The median home price in San Francisco is $1.3 million.

How do you pay for a $1.3 million house?

Can you make the mortgage payments?

The focus of this post is on how a tech employee can use a combination of salary, stock options, and savings to buy a house in San Francisco.

Three Pieces: Salary, Stock Options, and Savings

Buying a house as a tech employee will involve some combination of salary, stock options, and savings.

Salary

Salary is what we can count on.

Your bonus may go up and down. Your stock options will vary from year to year. Salary stays on a steady path.

Paul Kantner said it best,

“San Francisco is 49 square miles surrounded by reality.”

He’s right.

The reality is that anywhere else, I would recommend you buy a house valued at 2 to 2.5 times your annual income.

That means you would need a salary of $520,000 to afford that median priced home at $1.3 million.

The rule works in Nashville, where the median priced home is $196,500. (Our second office is located in Nashville)

It does not work in San Francisco.

You may pay 4 to 6 times your annual income in San Francisco.

Stock Options

Stock options are a key source of funds for buying a house.

The problem is that we cannot count on the value of your stock options from one year to the next.

The amount you receive each year varies.

Stock options from a start-up vary the most. They could be worth nothing today. Then worth millions in a few years.

Restricted Stock Units (RSU) from Apple or Google vary less.

But, as employees at LinkedIn and Twitter know, the value of those RSU can change fast.

Savings

Your savings is the extra left from your salary and stock options.

There are different ways to put your savings to work buying a house.

You could adjust the amount you put down.

Go with ten percent instead of twenty percent. Or, put down more than twenty percent to get a lower monthly payment.

What if you have millions? You could pay cash.

We will examine ways to combine these choices.

Three Ways to Buy a House

With salary, stock options, and savings as your tools, you can choose how to use your resources to pay for a house.

We will look at three different ways.

Hey, This is Your Life

You work in tech, with a salary of $300,000.

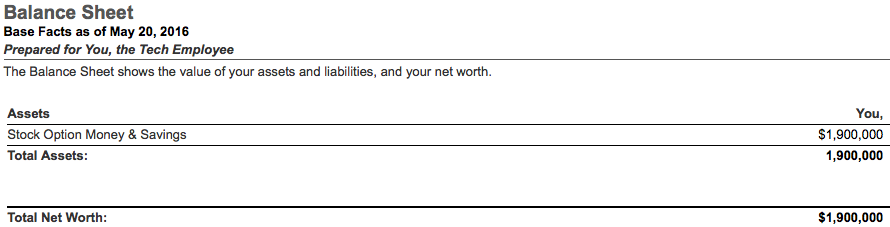

Two years ago you cashed out your stock options in an IPO.

The tax bill was surprising, but now you have $1.9 million.

You are ready to buy a house.

Here’s the deal:

We cannot predict the future and do not pretend that we can. The past offers insight into what the future might look like.

We will use these assumptions to model three different ways you can pay for a house in San Francisco.

- Home Prices – increase 3.69% per year

- Rent – $3,500 a month

- Mortgage Rates – 4% on a 30 year fixed rate

- Property Taxes – 1.33% of purchase price

- Purchase Price – $1.3 million

- Asset Allocation – you invest in a 60% stock, 40% bond portfolio with an average return of 7.8%

We assume you stay in the house for ten years.

Our goal is to examine the impact over ten years on total wealth.

How much will your net worth grow from the time you buy to the time you sell?

Here is our starting point:

