Here’s how tech employees should handle concentration risk for the best financial outcome.

One of the key tenets of investing is diversification. This practice of spreading your investments around helps you minimize your risk.

But what happens when most of your eggs are, conversely, in one basket? You face concentration risk.

This tends to be the case for tech employees with equity compensation, namely ones who’ve had a long tenure at their company. If you hold any combination of incentive stock options (ISOs), restricted stock units (RSUs), and shares worth more than $3 million, you face concentration risk as you near your IPO.

After your company goes public, two things are likely:

1. You’ll manage your equity compensation for a while.

You may have some short-term goals to fund post-IPO but when your equity compensation is well over a million dollars, you’ll have more money left over to manage. This makes your situation a bit more complex than simply funding a down payment on a house. Anticipate managing your equity compensation for a few years.

2. You’ll be exposed to risk for an extended period of time.

Understanding concentration risk’s effect on you is key to minimizing the odds of things going awry while maximizing your post-IPO gains.

This post focuses on the second point. Read on to learn how you should handle concentration risk for the best financial outcome.

What is concentration risk?

Concentration refers to the idea that a lot of your money is wrapped up in one stock. So, whatever happens to that single stock determines what’ll happen to your money.

Metrics like your company’s post-IPO stock price largely determine your net worth by way of your shares and unexercised stock options. The stock’s performance also determines your future compensation and net worth, that is, once your unvested stock options and restricted stock units eventually become income.

Concentration risk refers to the amplified losses that may occur from having a large portion of your money in a particular investment.

When it comes to your money, concentration risk can look like two types of risk after your IPO:

1. Risk of a negative absolute return

Experiencing a negative absolute return means you would’ve been better off selling at the IPO list price (which typically isn’t possible due to lockups) and parking your money in cash.

In a 2021 paper, J.P. Morgan found that between the years of 1980 and 2020, over 42% of individual stocks did not have positive returns. These stocks’ concentrated investors would have been better off in cash.

2. Risk of a negative excess return

Having a negative excess return means the individual stock performed better than cash and had a positive return, but it performed worse than the overall market. Investors in this position would’ve been better off diversifying by selling at the IPO list price and immediately investing that money into the entire US stock market.

J.P. Morgan found that from 1980 to 2020, 66% of individual stocks underperformed the total US stock market, represented by the Russell 3000. This finding demonstrates that those who are concentrated in the stock of one company likely won’t be rewarded for the additional risk and volatility that comes with their investment approach.

Concentration vs. diversification

Concentrated investments are unpredictable and volatile. Their performance fluctuates often and at drastic amounts. With performance volatility, there’s a large range of possibilities for what your company’s stock might do. Because each company has a unique trajectory, there’s no historical average to look to for predictions. Historical averages are typically based on the performance of hundreds or thousands of stocks over long periods of time. In the case of your IPO, the company has either just gone public or will do so soon, giving you no substantial history to work with.

The best way to think about concentrated investments is that individual results may vary.

Your stock can land anywhere on the range, from being completely worthless or delisted, to being worth a thousand times more than what it is today.

Unlike concentration, diversification entails investments in many companies’ stocks with performance histories that span decades (and in some cases, over a century). Because diversified portfolios entail having your money in various baskets, they’re more predictable and less volatile. The historical averages that accompany diversified investments allow for a narrower range of possibilities for what can happen to your money. Performance history that dates back to the 1920s and involves thousands of stocks also allows for conversations around historical expected returns.

A quintessential example of diversification is the DFA All US Core 1 mutual fund (DFEOX for short). Containing 2,696 stocks, this fund represents the performance of the entire US stock market. DFEOX has an investment tilt toward small-cap, value, and high-profitability stocks. In other words, instead of simply investing in the entire US stock market the way a total US market index fund would, DFEOX starts with the entire US stock market and then overweights slightly small-cap stocks, value stocks, and high-profitability stocks.

Using DFEOX as a reference point for diversification, we’ll compare its performance with single tech company stocks, which represent concentration. Note that the real-life examples below each span different time frames.

