Some of the heavy hitters in the tech world that we’ve watched IPO this year include Dropbox, Spotify, and Zscaler. Some notable upcoming IPOs include companies like DocuSign, Zuora, and Pivotal.

If you’re an employee of a company that may go public in 2018, it’s important to know the chances and what to do if it finally happens so you can plan accordingly.

A Brief History of US Tech IPOs

The year 2014 was a huge year for US tech companies, seeing 37 IPOs total. To date, that year has been the best for initial public offerings in this decade:

| Year | Tech IPOs |

| 2010 | 19 |

| 2011 | 24 |

| 2012 | 32 |

| 2013 | 35 |

| 2014 | 37 |

| 2015 | 23 |

| 2016 | 16 |

| 2017 | 24 |

Sources: 2010-2014 (https://www.pwc.com/gx/en/technology/publications/assets/full-year-and-q4-2014-global-tech-ipo-review.pdf) 2015-2017 (https://www.pwc.com/gx/en/technology/ipo-review/q4-2017-global-tech-ipo-review.pdf)

2014’s IPOs caught the attention of institutional investors, including mutual fund and hedge fund managers. We started seeing those big players in the investment world focus in on Silicon Valley, each hoping to find and pour money into the next big tech IPO.

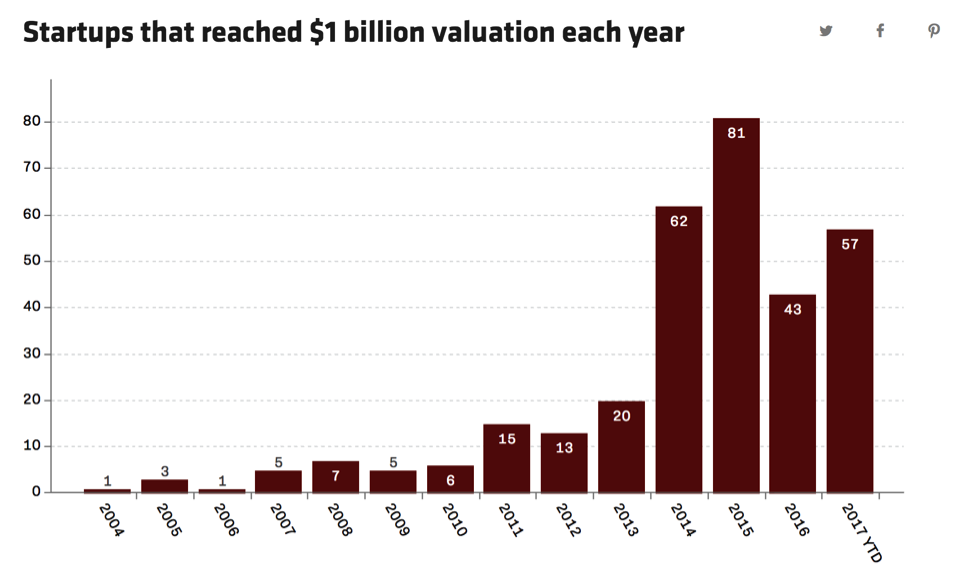

2014 was also the year that saw the birth of the startup “unicorn,” or private tech companies with $1 billion (or higher) valuation.

According to a report by Recode, there were just 20 startups that reached unicorn status in 2013. Then, once the money started flowing into the tech space in 2014, the unicorn club suddenly got a lot bigger:

What Happened to IPOs After 2014?

As you may have noticed the first table above, the number of tech IPOs decreased dramatically after 2014. In 2015, there were 23. That year saw some big names like Atlassian, Square, and Fitbit go public.

The following year, in 2016, IPOs continued to drop. We saw just 16 tech IPOs, including Line and Twilio. In 2017, we saw IPOs rise back up for a total of 24. Snap, StitchFix, and Roku led the way last year.

But despite the increase, the initial public offerings still didn’t meet the anticipation institutional investors must have had back in 2014 when money started pouring in to Silicon Valley’s tech companies.

With so many unicorns born between 2014 and 2017, the list of companies expected to IPO grew longer than the pace of actual IPOs could realistically keep up with. The buzz has continued since 2014, though, and that’s left many employees constantly feeling like an IPO has been 12 months away for the past 5 years now.

2018 might bring some welcome news for those employees. It could actually be the year that’s different.

IPOs of 2018: This Might Finally Be the Year

This year could be different for a few reasons.

For one, stock market trends, including IPOs, are like the weather: it has to change eventually. These companies that have been on the verge of potentially going public must provide an exit to their investors and employees at some point.

Not to mention, the Jumpstart Our Business Startups (JOBS) Act of 2012 made it easier for companies to IPO. That’s still having an impact today, especially when it comes to secret filings.

Secret filings allow companies with less than $1 billion to confidentially file IPO registration statements. They don’t need to release documents until 15 days before their roadshow.

A third factor that could lead to 2018 being another big year for IPOs? The Tax Cut and Jobs Act of 2017 lowered the corporate tax rate. As a result, big tech companies now have a lot of extra cash available for acquisitions.

(One recent example of this is Salesforce’s announcement to acquire Mulesoft in March.)

This act will probably have an indirect impact on the market, and we’ll likely see companies move more money into acquisitions. These actions may increase the stock market valuation of tech companies, leading to more IPOs.

The 2018 Tech IPOs to Date

We still have a long way to go in 2018, but here are some big IPOs we’ve already seen in the first few months of the year:

Dropbox

The file hosting service company raised a take just shy of $1 billion in its March 23 IPO. The IPO price was set at $21. As of April 20, the share price has reached $28.92.

Spotify

Going a different route, Spotify chose to do a direct listing, which means it sold only existing shares and didn’t raise any new money. Trading began on April 3 with a reference price of $132 per share and reached a high of $158.45 on April 20.

Zscaler

Debuting on the NASDAQ on March 15, Zscaler’s IPO more than doubled its debut price of $16 in the first day, jumping to $33. It has since dropped down and leveled out, with the latest price of $27.22 as of April 20.

What to Do As an Employee Planning for a 2018 IPO

We expect many more IPOs of 2018, including a slew of tech IPOs happening this spring.

One of the biggest we’re watching as April comes to a close is DocuSign, with a price range of $24 to $26 per share. That range would give the e-signature company a market cap between $3.65 billion and $3.95 billion.

But whether you’re at Docusign or another big tech company that could join the IPOs of 2018 list, you still need to do the same thing: plan ahead!

Here’s how you can get started:

- 3 Things To Do Before Your Lock-Up Expires

- The Definitive Guide on the Dropbox IPO for Tech Employees

- 5 Key Decisions to Make About Stock Options

Once you check out those posts, you may want to consider a stock option analysis so you know the best route to take with your equity once you receive it.

If you truly want to make the most of your potential wealth, however, a full and comprehensive financial plan might be the smartest path forward. Preparing now can position you for an optimal outcome once your company finally goes through its own IPO in 2018.