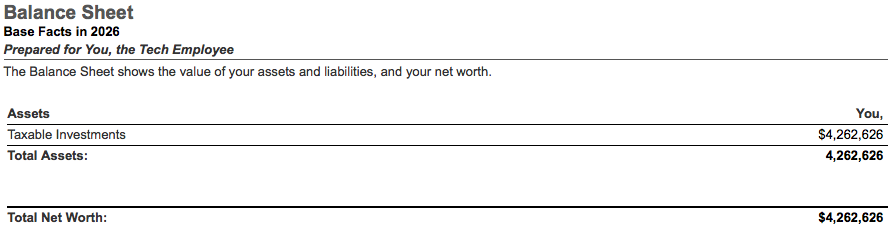

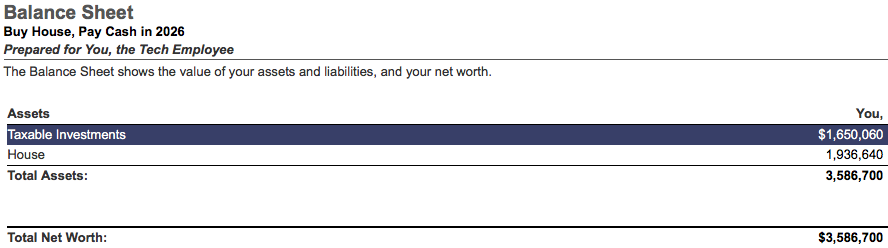

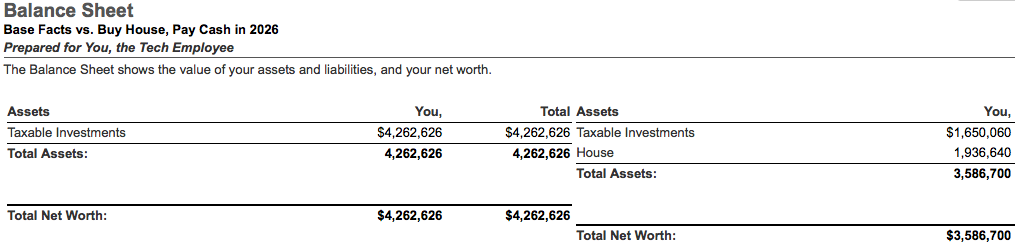

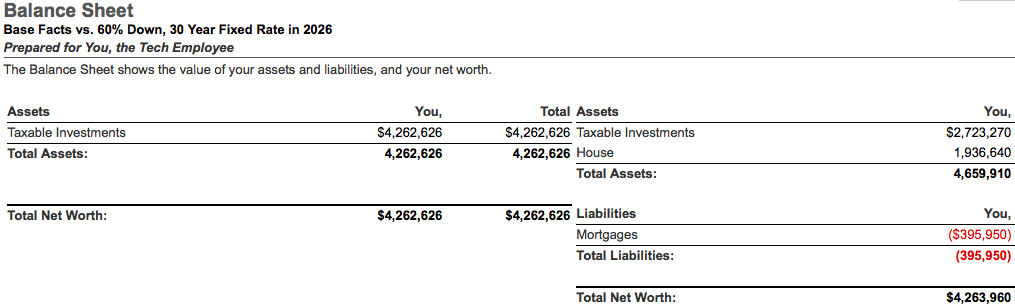

This is what we expect your net worth to be after ten years, without buying a house.

In ten years (2026), we would expect your net worth to grow to $4,262,626.

Let’s examine the three ways to buy a house in San Francisco.

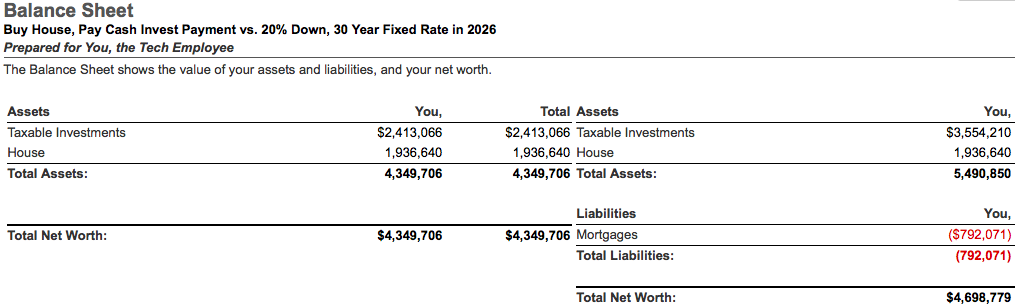

1. Down Payment and a Mortgage

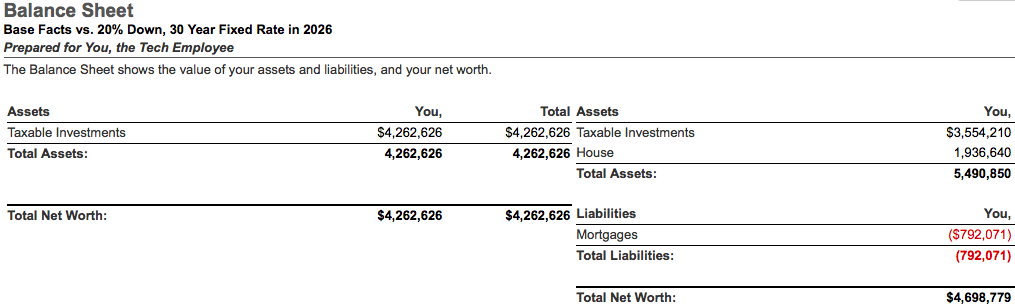

You purchase a house for $1.3 million. You put $260,000 down (20%) and take out a $1,040,000 thirty-year fixed rate mortgage at 4%.

Here is a comparison of your expected net worth without and with the house.

Buying the house with a 30 year fixed rate mortgage and 20% down increases your expected net worth by

$436,153

This is an increase of 10%.

Why the increase?

The increase is the appreciation of your house and positive leverage.

Let me explain:

You buy a $1.3 million house, but your cost is only $260,000.