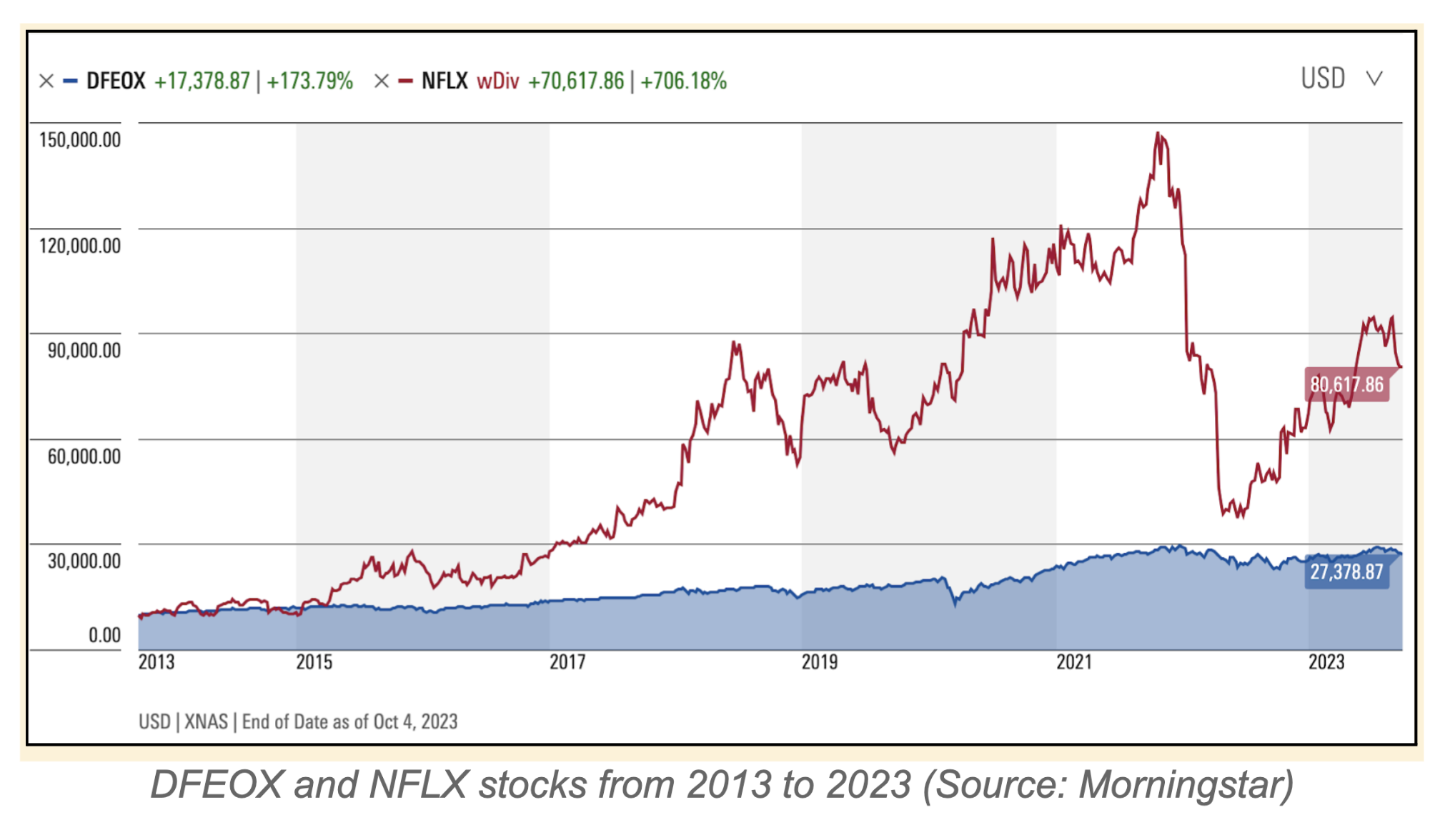

DFEOX vs. Netflix, over ten years

We’re starting by comparing Netflix (NFLX) with DFEOX over a ten-year period. Looking at the chart above, the dollar amounts at the 2023 mark represent how much money you’d end up with if you had invested $10,000 in 2013. As you can see, a $10,000 investment in Netflix in 2013 would’ve resulted in $80,617.86, while the same investment in DFEOX would’ve grown to $27,378.87. Over this ten-year period, you would’ve been better off holding Netflix than you would’ve been investing in the entire US stock market. Though NFLX’s end result is favorable, notice the dramatic volatility its investors had to endure, versus the slow, smooth climb DFEOX investors experienced.

DFEOX vs. Dropbox, over five years

[/et_pb_text][et_pb_image src=”https://kbfinancialadvisors.com/wp-content/uploads/2023/11/Screen-Shot-2023-11-14-at-6.20.39-PM.png” alt=”Chart comparing diversified DFEOX and concentrated DBX stock performance from 2018 to 2023″ _builder_version=”4.23″ _module_preset=”default” width=”700px” width_tablet=”700px” width_phone=”700px” width_last_edited=”on|desktop” module_alignment=”center” global_colors_info=”{}”][/et_pb_image][et_pb_text _builder_version=”4.23″ _module_preset=”default” global_colors_info=”{}”]

Next up is Dropbox (DBX) — which had its public debut in 2018 — compared with DFEOX over a five-year period. While DFEOX’s performance is much noisier than it was in the previous chart, notice that its volatility still pales in comparison to that of DBX. Another takeaway here is that from 2018 to 2023, you’d financially be worse off concentrated in Dropbox than you would be diversified in DFEOX.

