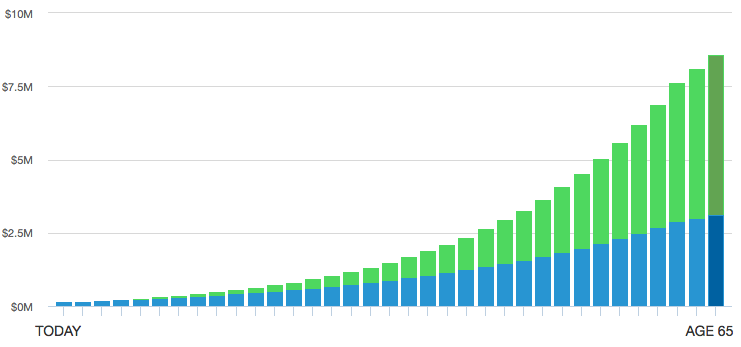

Let’s take a look at the career of two tech employees. They both have $150,000 in income and $100,000 in investments.

Aaron

Aaron always knew he wanted to work in tech. His dad was an engineer. But, Aaron feels the pressure.

He measures his success against others. “Bill Gates was a millionaire in his twenties.” Aaron says.

Aaron is 31. He’s not a millionaire.

Aaron’s income increases by five percent per year. He saves ten percent of his income. He is disorganized, and what investments he makes only earn five percent.

Lisa

Lisa’s dad encouraged her to work on computers. She ended up in tech.

Lisa doesn’t dream of being the next Steve Jobs. She makes her own way.

Lisa is 31. She focuses on her career and works with an advisor. Lisa’s income increases seven percent per year. She saves ten percent. Her investments earn nine percent.

The Impact of Compound Return on Good Decisions

How do Aaron and Lisa compare?

Aaron did ok (blue bars). $3 million is not bad. But, it took him thirty plus years to get there.

Oversight in his investments. A lack of focus in his career. Made it hard for him to keep up with Lisa (green bars). The difference over thirty years is amazing:

- Ten Years – Aaron $395,595; Lisa $536,898

- Twenty Years – Aaron $1,023,437; Lisa $1,861,478

- Thirty Years – Aaron $2,284,508; Lisa $5,568,286

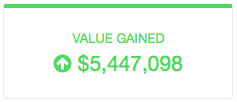

By age sixty five, the total difference is:

This is transformational!

This is where your financial advisor should focus.

How to Capture Compound Return on Good Decisions

There are five steps to put compound return on good decisions to work for you.

1. Create a Clear Vision

There are many ways to create a clear vision. I will share two.

Your Perfect Day, Five Years from Now

This is one we use with our Wealth Management clients. Melissa, my wife, and I also use this method.

In 2010, working with a financial advisor, we each imagined our perfect day. Our visions were similar.

Melissa imagined being at the lake. I imagined an outdoor adventure in the fall. As we dug deeper, one key difference emerged:

How many kids will you have?

Melissa was pregnant with our first at the time. She said, “Two.” I said, “Three.” She said, “You’re CRAZY!”

Our third child (a surprise) was born in August 2014.

How to do it:

Work with your financial advisor. Bring your spouse or partner if applicable to you.

Close your eyes.

Imagine your perfect day five years from now. A day when you feel good and happy. A day when things go your way.

Describe it:

- Where are you?

- What month is it?

- What time of day?

- Who are you with?

- What are you doing?

- How do you feel?

Your advisor should ask lots of open ended questions and document what you say. She should also probe for differences between your vision and your partner’s.

Now, for the next twenty one days, spend five minutes thinking about that vision. Tell your partner one new detail per day (you can also partner with a friend).

At the end of twenty one days, buy yourself or your partner a small gift that represents your (or their) vision. Put it where you can see it everyday.

Next Year, And All the Steps In-Between

On Your Way to Wealth includes what we call Charting the Course. I ask clients about their one-year goals and five-year vision.

One year is easy. You will tell me what’s going on, what stays the same, and what changes.

We can always talk about next year.

Ben Austin of stop start do has a great method for focusing on that one year vision everyday.

I use his method every morning. It’s the first step I take to have a successful day.

Here’s how:

- Start with a clear twelve to eighteen month goal

- Write down the steps you will take each month

- Spend five minutes each day seeing yourself completing the steps and accomplishing the goal

Some days you will do this to no effect. It will feel like a waste of time.

Other days you discover something new. A detail you did not see before. Or the recognition of a new step along the way to your goal.

The key is to be consistent.

2. Focus on 5 Days, 5 Years

Tim Ferris said:

We overestimate what we can do in a day, but underestimate what we can do in a year.

Note – I believe he said it in this episode. He may have adapted the quote from Bill Gates.

This vicious cycle will doom you to failure. The feeling of coming up short by overestimating what you can get done distracts you from seeing your progress.

Stop it now!

Focus on the next five days. What are the key things you need to do? Limit yourself to one or two.

Hold onto your five year vision. Don’t worry about next week or next month.

Focus on the next five days. Create a clear vision for five years.

Remember that your vision is flexible. Be open to change. The best opportunities are rarely recognized at first.

The vision is flexible but the next five days are not. Stay open to new opportunities. But, don’t get caught putting out fires.

3. Save, Spend

Identify which is most important at the moment. Where should you focus?

- Wealth Conversion – saving is most important

- Wealth Management – spending (use) is most important

Effectively manage both saving and spending.

I worked with a client who uses his tech earnings to fund other interests.

He earned lots of money. Then took extended time off with no income.

We focused on saving while he was working. He put more than $50,000 a year aside.

During his time off, we focused on spending. He created a clear budget for the project he was funding to manage his resources.

4. Don’t Miss Out

Global progress moves forward. Everyday billions of people go to work trying to better their life. Our individual efforts create a better world for everyone.

I sometimes stand on the sidewalk in San Francisco and marvel. Everywhere you look people are busy. It’s like having a courtside seat to the global economy.

Take part in the progress by investing your surplus.

Personal progress is also important. Invest in yourself by:

- Reading books

- Learning new skills through training

- Getting feedback through coaching

- Recharging your mind by taking a vacation

You are the most valuable asset in your financial plan.

5. Get Organized

What kind of company are you?

Are you a startup? Just an idea and a set of skills seeking market validation. Disorganized but with some potential.

Are you a unicorn? Lots of money, but still trying to grow out of the startup stage. Well funded. Inefficient at best.

Are you a tech titan? Publicly traded, your systems are in place. You work with a team of experts to organize your financials.

There is a real cost to being disorganized.

Going it alone. Doing it yourself may be necessary at first. But, it’s time to grow up.

Get organized to break through growth barriers.

Make Compound Return on Good Decisions Work for You

Compound return on good decisions is the most powerful force in life and money.

Like interest builds in an investment account, each good decision pays you a return that grows year after year.

Compound return on good decisions is our mission at KB Financial Advisors.

Start putting it to work for you by scheduling a free call today.