Your mortgage payments remain the same.

You get the full appreciation on $1.3 million for only $260,000.

When you buy, your house is worth $1.3 million. Your mortgage pay off is $1,040,000. Ten years later, your house is worth $1,936,640.

$1,936,640 – $1,040,000 – $260,000 = $636,640 Total Return

Your down payment of $260,000 nets you a gain of $636,640 after your mortgage pay off.

That is a gain of 245%.

This is crazy:

What about all the interest I paid the last ten years?

Interest is the price you pay to use leverage in the form of a mortgage. You pay $377,899 in interest after ten years.

Your total return after considering interest is:

$1,936,640 – $1040,000 – $260,000 – $377,899 = $258,741 Total Return

Your gain is 99%.

Using a mortgage puts leverage to work in your favor.

2. Pay Cash

You use $1.3 million of your stock option money and savings to pay cash for the house.

Expected net worth after ten years is $3,586,700.

Here is a comparison of your expected net worth without the house and paying cash for the house.

Paying cash for the house decreases your expected net worth by

$675,926

This is a decrease of 16%.

Here’s why:

You sold stocks and bonds to buy a house. Your expected return on your stock option money and savings is 7.8%. We expect your house to return 3.69%.

You also gave up leverage by paying cash.

The results are no mortgage payment (yay!) and reduced returns (oh no!).

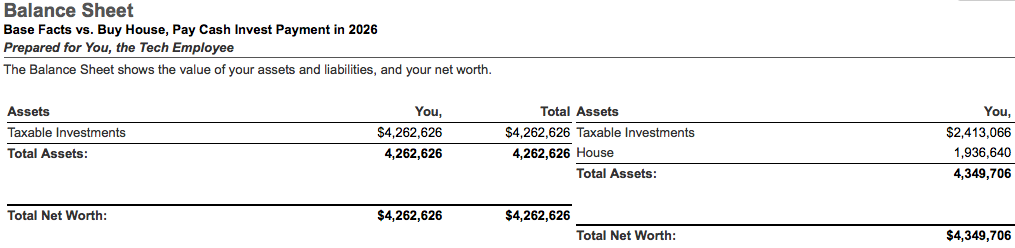

What If I

Pay cash. Then invest an amount equal to my mortgage payment every month.

With twenty percent down, your mortgage payment would have been $4,965.

Paying cash and investing $4,965 per month, your expected net worth is $4,349,706.

Better than without the house because your rent turns into a monthly investment of $4,965.

Not as good as with a mortgage.

Your monthly savings adds up to $595,800 over ten years. But, keeping the $1,040,000 invested, with a mortgage, adds up quicker.

3. Bigger Down Payment, Smaller Mortgage

Let’s change our assumptions.

Your salary drops to $200,000. You determine that you can only afford a mortgage payment of $2,483 per month.

This works out to a mortgage balance of $520,000.

You buy a $1.3 million house. You use $780,000 of your stock option money and savings for a down payment.

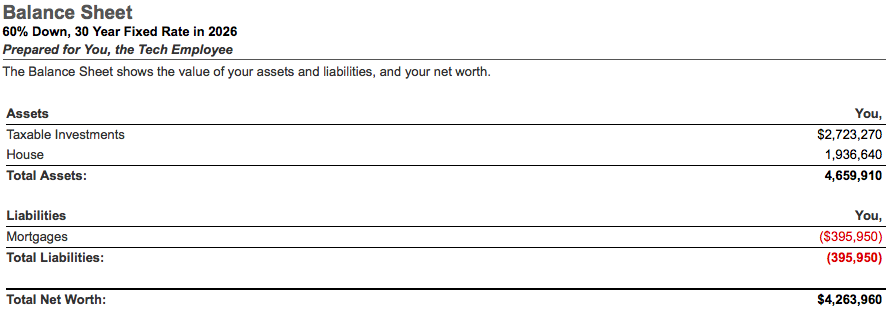

After ten years, your expected net worth is $4,263,960.

Here is a comparison of your expected net worth without the house and with a 60% down payment.

The increase is $1,334.

Sixty percent down is the break-even point.

The leverage from the smaller mortgage increases your expected net worth. But, you are putting a majority of your money into a house with a lower expected return.

How to Find the Right Approach for You

Using a mortgage works out better on the surface.

You expect to have more money with a mortgage than you would paying cash.

Now:

We overlooked one assumption.

That having more money is your only goal.

Life is not that simple.

You may value the comfort of not having a mortgage payment. It’s ok if you do.

Exploring scenarios like the three we have looked at here helps you make an informed decision.

Remember that buying a house is a life choice.

Run the numbers.

Choose the approach that works best for you.

Schedule a call today to get more specific than the three ways discussed here.