DFEOX vs. Snowflake, over three years

[/et_pb_text][et_pb_image src=”https://kbfinancialadvisors.com/wp-content/uploads/2023/11/Screen-Shot-2023-11-14-at-6.45.59-PM.png” alt=”Chart comparing diversified DFEOX and concentrated SNOW stock performance from 2020 to 2023″ _builder_version=”4.23″ _module_preset=”default” width=”700px” width_tablet=”700px” width_phone=”700px” width_last_edited=”on|desktop” module_alignment=”center” global_colors_info=”{}”][/et_pb_image][et_pb_text _builder_version=”4.23″ _module_preset=”default” global_colors_info=”{}”]

Lastly, we’ve got Snowflake (SNOW) — which went public in 2020 — compared with DFEOX over a three-year period. Again, DFEOX’s performance is much more smooth and steady in comparison to the concentrated stock. There were brief windows in 2020 and 2021 where SNOW investors were rewarded for the concentration risk they had — notice the instances where the concentrated stock performed better than its diversified counterpart. However, what followed each of those spikes were crashes, the more recent of which Snowflake has yet to recover from. Currently, investors who hold concentrated investments in Snowflake are not being rewarded for the concentration risk they’ve taken on.

The other risk at play: di-worse-ifying

Though I’ve made a strong case for diversifying, it’s not the end-all, be-all. Make sure you take a strategic approach to diversifying, otherwise you may just make matters worse.

A risk that I call di-worse-ifying is the act of selling at the wrong time when your company’s stock would have continued to outperform the market as a whole.

Concentration risk is a double-edged sword:

1. If you don’t sell.

By holding onto your concentrated stock, you run the risk of your stock underperforming, compared to your position if you’d sold and diversified your investment.

2. If you sell.

By selling your concentrated stock and directing that money into a diversified investment, you risk watching your company stock continue to go up and outperform the market.

Most of my clients tend to fixate on the latter issue. They worry they’ll regret selling too soon without realizing that holding onto concentrated stock is just as risky as selling it.

J.P. Morgan found that only 10% of stocks from 1980 to 2020 yielded a 500%-plus return compared to the total US stock market.

Risk is a game of probability, so let’s look at some more metrics around how a post-IPO stock usually performs compared to the entire US stock market. Your stock has a:

- Seven in ten chance of underperformance. These stocks leave you better off diversifying.

- Two in ten chance of similar performance. These stocks track along with the stock market, but with much more volatility along the way.

- One in ten chance of overperformance. These rare stocks are mega winners that transform the trajectory of your financial future — we’re talking making ten to 100 times the money you invested.

Minimizing your risk & maximizing your gains

Now that you understand the risks concentrated stock exposes you to, what can you do to mitigate them?

Minimize your risk while maximizing your gains with these three steps:

1. Fund your goals

If you have specific, short-term goals with easy-to-determine price tags, fund them. This especially applies to goals like making a downpayment on a house, or any other ones valued at $500k or less. After you identify your short-term goal’s price tag, determine how long it would take for you to save that amount of money if you continued working. Then give yourself permission to sell enough of your equity to fund it.

2. Achieve financial freedom

Once you take care of your short-term goals, shift your focus to the long term goal of achieving financial freedom. This end goal would allow your career (the job) to become optional. To start, calculate the amount of money you need to replace your annual salary using this simple formula: Divide your current salary by 0.05 (derived from a 5% withdrawal rate). The number you end up with is the investment portfolio needed to replace your salary. If it’s possible for you to fund this number by selling your stock, do it.

3. Hold the rest

Once you’ve funded your short-term goals and achieved financial freedom, give yourself permission to hold the rest of your shares. I refer to these as “forever shares” because selling them is not part of your current plan. Hold onto this chunk of shares for the “what-if” scenario. Though unlikely, there’s a chance your company will be among those one-in-ten mega winner stocks that outperform the US market by 500%+.

Now, how many of your shares should you hold onto? I recommend at least 10% of the total equity you’ve been granted (total option grants and total RSU grants). Realize you may have to hold onto your forever shares for a long time, hence the name. In fact, you may hold onto these shares for so long that you no longer work at your company and it becomes unrecognizably different. For instance, just look at Netflix’s transformation from a DVD rental service to an online streaming service and production company.

Though your IPO plan doesn’t indicate a specific timeline for selling your forever shares, make sure it does outline triggers for when to sell them.

Mitigate concentration risk for good

Gaining an understanding of concentration risk is essential for any tech employee with a looming IPO. It’s the first step to minimizing your risk and maximizing your financial success.

Now that you have foundational knowledge, it’s time to enlist the help of a professional who’s advised countless people in your same position. Let’s face it, this is your first IPO and you likely have blind spots. The right financial advisor would help cover those blind spots while saving you time and stress along the way.

Book a call today to talk to myself or another expert on our team about mitigating concentration risk and strategically planning for your IPO.